GCEX sees Revenues up 64% in 2024 to £3.8M driven by Crypto CFDs trading

FX and digital belongings institutional dealer GCEX has launched its 2024 monetary outcomes, indicating a rebound in Revenues following a disastrous “crypto winter” 2023 on the firm.

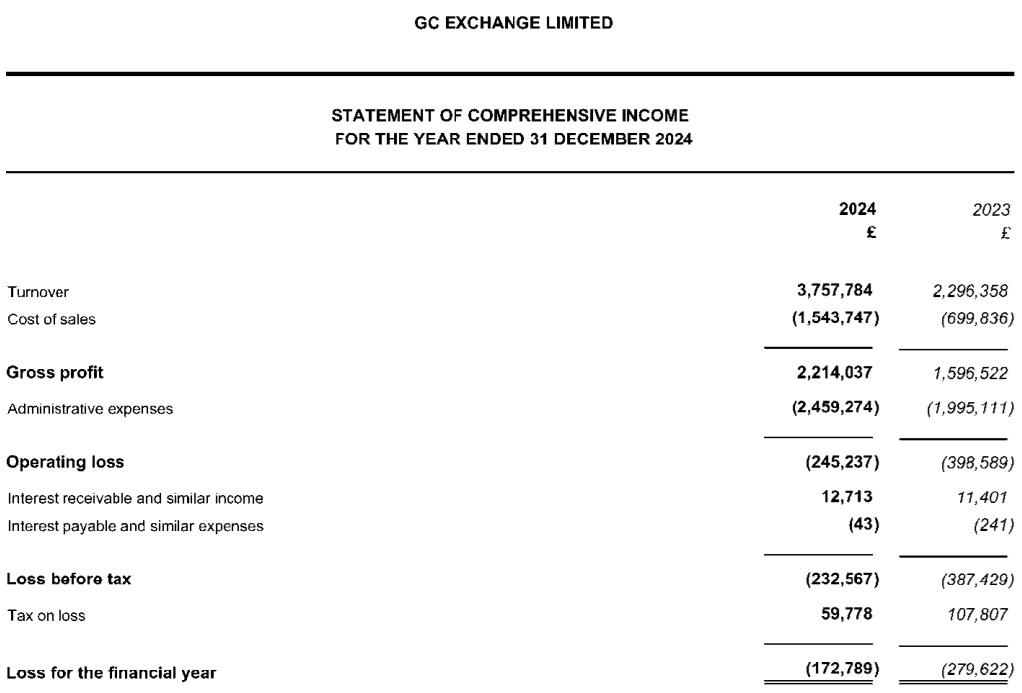

GCEX reported Revenues of £3.76 million in 2024, up by 64% from £2.30 million the earlier 12 months. The 2024 Income determine nevertheless remains to be under the £4.46 million that GCEX introduced in throughout 2022.

GCEX reported a Internet Loss for the 12 months of £173K, improved from the corporate’s £280K loss in 2023.

The income development at GCEX was largely pushed by a 315% enhance within the quantity of crypto CFDs, reflecting a restoration out there following the aformentioned “crypto winter.” The corporate has seen a constructive income development for the reason that final quarter of the monetary 12 months, which is anticipated to proceed into 2025.

Regardless of the numerous enhance in turnover, GCEX reported a pre-tax lack of £233K (2023: £387K), and a Internet Lack of £173K. This was primarily attributed to a considerable rise in the price of gross sales (+121%) and a rise in operational bills (24%), notably froam intra-group bills, consulting, workers prices, and international alternate revaluation losses.

Consistent with its technique, the corporate has made efforts to diversify its shopper base and additional develop its execution-only shopper providing. Moreover, it has enhanced liquidity in its FX and crypto companies by including new liquidity suppliers. On the technological entrance, the corporate launched a shopper portal, which not solely improves the shopper expertise but in addition streamlines inside operations.

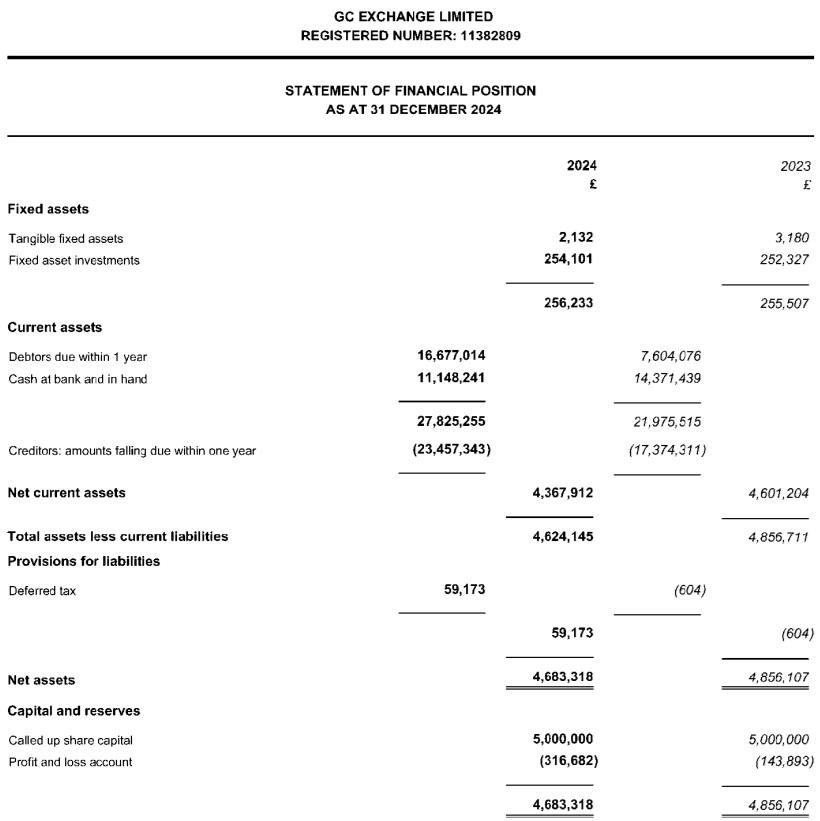

As of December 31, 2024, shareholders’ funds stood at £4.7 million (2023: £4.9 million). GCEX mentioned it stays centered on its development targets, with explicit emphasis on investing in enterprise growth, advertising and marketing, and strengthening its compliance crew.

Based in 2018 by former CFH Clearing (now Finalto) co-founder and CEO Lars Holst (pictured above), GCEX Group empowers institutional {and professional} shoppers to entry deep liquidity in CFDs on digital belongings and FX, alongside spot buying and selling and conversion of digital belongings. The corporate additionally affords a complete vary of Foreign exchange brokerage and crypto-native expertise options underneath its XplorDigital suite.

Headquartered in London, with a number of workplaces throughout the globe, GCEX is regulated by the UK’s FCA, registered with the Danish FSA as a VASP and forex alternate and has been granted a Digital Asset Service Supplier license by the Dubai Digital Belongings Regulatory Authority. True International Ventures are traders in GCEX.

GCEX’s 2024 revenue assertion and stability sheet comply with under.