BB wants forex intervention fund before peg shift

Highlights:

- Bangladesh plans foreign exchange fund forward of crawling peg transition

- IMF delay over NIR flooring impacts $1.3B mortgage tranche

- Free float now might hurt already low NIR reserves

- Previous deregulation led to hoarding, compelled charge intervention

- Sri Lanka’s float mannequin cited as stabilization case examine

The Bangladesh Financial institution plans to create a international change intervention fund, utilizing its reserves, because it prepares to undertake a crawling peg change charge. The fund would assist stabilise the greenback market when better flexibility is launched.

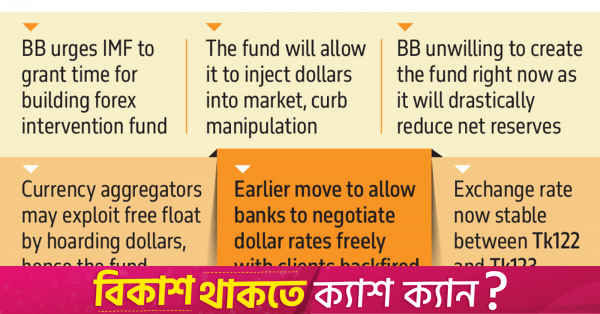

The central financial institution has requested the Worldwide Financial Fund (IMF) for extra time to determine the fund earlier than eradicating the ground on Internet Worldwide Reserves (NIR) or switching to the crawling peg, in keeping with a senior official.

The transfer goals to curb potential market manipulation and scale back volatility as soon as the change charge is allowed to drift extra freely.

The problem stays a sticking level within the ongoing IMF negotiations, delaying the discharge of the following $1.3 billion tranche from the lender’s $4.7 billion mortgage package deal. Even throughout the latest IMF-World Financial institution Spring Conferences in Washington, BB Governor Ahsan H Mansur resisted calls to undertake a free float regime instantly.

“The central financial institution might roll out the intervention fund and shift to a versatile charge now,” mentioned a senior BB govt, requesting anonymity. “However doing so would cut back NIR, already right down to $17 billion – beneath the IMF’s $19 billion flooring.”

Bangladesh’s gross reserves presently exceed $21 billion, sufficient to cowl practically 4 months of imports. Nonetheless, the IMF displays NIR, which excludes sure liabilities, as a key benchmark.

In the course of the IMF’s latest Dhaka overview mission, BB proposed scrapping the NIR flooring to permit the fund’s creation. Whereas the IMF hasn’t responded but, the central financial institution hopes to achieve an settlement by June.

A BB official warned {that a} sudden free float might set off disruptions, with aggregators hoarding {dollars} to drive up costs. “With inflation already excessive, we have to keep away from added volatility,” he mentioned. “The fund would enable us to inject {dollars} and counter manipulation.”

Citing India’s mannequin, he famous that the Reserve Financial institution of India often intervenes within the foreign exchange market to regular the rupee amid capital outflows and commerce uncertainties.

He additionally shared a latest incident: when the Bangladesh Financial institution straight paid Qatar for vitality imports, bypassing the open market, greenback hoarders have been compelled to promote at decrease charges, inflicting the change charge to fall by Tk0.50 to Tk0.60.

Market classes from previous deregulation

Earlier this 12 months, the Bangladesh Financial institution briefly allowed banks to freely negotiate greenback charges with shoppers. The transfer backfired as aggregators exploited the system, pushing the speed to Tk127. The central financial institution shortly reverted to a managed regime, introducing a uniform reference charge with no buying and selling band. Verbal steerage from the regulator now influences pricing negotiations.

With remittance and export earnings up, the change charge has stabilised between Tk122 and Tk123.

Mehdi Zaman, deputy managing director of Japanese Financial institution, instructed The Enterprise Commonplace the market stabilised due to greater greenback inflows and efficient regulatory management. “The hole between the very best and lowest charges is now beneath Tk1,” he mentioned.

Sri Lanka’s expertise with free float

Sri Lanka adopted a free float in 2023 underneath its IMF programme. The rupee initially plunged from 200 to 363 per greenback however stabilised beneath 300 in 2024 as reserves recovered. Sri Lanka’s reserves have risen from $1 billion in 2022 to over $5 billion, aided by IMF assist and a versatile change regime.

Source link