Bitcoin (BTC) Miner First-Quarter Results May Disappoint as Hashprice Fell, Tariffs Hit: CoinShares

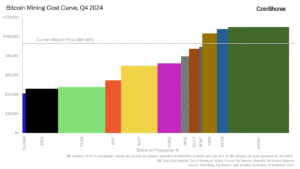

Bitcoin (BTC) miners’ first-quarter outcomes could disappoint as a result of the hashprice, a measure of day by day mining profitability, fell additional and commerce tariffs weighed in the marketplace, asset supervisor CoinShares (CS) stated in a blog post on Friday.

“Q2 outcomes could present deterioration, as tariffs on imported mining rigs vary from 24% (Malaysia) to 54% (China),” analysts led by James Butterfill wrote.

Bitcoin miners which might be depending on older or less-efficient rigs are confronted with greater publicity to those tariffs, the report stated.

Core Scientific (CORZ) is “higher insulated, because it transitions to HPC,” the authors wrote, including that Bitdeer (BTDR), which makes its personal rigs, might see margin stress on gross sales outdoors the U.S.

The asset supervisor predicts that the Bitcoin community hashrate might attain 1 zettahash per second (ZH/s) by July and a couple of ZH/s by early 2027.

The hashprice outlook isn’t as constructive.

The asset supervisor’s mannequin signifies “a gradual structural decline, with costs prone to stay range-bound between $35 and $50 per PH/day by way of to the 2028 halving cycle.”

Tariffs and commerce tensions could possibly be constructive for bitcoin adoption within the medium time period, asset supervisor Grayscale said in a analysis report earlier this month.

Learn extra: Bitcoin Miners With HPC Exposure Underperformed in First Two Weeks of April: JPMorgan

Source link