Bitcoin Bullish Bias Builds — Higher Ground Ahead?

Key Highlights

- Bitcoin worth began a gradual improve above the $92,000 resistance.

- A connecting bullish development line is forming with help at $92,400 on the 4-hour chart of BTC/USD.

- Ethereum worth is consolidating above $1,750 and goals for a recent improve.

- Gold is correcting features and would possibly decline beneath the $3,220 help zone.

Bitcoin Value Technical Evaluation

Bitcoin worth began a recent improve above the $88,000 zone towards the US Greenback. BTC was capable of surpass the $90,000 and $92,000 resistance ranges.

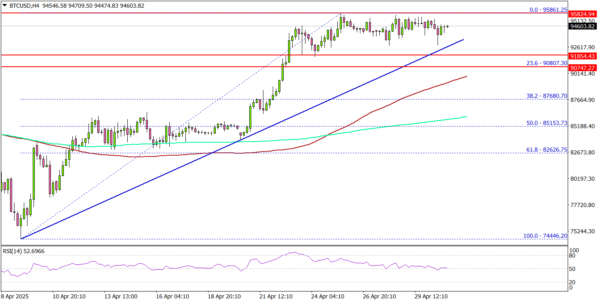

Wanting on the 4-hour chart, the value settled above the $92,000 stage, the 100 easy transferring common (pink, 4-hour), and the 200 easy transferring common (inexperienced, 4-hour). Nonetheless, the bears appear to be energetic close to the $95,000 and $96,000 ranges.

On the upside, the value may face resistance close to the $95,500 stage. The following key resistance is $96,200. The primary resistance may very well be $96,500. A profitable shut above $96,500 would possibly begin one other regular improve.

Within the said case, the value could maybe rise towards the $98,000 stage. Any extra features would possibly name for a take a look at of $100,000.

Speedy help is close to the $94,200 stage. There may be additionally a connecting bullish development line forming with help at $92,400 on the identical chart. The following key help sits at $90,800 or the 23.6% Fib retracement stage of the upward transfer from the $74,446 swing low to the $95,861 excessive.

A draw back break beneath $90,800 would possibly ship Bitcoin towards the $88,000 help. Any extra losses would possibly ship the value towards the $85,200 help zone and the 50% Fib retracement stage of the upward transfer from the $74,446 swing low to the $95,861 excessive.

Taking a look at Ethereum, the bulls appear to be in management and would possibly quickly goal for a transfer above the $1,850 resistance zone.

Right this moment’s Financial Releases

- US ISM Manufacturing Index for April 2025 – Forecast 48.0, versus 49.0 earlier.

- US Preliminary Jobless Claims – Forecast 224K, versus 222K earlier.