Bitcoin Mining Costs Jump To $137,000 Per Coin When Accounting For Non-Cash Expenses: CoinShares

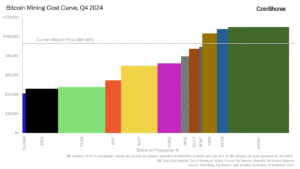

Bitcoin BTC/USD mining bills rose sharply within the ultimate quarter of 2024, with CoinShares reporting that the full common value to provide one Bitcoin, together with non-cash gadgets, climbed to $137,018.

This determine contains depreciation and stock-based compensation, providing a extra complete take a look at the monetary stress dealing with miners regardless of the power in Bitcoin’s market value.

What Occurred: According to CoinShares’ This fall 2024 Mining Report, the weighted common money value to provide a Bitcoin amongst publicly listed miners jumped 47% quarter-over-quarter, from $55,950 in Q3 to $82,162 in This fall.

Excluding outliers like Hut 8 HUT, which noticed prices skewed by a big deferred tax expense, the money value averaged $75,767.

Regardless of the rising value base, most miners remained marginally worthwhile, with Bitcoin buying and selling round $82,000 all through This fall.

Nonetheless, the inclusion of non-cash bills, similar to accelerated depreciation of mining tools and inventory compensation, paints a extra complicated and probably regarding image for the trade.

The $137,018 whole common value represents a major hole between headline profitability and precise monetary sustainability when all bills are factored in.

ASIC Depreciation And Aggressive Pressures

A serious driver of those prices is the fast-paced depreciation cycle of ASIC (application-specific built-in circuit) {hardware}, which have to be ceaselessly upgraded to stay aggressive.

Not like gold mining tools, which maintains utility over lengthy intervals, Bitcoin mining {hardware} shortly turns into out of date, forcing corporations into steady reinvestment.

“This dynamic leads to a novel monetary pressure,” the CoinShares report famous. “Miners are trapped in an ‘ASIC hamster wheel’—a continuing want to exchange {hardware} pushed not by put on and tear, however by technological obsolescence.”

The report provides that Bitcoin mining economics differ materially from gold mining, which usually options extra steady manufacturing forecasts and longer depreciation timelines.

In distinction, Bitcoin mining outcomes are strongly influenced by the actions of rivals: if one miner will increase capability, others’ relative output can decline, even with out modifications to their operations.

Hashrate Acceleration And Ahead Steering

Regardless of these mounting bills, Bitcoin’s community hashrate reached a file 900 exahashes per second (Eh/s) on the finish of 2024, barely forward of CoinShares’ earlier projections.

The agency now expects the community to breach the 1 zettahash per second (Zh/s) mark by July 2025, with hashrate forecast to succeed in 2.0 Zh/s by early 2027.

CoinShares attributes the rise to robust value motion and favorable coverage developments, which motivated miners to speed up infrastructure deployments regardless of rising capital and operational prices.

Additionally Learn: TRUMP Meme Coin Surges 15% As Organizers Clarify Participation Rules For Gala Dinner

Structural Challenges And Business Shifts

CoinShares notes that the mining sector is turning into more and more saturated, with valuation multiples compressing throughout publicly listed corporations.

This displays rising consensus that Bitcoin mining is now a zero-sum recreation, the place positive factors in hashrate by one miner come on the direct expense of one other’s market share.

In response, a number of miners, together with Core Scientific CORZ and Cipher Mining CIFR, have begun diversifying into AI infrastructure and high-performance computing (HPC) providers, making an attempt to construct extra steady and scalable income streams.

CORZ has already dedicated 43% of its vitality capability to AI-related operations, with CIFR planning to allocate 35% of its future buildout in that route.

Miners With Price Reductions

Whereas most miners noticed increased prices in This fall, CleanSpark CORZ, Iren IREN and Cormint have been exceptions.

They managed to scale back their value of income per Bitcoin mined by 8%, 39%, and 44%, respectively, by means of fleet effectivity enhancements, elevated uptime, and decrease vitality costs.

- CleanSpark diminished prices by boosting uptime from 94% to 98%, and bettering effectivity from 22 J/TH to 18 J/TH.

- Cormint benefited from decrease energy costs, dropping to 1.8¢/kWh, and working self-discipline that allowed scale advantages to stream to the underside line.

- Iren considerably expanded its Childress facility, boosting hashrate and reducing internet electrical energy value per BTC by 39%.

Financial Context And Geopolitical Tendencies

CoinShares additionally contextualized the mining panorama inside broader macroeconomic and geopolitical developments.

A number of U.S. states, together with Arizona, Oklahoma, and Texas, are actively exploring state-level strategic Bitcoin reserves, probably contributing over $10 billion in cumulative shopping for stress at present costs.

In the meantime, tariff insurance policies on imported mining rigs, starting from 24% to 54%, could weigh on miner profitability in Q2 2025, significantly for these depending on older or much less environment friendly {hardware}.

Regardless of macro uncertainty and tighter margins, CoinShares maintains that Bitcoin’s store-of-value narrative stays intact, particularly as U.S. commerce companions undertake extra accommodative insurance policies within the face of inflationary pressures.

The report concludes that whereas mining is turning into extra capital-intensive and aggressive, its distinctive positioning throughout vitality, compute, and monetary infrastructure makes it an asset class to observe.

Learn Subsequent:

Picture: Shutterstock

© 2025 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Source link