Bitcoin price holds $95K, ETH and Cardano in green as Blackrock ETF acquires $1B BTC

- Cryptocurrencies market cap holds agency at $3.1 trillion on Tuesday, with liquidity trickling down in direction of altcoins.

- Bitcoin value stagnates simply above the $95,000 degree, with Ethereum and Cardano posting superior features within the final 24 hours.

- Blackrock’s IBIT ETF posted $1 billion inflows on Monday, outweighing giant redemptions from Constancy and Ark Make investments.

Cryptocurrencies market capitalization consolidates above the $3 trillion mark on Tuesday, as US JOLTs knowledge raises hopes of imminent fee cuts.

As investor risk appetite grows, altcoins are attracting extra liquidity as Bitcoin value stagnates at $95,000, regardless of a report inflows from Blackrock’s IBIT ETF.

Bitcoin market replace:

Bitcoin value rose by one other 1% on Tuesday, advancing in direction of $95,500 earlier than hitting a sell-wall.

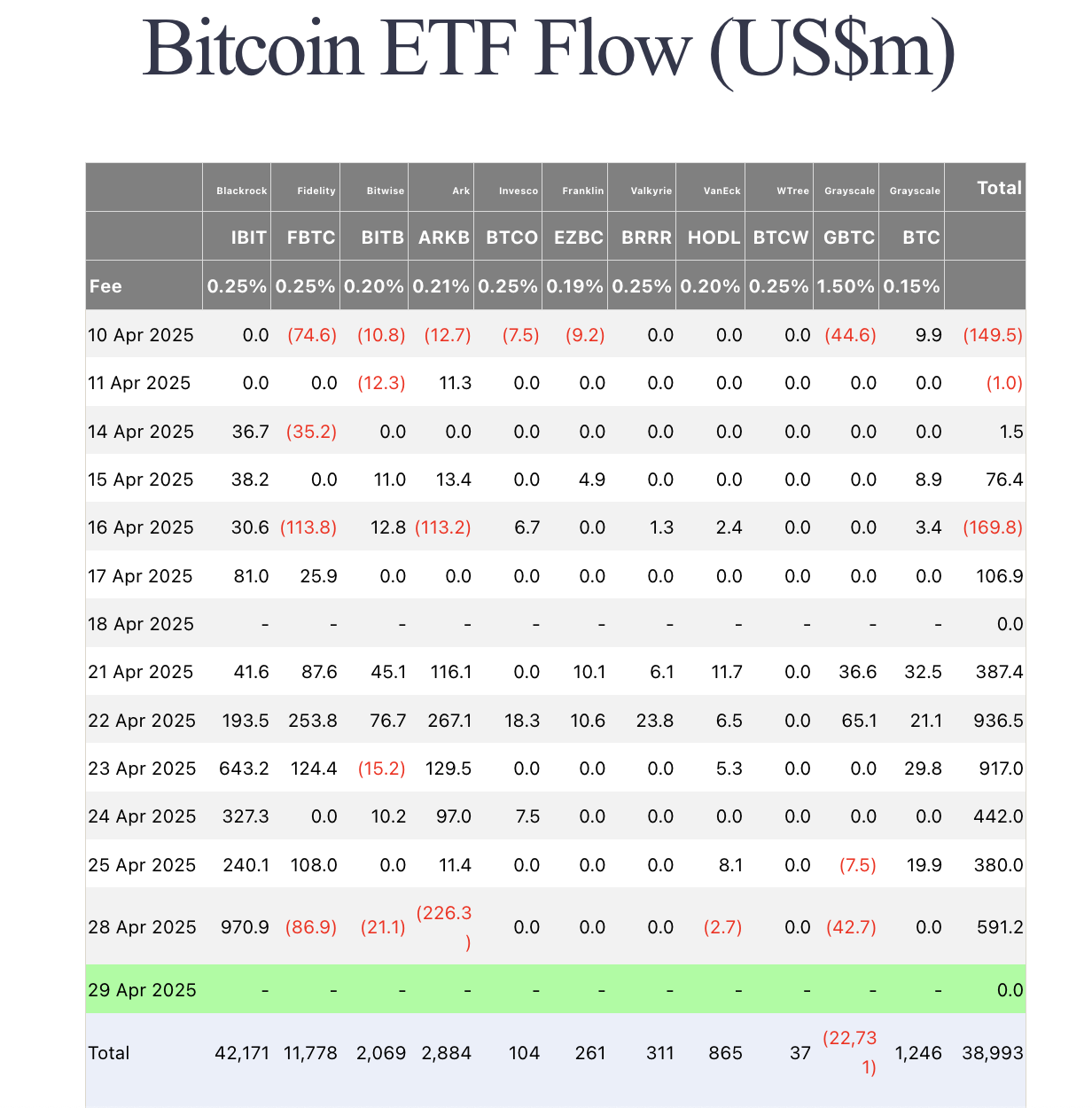

Chart of the day: Blackrock’s IBIT ETF set report with $970M single-day influx

Bitcoin ETFs have been experiencing a shopping for spree for the final eight days of buying and selling, relationship again to April 14.

Blackrock’s IBIT ETF posted $1 billion influx on Monday, whereas giant redemptions from Constancy and Ark Make investments noticed combination deposits drop to $591 million.

Bitcoin ETF Flows, April 29, 2025 | Supply: Farside

Demand from market-leading Blackrock may doubtlessly immediate different individuals into shopping for mode within the coming days.

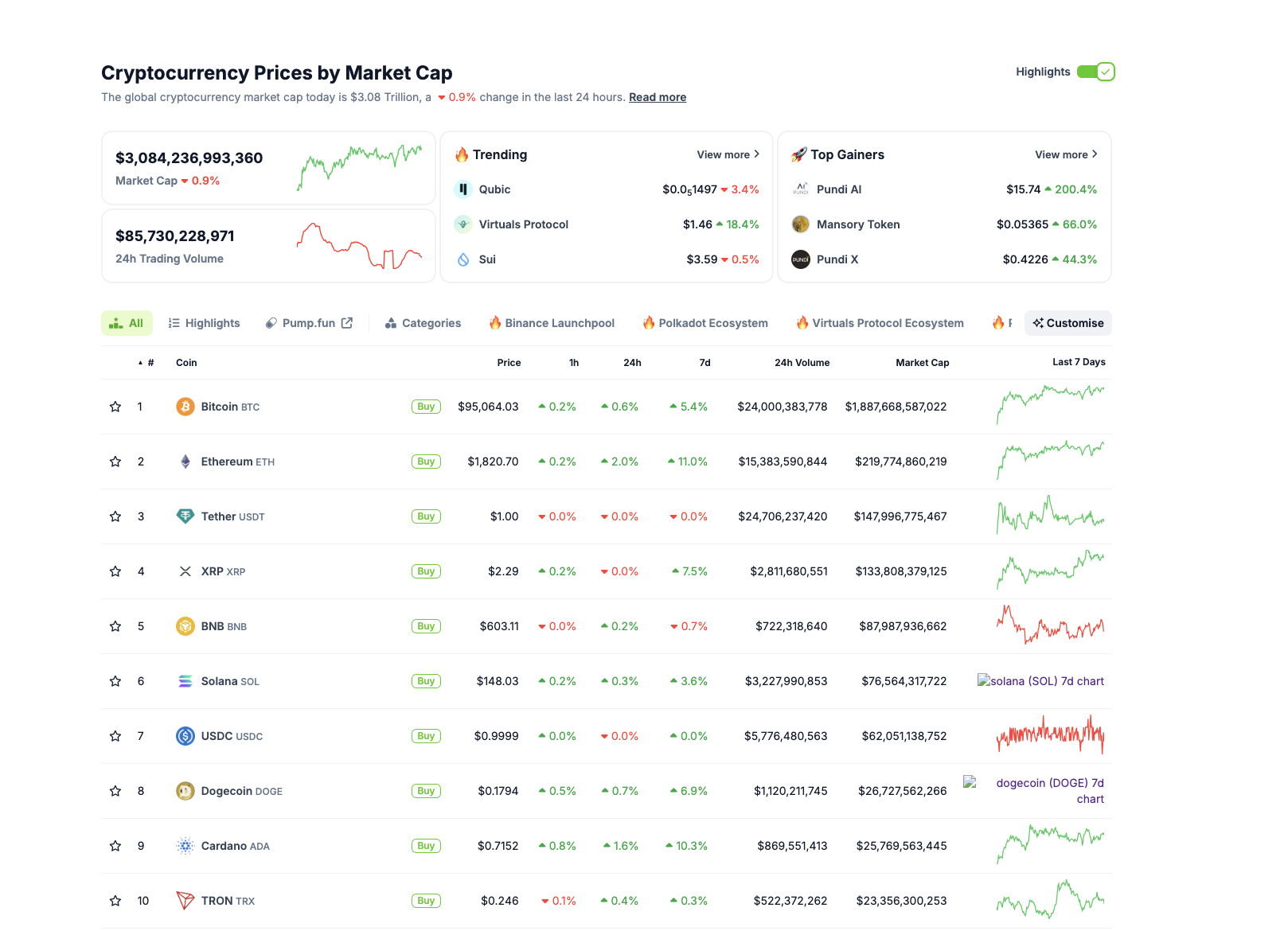

Altcoin market updates: Ethereum and Cardano skip forward of BTC as market momentum strengthens

After week-long consolidation, mega cap altcoins broke above key resistance zones on Tuesday. Ethereum and Cardano stood out with 2% features, respectively, exceeding Bitcoin’s 0.6% uptick at press time. With markets displaying stronger upside momentum for altcoins than BTC, this means that buyers are displaying higher-risk urge for food.

Crypto market efficiency, April 29 | Supply: Coingecko

Among the many prime 20 ranked cryptocurrencies, Bitcoin Cash (BCH) led the gainers with a 6% rally, as ongoing controversy surrounding Monero (XMR) drives market curiosity in direction of Privateness cash.

Outstanding Actual World Asset protocol, Hyperliquid additionally posted a big 18.4% in features, signalling elevated demand for tokenized devices.

Crypto information updates:

Circle obtains Abu Dhabi approval to develop stablecoin operations in Center East and Africa

Circle has obtained In-Precept Approval (IPA) from the Monetary Companies Regulatory Authority (FSRA) of Abu Dhabi World Market (ADGM) to function as a regulated cash providers supplier throughout the Center East and Africa. The approval permits Circle to progress towards securing a full Monetary Companies Permission (FSP), enabling broader entry to its USDC stablecoin and digital asset providers within the area.

The IPA follows Circle’s incorporation inside ADGM in December 2024 and builds on its ongoing collaboration with regional innovation hubs equivalent to Hub71. This regulatory clearance kinds a key a part of Circle’s broader growth technique aimed toward advancing stablecoin adoption in compliant frameworks throughout rising markets.

1inch launches on Solana, plans cross-chain swaps with ten supported networks

1inch has deployed its Fusion protocol on Solana, enabling MEV-protected token swaps for over 1 million Solana-based belongings. The launch consists of six developer APIs and a Dutch auction-based system designed to cut back slippage and enhance liquidity for merchants working inside the Solana ecosystem.

Following robust DeFi exercise on Solana in Q1 2025, 1inch now goals to roll out cross-chain swap performance connecting Solana with ten different networks. The transfer is meant to unify fragmented liquidity swimming pools and streamline decentralized buying and selling throughout a number of blockchains.

Source link