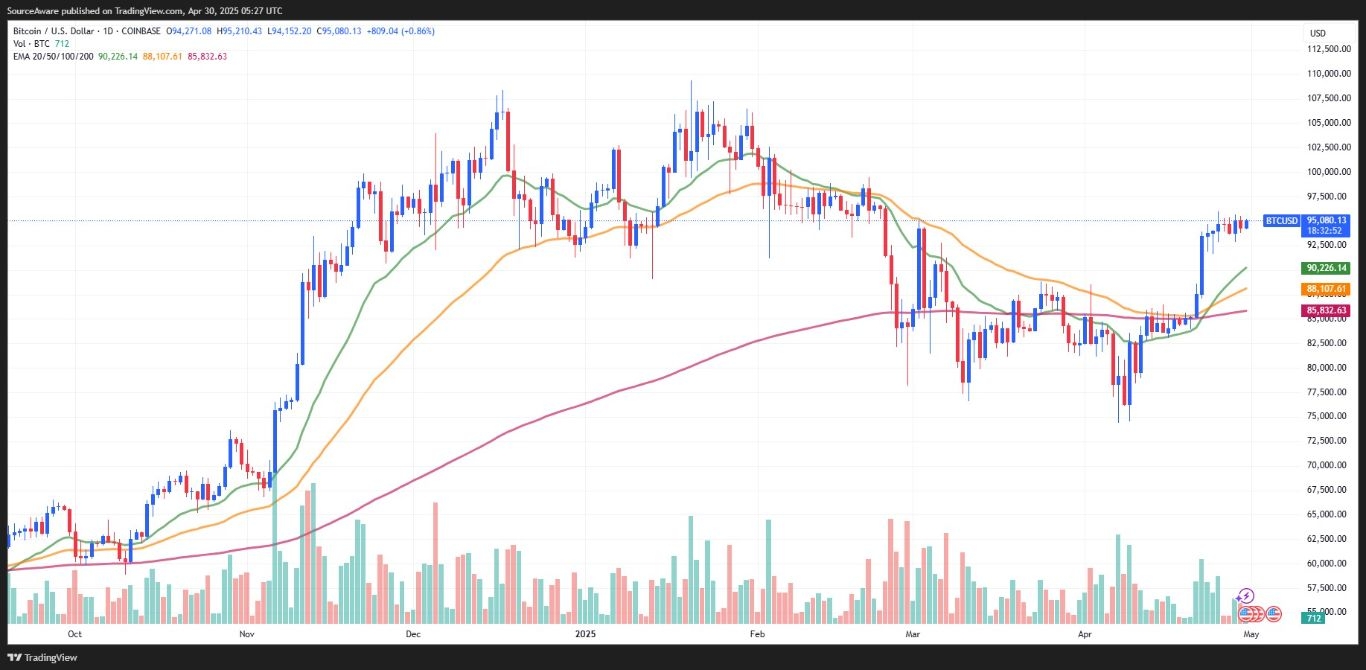

Bitcoin Stalls Below $95K, Monero Surges 43% (Chart)

Information supplied by TradingView reveals that King Crypto has traded primarily between $94,000 and $95,000 over the previous week, with neither bulls nor bears managing to realize the higher hand to drive the value motion.

BTC/USD 1-day chart. Supply: TradingView

The pause in crypto costs comes as issues round Trump’s commerce struggle and tariffs have begun to subside. Many now notice that the early numbers had been designed to get buying and selling companions to the negotiating desk, which has labored for many nations aside from China.

Whereas costs have stagnated, behind the scenes, speculative capital is coming into the market at a feverish tempo, with onchain analytics agency Glassnode reporting a surge in Bitcoin’s so-called “sizzling capital.”

#Bitcoin’s Scorching Capital (sum of cash moved within the final 24h + 1d–1w) reached $39.1B on 28 Apr – its highest since 10 Feb. This metric captures short-term holder exercise and is a proxy for speculative capital coming into the market: https://t.co/gxCGzWzEHW pic.twitter.com/hephgPEzTx

— glassnode (@glassnode) April 29, 2025

As proven within the X publish above, Glassnode information signifies that the sum of tokens transferring over the previous week hit the best stage since early February, surging by greater than 90% to virtually $40 billion.

“Since 21 Apr, $BTC sizzling capital rose from $20.7B to $39.1B – a rise of $18.7B or +92%,” Glassnode stated in a follow-up post. “This is without doubt one of the quickest upticks in short-term realized cap in latest months, signaling a surge in lively capital turnover.”

Glassnode added that BTC sizzling capital hit a low of $17.5B on March 23, its lowest stage since December, and over the previous 5 weeks, it has added greater than $21.5B, “suggesting a speedy shift from dormancy to hypothesis amongst newer market entrants.

Nonetheless, regardless of the surge in sizzling capital, Glassnode says it is too early to declare the return of a full-blown bull market, as total community participation stays low.

“Indicators of early FOMO are rising, with the Scorching Capital Share ticking larger and profitability metrics like P.c Provide in Revenue (86%) and NUPL (0.53) increasing notably,” the agency wrote in its newest Market Pulse analysis. “Nonetheless, whereas on-chain exercise similar to switch quantity and costs are recovering, day by day lively addresses stay suppressed, suggesting that full natural community engagement continues to be rebuilding.”

The report confirmed that futures open curiosity is rising, however funding charges have flipped to detrimental, a sign that brief sellers have entered the market.

“This mixture of elevated leverage, aggressive brief positioning, and chronic taker demand creates a fragile however explosive setup,” Glassnode stated. “Ought to the rally maintain, brief squeezes may drive a unstable extension larger; conversely, if momentum stalls, the market may see amplified swings as each side unwind.”

The report concluded by noting that whereas spot demand and ETF participation are materially enhancing, “the rising indicators of FOMO and leveraged imbalance in futures counsel that volatility dangers stay elevated within the brief time period.”

On the time of writing, Bitcoin trades at $94,990, a rise of 1.62% on the 7-day chart.

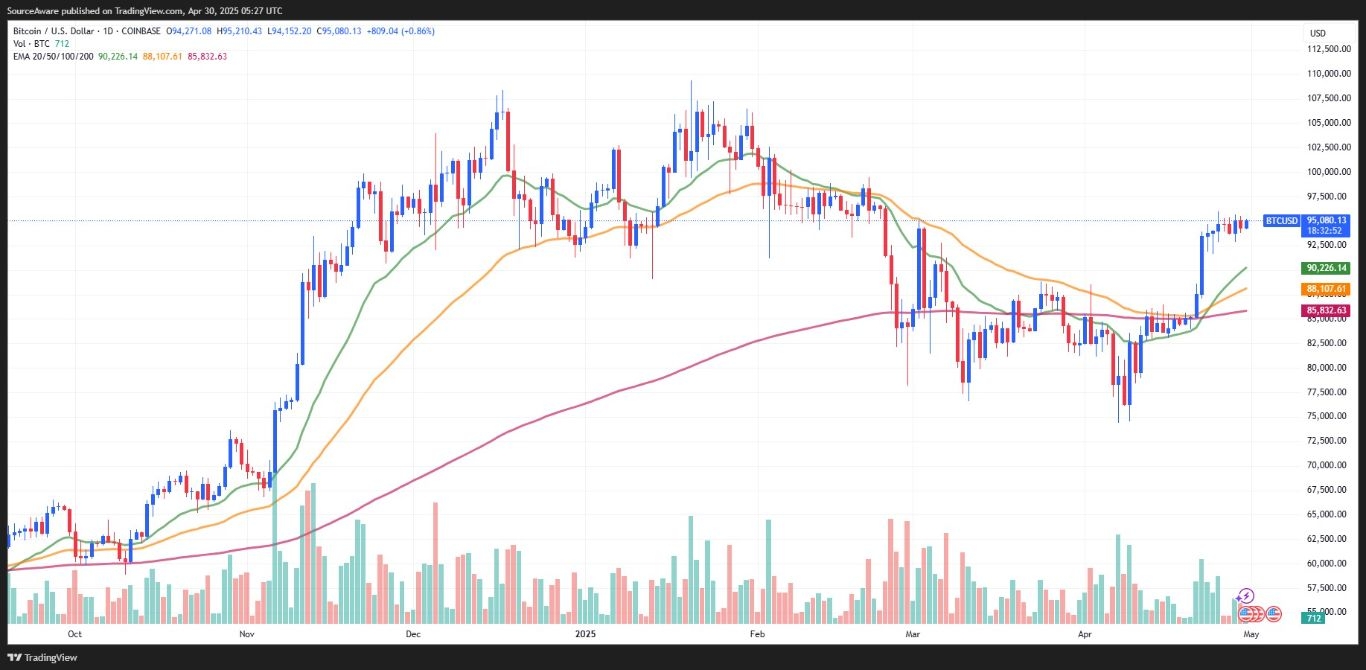

Monero Surge Linked to Bitcoin Theft

Monero (XMR), a number one privateness token, was one of many high performers over the previous week, spiking 43.5% on Sunday and into Monday.

XMR/USD 1-day chart. Supply: TradingView

The sudden surge excited privateness followers, however their enthusiasm has since been tempered by onchain sleuth ZachXBT, who stated the pump was possible as a result of a suspicious switch involving 3,520 Bitcoin, valued at $330.7 million, that will point out a major theft.

9 hours in the past a suspicious switch was created from a possible sufferer for 3520 BTC ($330.7M)

Theft deal with

bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55gShortly after the funds started to be laundered by way of 6+ on the spot exchanges and was swapped for XMR inflicting the XMR value to spike…

— ZachXBT (@zachxbt) April 28, 2025

ZachXBT famous that when the switch was confirmed, the stolen stash was rapidly distributed to 6 on the spot exchanges for laundering, finally being swapped into Monero. The sudden spike in demand led to a 50% surge in XMR’s value, with the token topping out at $329.

Monero has since given again among the good points, and on the time of writing, trades at $280.58 for a rise of 23.5% on the 7-day chart.

Able to commerce our daily Forex analysis on crypto? Right here’s our listing of the most effective MT4 crypto brokers price reviewing.

Source link