BTC price reaches 70-day peak, propelled by Michael Saylor and 21Shares

- Cryptocurrencies’ complete market cap rises above the $3.1 trillion market on Friday, its highest since early March.

- Bitcoin worth hits a 70-day peak of $97,431 on Friday.

- Michael Saylor-led Technique pronounces plans to lift one other $21 billion to fund BTC purchases in Q2.

- SUI attracted important search curiosity on Coingecko after 21 Shares’ ETF submitting.

The cryptocurrency mixture market cap dips by 1.4% within the early hours of Friday regardless of BTC worth rallying above $97,000 for the primary time in 70 days. Lagging altcoin efficiency alerts a cooling risk appetite.

With energetic bullish catalysts from TON’s partnership with Ethena and 21 Shares’ spot SUI ETF launch, it stays to be seen if altcoins will entice extra liquidity on Friday.

Bitcoin market updates:

Bitcoin worth lastly breached the 97,000 help on Friday after a number of unsuccessful makes an attempt at flipping the $95,000 resistance earlier within the week.

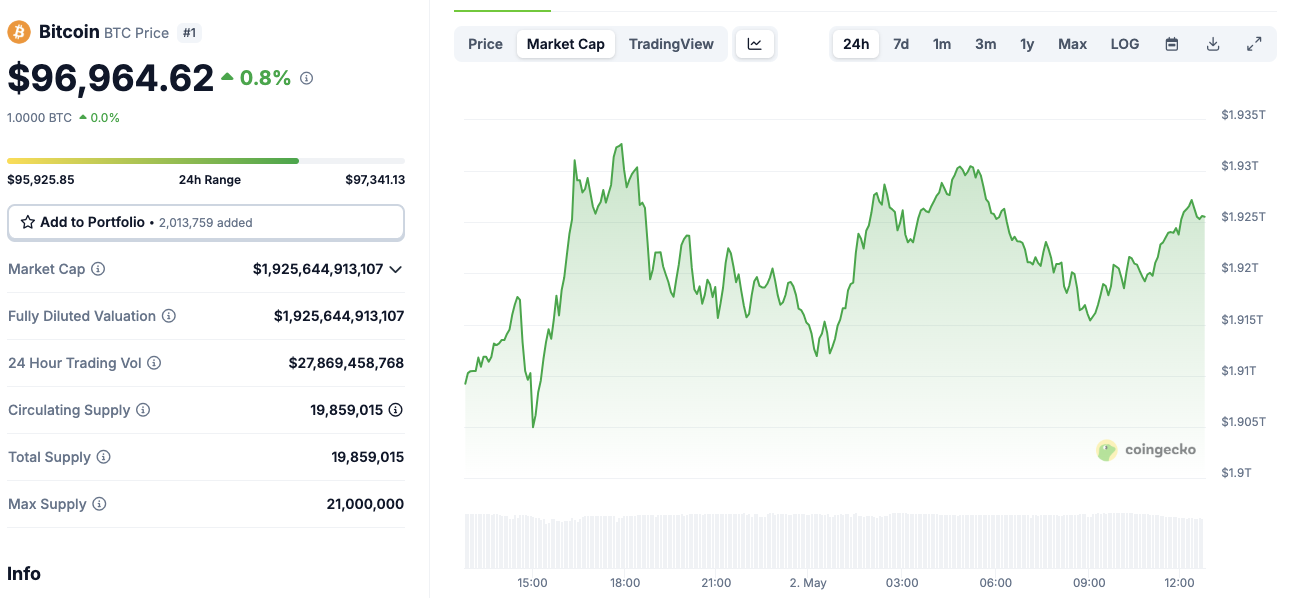

Bitcoin worth motion (BTC) | Coingecko

Coingecko knowledge exhibits BTC worth reached a 24-hour peak of $97,431, earlier than retracting to seek out help above the $96,500 on the time of writing.

Notably, with 24 billion in buying and selling quantity over the past day, BTC continues to seek out patrons on the present multi-month peak.

Additional emphasizing this pattern, BTC has efficiently fashioned a short-term help cluster effectively above the earlier rejection level at $95,500, holding up firmly inside the slender 2% vary between $95,900 and $97,431.

Why is Bitcoin worth going up right now?

A weak labor market report revealed this week, unusually high ETF demand, Arizona State passing a bill to ascertain the primary Bitcoin ETF reserve and the Q2 BTC buy plan unveiled by Micheal Saylor’s Microstrategy are amongst prime 4 components propelling BTC worth as of Friday.

Chart of the day: Bitcoin ETFs return to purchasing mode after temporary blip.

Bitcoin ETFs returned to purchasing mode on Thursday, posting a notable $422 million of mixture inflows.

After an eight-day shopping for spree that noticed the ETFs purchase $4 billion in eight consecutive days of buying and selling, the $54 million outflows on Thursday initially raised considerations of an abrupt sell-off.

Bitcoin ETF Flows | Supply: Farside

However on Friday, the shopping for frenzy continues with Blackrock’s IBIT and Grayscale’s GBTC funds main the way in which with one other $351 million and $41 million of deposits, respectively.

Altcoin market replace: StakeStone, SUI and Vanar Chain lead mid-cap momentum

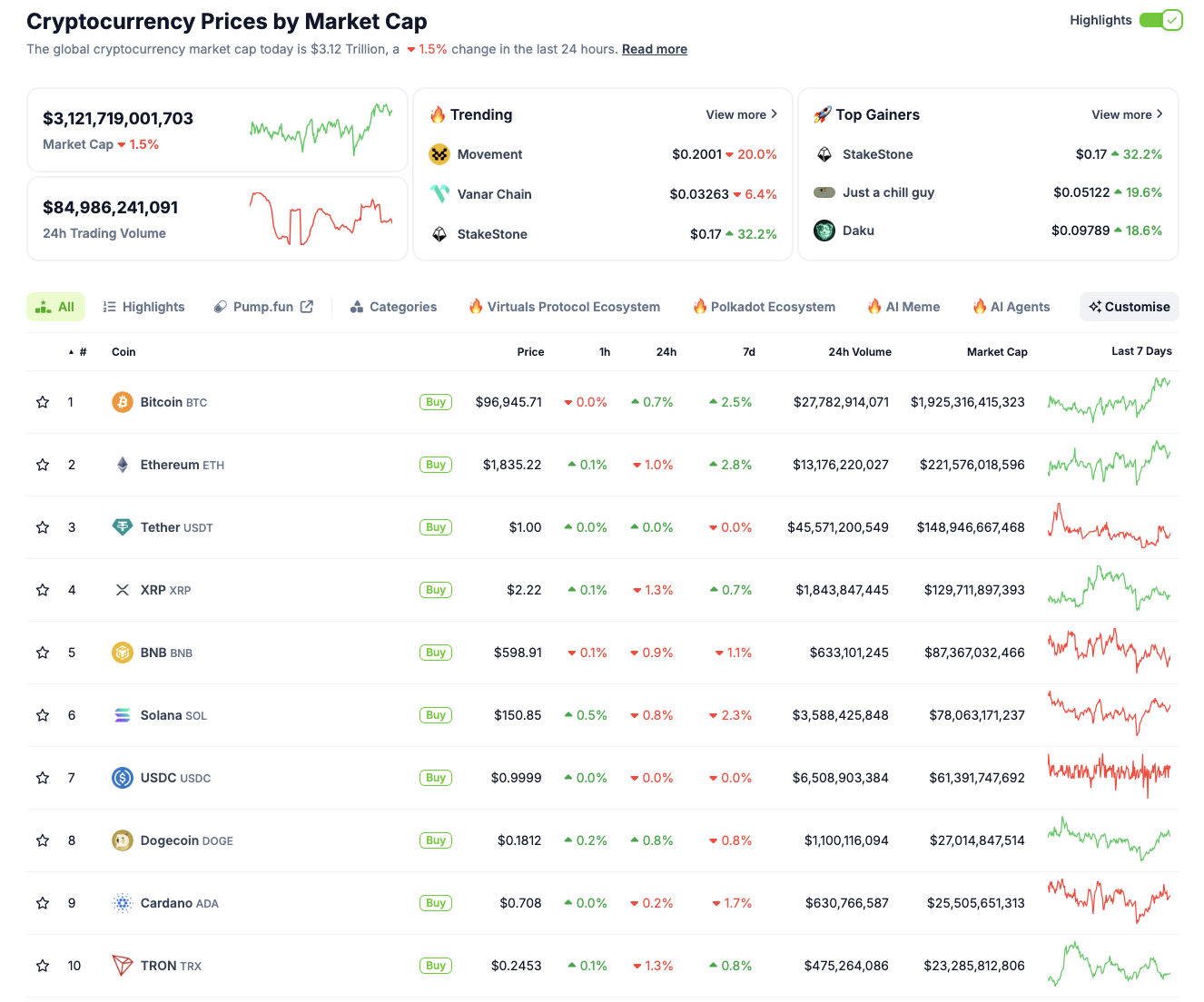

The worldwide crypto market cap stands at $3.12 trillion on Friday, up 1.5% previously 24 hours, signaling average optimism regardless of ongoing regulatory and delisting stress throughout main exchanges.

Buying and selling quantity hit $84.98 billion, indicating wholesome liquidity situations amid a risky week.

Main layer-1s confirmed modest positive aspects. Solana (SOL) rose 0.7% to $150.85, Ethereum (ETH) rose 0.7% to $1,835.22, and Cardano (ADA) remained flat at $0.708.

Prime 10 cryptocurrencies efficiency, Might 2 2025 | Supply: Coingecko

Whereas mega-cap property noticed muted positive aspects, traders have been wanting towards mid-cap property.

Main the altcoin surge is StakeStone (STONE), climbing 31% to $0.173 after a surge in DeFi exercise on new LST platforms. Analysts level to elevated staking incentives and a quickly increasing liquidity pool as key drivers. SUI, the native token of the Sui blockchain, gained 6.2% to commerce at $3.45, benefiting from bullish tailwinds on 21 Shares’ ETF submitting.

Vanar Chain (VANRY) additionally impressed, rising 36.4% to $0.0326, because the protocol secured a high-profile gaming partnership that fueled renewed neighborhood curiosity.

Regardless of Coinbase’s delisting of MOVE, most mid-cap altcoins maintained resilience, supported by sector-specific narratives in liquid staking, AI brokers and gaming infrastructure.

Adam Again-backed TBG outlines plan to accumulate 260,000 Bitcoin by 2034

The Blockchain Group (TBG), a Bitcoin treasury agency listed on Euronext Development Paris beneath the ticker ALTBG, has introduced plans to build up between 170,000 and 260,000 BTC by 2034. The goal, detailed within the firm’s newest fiscal report, represents an ambition to seize as much as 1% of Bitcoin’s complete provide over the subsequent decade.

TBG transitioned to a Bitcoin Treasury Firm mannequin in November 2024 and has since ramped up its BTC holdings from 15 BTC in December to 620 BTC by April 2025.

TBG’s strategic progress is backed by crypto-native traders together with Fulgur Ventures, UTXO Administration and TOBAM. Adam Again, CEO of Blockstream, serves as a strategic advisor to the agency.

Motion Labs suspends co-founder Rushi Manche amid governance investigation

Motion Labs has suspended its co-founder Rushi Manche amid an ongoing investigation led by Groom Lake into inner governance points and incidents involving a market maker. The choice comes as the corporate faces scrutiny over alleged token manipulation and inner disputes which have destabilized its management construction.

Concurrently, Coinbase introduced it’s going to delist the MOVE token on Might 15, citing failure to satisfy the alternate’s itemizing requirements following a routine overview. The MOVE token has since dropped to an all-time low as investor confidence continues to say no within the wake of governance considerations and market maker-related controversies.

Tether acquires 70% stake in Adecoagro, expands into real-world infrastructure

Tether Investments has acquired a 70% controlling stake in Adecoagro (NYSE: AGRO), a number one South American sustainable manufacturing agency. The acquisition marks a major pivot in Tether’s enlargement technique, shifting past stablecoins into power, agriculture, knowledge and communications infrastructure. This follows Tether’s preliminary $100 million funding in September 2024 for a 9.8% stake within the firm.

With majority possession secured, Tether has restructured Adecoagro’s board of administrators, changing 5 outgoing members with new appointees aligned with its strategic targets. The board now consists of new Government Chairman Juan Sartori and 4 extra members as Tether goals to speed up Adecoagro’s progress in renewable power.