Cboe registers 16% Y/Y increase in Global FX revenue in Q1 2025

Cboe International Markets, Inc. as we speak reported monetary outcomes for the primary quarter of 2025.

File International FX internet income of $21.3 million elevated 16% as in comparison with the primary quarter of 2024. The rise was on account of greater internet transaction and clearing charges.

ADNV traded on the Cboe FX platform was $51.9 billion for the quarter, up 15% in comparison with final yr’s first quarter, and internet seize fee per a million {dollars} traded was $2.77 for the primary quarter of 2025, up 6% in comparison with $2.62 within the first quarter of 2024.

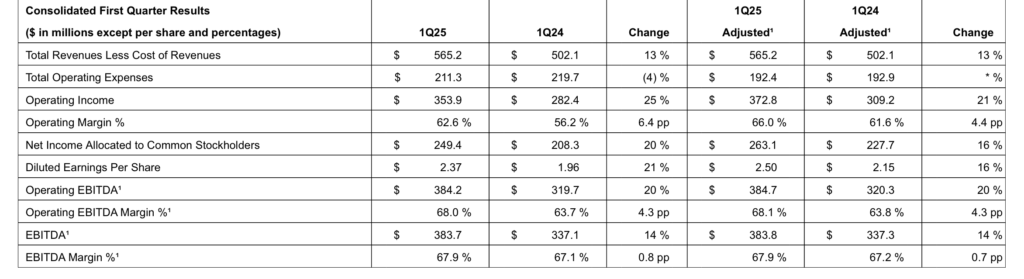

Complete revenues much less value of revenues (known as “internet income”) of $565.2 million elevated 13%, in comparison with $502.1 million within the prior-year interval, a results of will increase in derivatives markets, money and spot markets, and Information Vantage internet income.

Complete working bills had been $211.3 million versus $219.7 million within the first quarter of 2024, a lower of $8.4 million. This lower was primarily on account of decrease depreciation and amortization, different bills, and journey and promotional bills, partially offset by a rise in expertise assist providers and compensation and advantages.

Diluted EPS for the primary quarter of 2025 elevated 21 p.c to $2.37 in comparison with the primary quarter of 2024. Adjusted diluted EPS of $2.50 elevated 16 p.c in comparison with 2024 first quarter outcomes.

“The broad-based energy of our enterprise mannequin was on show in the course of the first quarter, leading to quarterly data for whole internet income and adjusted diluted EPS,” mentioned Jill Griebenow, Cboe International Markets Govt Vice President, Chief Monetary Officer.

“Derivatives internet income grew 16 p.c as we noticed file buying and selling volumes throughout our multi-listed and proprietary choices merchandise. Money and Spot Markets internet income elevated 10 p.c, and Information Vantage recorded 8 p.c internet income development. Transferring ahead, we’re growing our natural whole internet income development steering vary to mid to excessive single digits from mid single digits, and we’re reaffirming our Information Vantage natural internet income development vary of mid to excessive single digits for 2025. As well as, we’re reaffirming our full yr adjusted working expense steering vary of $837 to $852 million. We’re happy with the robust begin to the yr and stay targeted on producing sturdy shareholder returns within the quarters forward.”