Crypto Companies Escape April’s Stock Market Turbulence

Whereas April was a tough month for the inventory market, cryptocurrency firms reportedly loved clean crusing.

As Bloomberg information reported Wednesday (April 30), firms comparable to Coinbase and crypto mining operation CleanSpark have risen sharply this month, having fun with double-digit will increase even because the S&P 500 Index slipped 2.5%.

In keeping with the report, this momentum comes as bitcoin has seen a 13% rally, restarting a debate over its standing as an investor secure haven.

“The primary driver has been clearly the spot value” for firms with bitcoin publicity, Keefe Bruyette & Woods analyst Bill Papanastasiou advised Bloomberg. “And lots of those miners as effectively, throughout this entire tariff debacle, had been hit fairly laborious, and now they’re rebounding.”

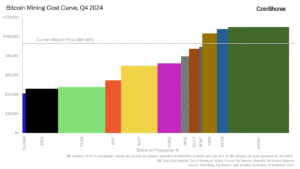

The report argued that the uptick carries some caveats. For instance, many crypto shares are down for the 12 months, after a tough first quarter when bitcoin prices plunged, taking these firms with them. Crypto miners are particularly laborious hit as token-minting grows much less worthwhile and tariffs threaten to ramp up {hardware} prices.

Amongst main firms, Galaxy Digital Holdings was the market chief, the report stated, with shares up 40%, lifted by permission to record on the Nasdaq and a rise in AI-computing enterprise from CoreWeave.

“Galaxy may be very intriguing simply given its, I’d say, multitude of companies it has going for it,” Cantor Fitzgerald analyst Brett Knoblauch stated. “And clearly because the crypto market does effectively, their crypto-adjacent companies do effectively.”

The information follows reviews from earlier this week of a wave of crypto-related “megadeals” following the election of President Donald Trump. Thus far this 12 months, crypto corporations have reached 88 offers price a total of $8.2 billion, The Wall Avenue Journal reported, citing knowledge from advisory agency Architect Partners. That’s virtually 3 times the transaction worth from 188 offers within the crypto sector within the entirety of final 12 months.

The president has named crypto-friendly regulators and has spoken of creating the U.S. the “undisputed bitcoin superpower,” whereas the Republican-led Congress is at work on laws to develop a regulatory framework for digital belongings.

Among the many president’s appointees is Securities and Exchange Commission (SEC) Chairman Paul Atkins, who final week criticized the regulatory coverage of the Biden administration and promised to take care of the “lengthy festering points” surrounding digital belongings and blockchain expertise.

“Innovation has been stifled for the last several years as a result of market and regulatory uncertainty that sadly the SEC has fostered,” Atkins stated lately through the SEC’s third Crypto Activity Drive roundtable.