Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

- Illicit actions primarily happen on the Ethereum and TRON networks, in response to Bitrace’s crypto crime report.

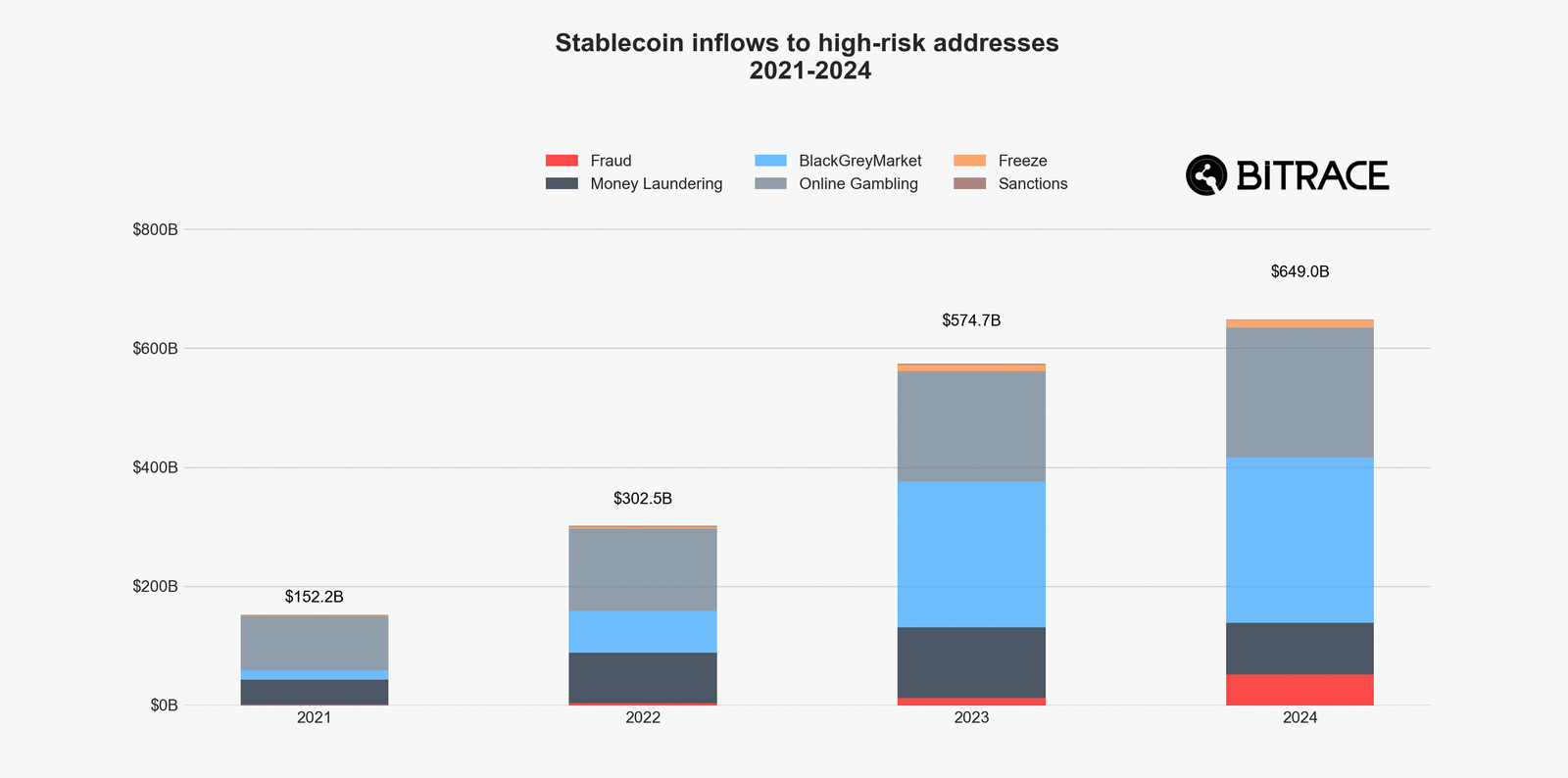

- Excessive-risk addresses that switch and retailer stablecoins collectively acquired $649 billion in 2024.

- Blockchain addresses related to fraudulent actions noticed a dramatic surge in stablecoin inflows, totaling $52.5 billion.

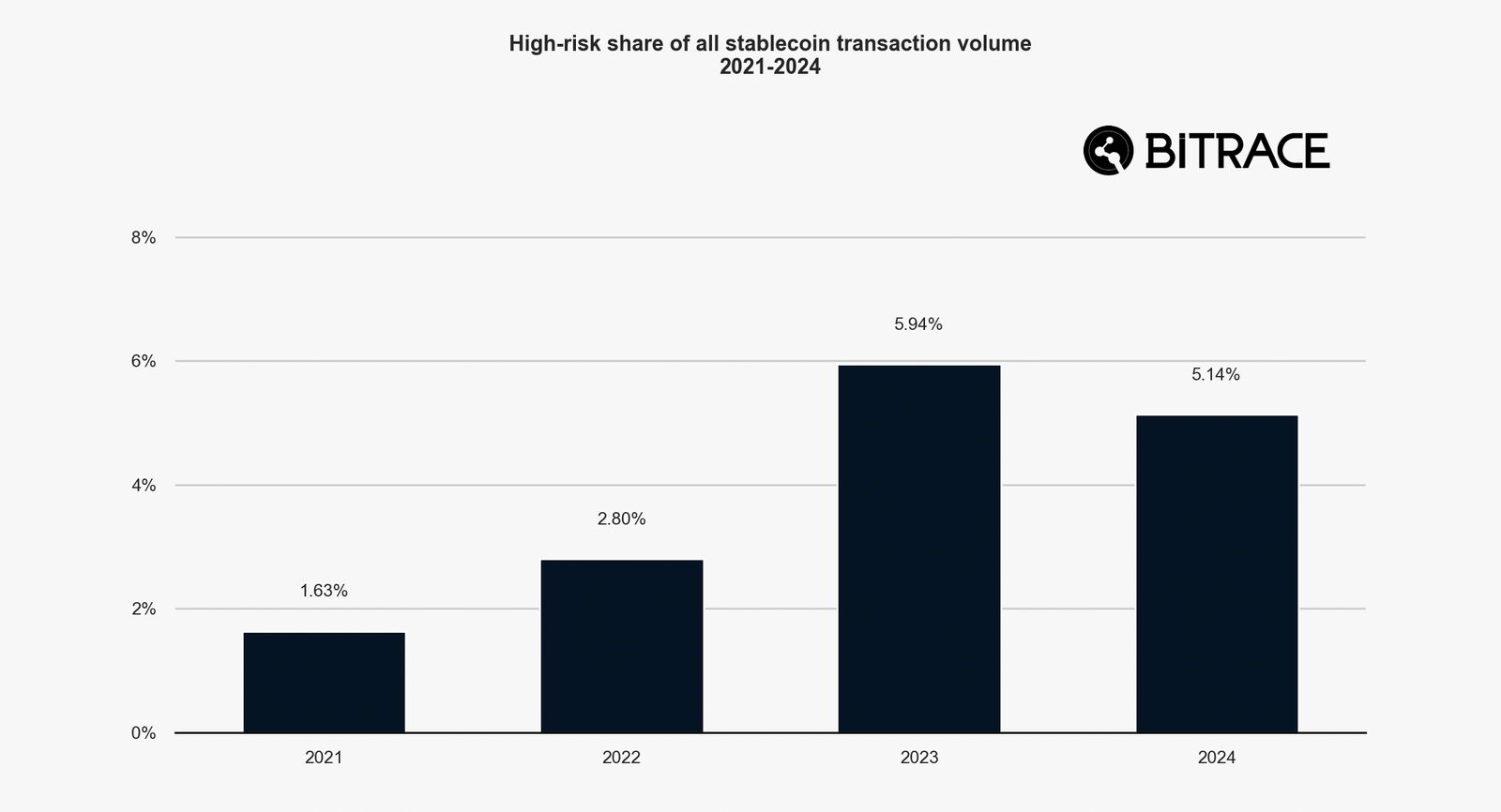

- Excessive-risk addresses accounted for five.14% of the entire stablecoin transactions in 2024.

The cryptocurrency trade is rising throughout a number of aspects, together with tokenized real-world property (RWA), futures and spot Alternate Traded Funds (ETFs), stablecoins, Synthetic Intelligence (AI), and its convergence with blockchain expertise, in addition to the dynamic decentralized finance (DeFi) sector. Elevated market capitalization and the continued adoption of the blockchain infrastructure are commendable milestones. On the identical time, felony enterprises are seeing a parallel growth, as they more and more leverage the crypto infrastructure, morphing their actions into complicated techniques that make it more durable for regulation enforcement authorities to hint.

In line with Bitrace’s 2025 Crypto Crime Report, most illicit actions are primarily discovered on Ethereum and TRON networks. Nonetheless, addresses marked as “high-risk” collectively acquired greater than $649 billion in 2024, surpassing the quantity acquired within the earlier 12 months.

Illicit actions consider Ethereum and TRON networks

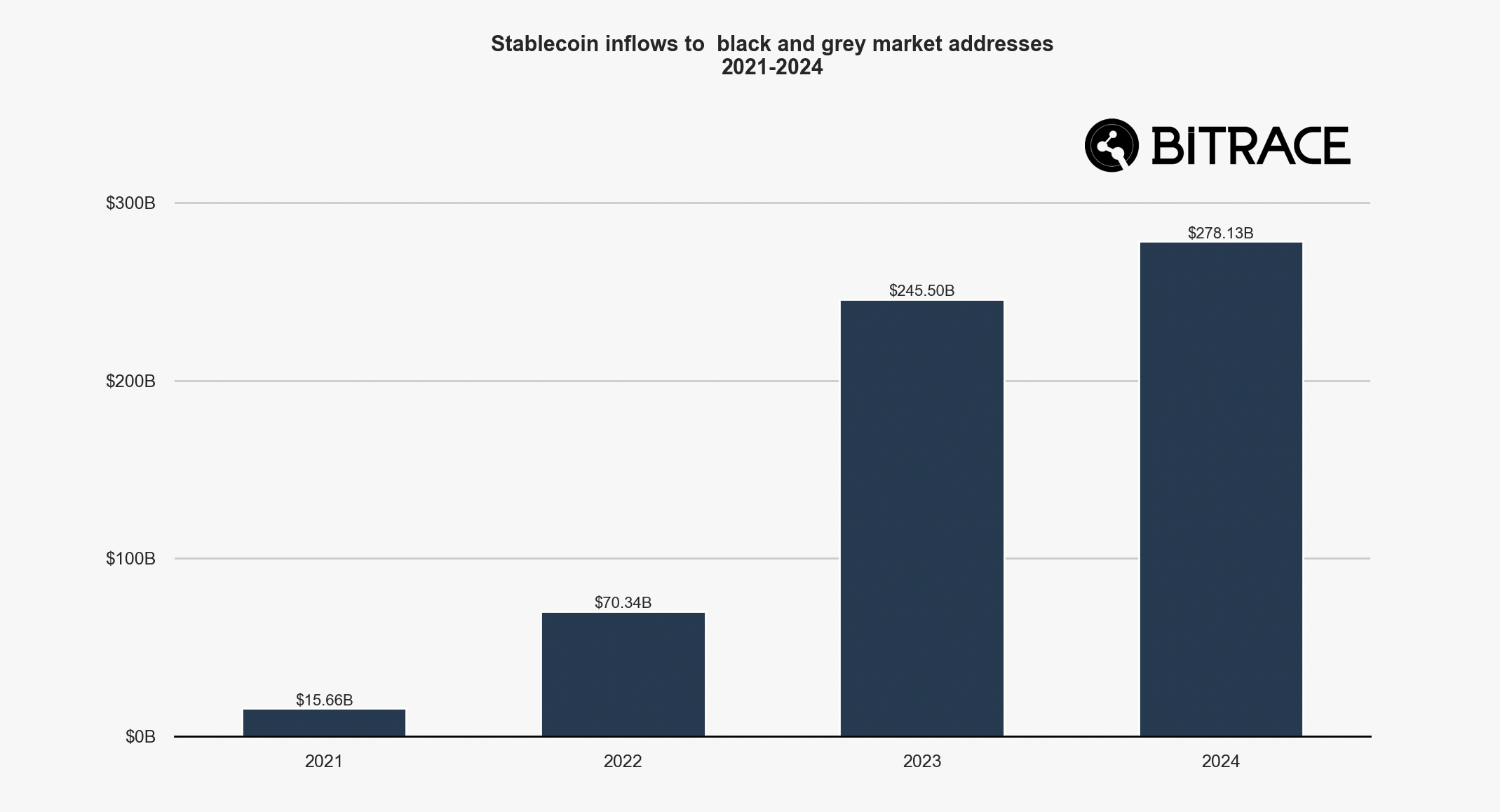

The 2025 Crypto Crime Report reveals that illicit commerce was rampant on Ethereum, the biggest good contracts protocol, and the TRON blockchain, with high-risk addresses related to black and grey markets receiving greater than $278.1 billion in 2024. This determine is up barely from 2023, however it’s also considerably larger than in 2021 and 2022.

Bitrace highlighted a number of stablecoin variations that facilitate illicit transfers, together with ERC20-USDT, ERC20-USDC, TRC20-USDT, and TRC20-USDC. Excessive-risk addresses utilized by illicit entities for receiving, transferring, or storing stablecoins collectively acquired roughly $649 billion, marginally larger than the earlier 12 months.

Stablecoin inflows to high-risk addresses | Supply: Bitrace

Relating to transaction quantity, high-risk actions within the cryptocurrency trade accounted for five.14% of the entire stablecoin transactions in 2024. This represents a 0.8% decline in comparison with 2023. Nonetheless, it stays considerably larger than the figures recorded in 2022 and 2021.

Proportion of high-risk actions in whole stablecoin transactions | Supply: Bitrace

Trying on the quantity of illicit actions by stablecoin sort, “TRON-based USDT dominated from 2021 to 2024. Nonetheless, in 2024, the share of USDT and USDC on Ethereum elevated,” Bitrace highlighted within the report.

Crypto fraud is on the rise

There’s a rising constructive correlation between escrow service platforms and illicit actions. Escrow companies, comparable to Huione Assure, which facilitate transactions throughout illicit provide chains, noticed transaction volumes surge to $2.64 billion by the fourth quarter of 2024, reflecting the rising demand for stablecoins in real-world economies, together with Southeast Asia.

On-line playing platforms and their related cost processors weren’t left behind, because the report signifies $217.8 billion in transactions in 2024, a 17.5% improve from 2023.

Stablecoin inflows to black and grey market addresses | Supply: Bitrace

Apparently, USDC’s share of stablecoins in these transactions surged to 13.36% from 5.22% the earlier 12 months. This uptick highlights the rising adoption of USDC within the playing sector, regardless of the stablecoin being issued by Circle, a good group.

“In 2024, blockchain addresses linked to fraud actions skilled an explosive development in stablecoin inflows, reaching USD 52.5 billion – exceeding the entire of earlier years mixed,” in response to Bitrace’s report.

It’s value mentioning that the sharp improve in illicit actions might not solely mirror actuality, as safety companies depend on present detection strategies amid an evolving and sophisticated fraud system. Due to this fact, as extra blockchains are monitored, beforehand undetected crypto crimes are reported, seemingly inflating statistics.

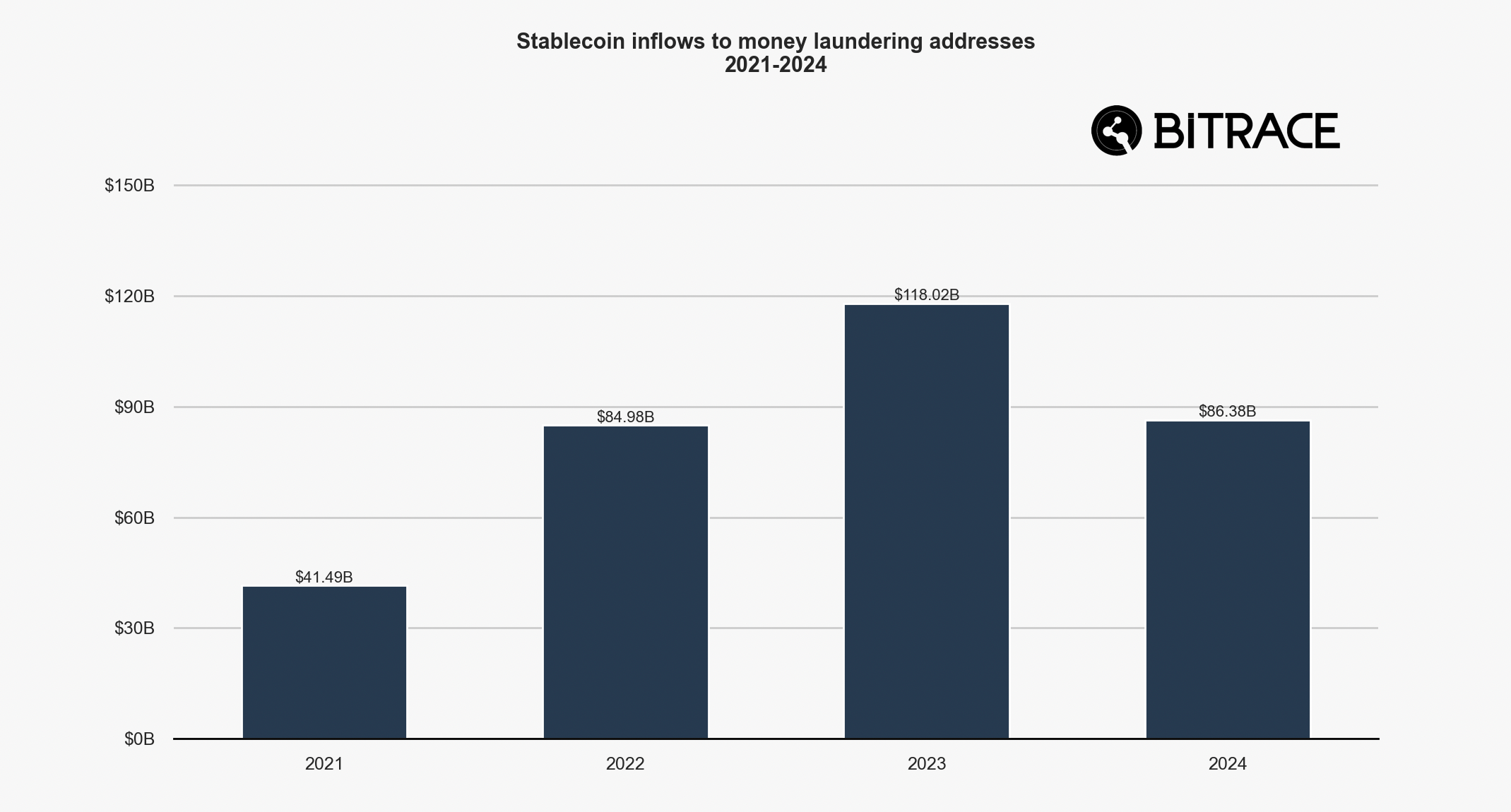

Cash laundering actions present indicators of decline

On the constructive facet, cash laundering actions confirmed indicators of easing, with the report highlighting addresses linked to related actions receiving $86.3 billion, marginally decrease than in 2023 and on the identical stage as 2022.

Stablecoin inflows to cash laundering addresses | Supply: Bitrace

The contraction in cash laundering actions means that regulatory initiatives and enforcement actions within the final two years have had a noticeable and measurable influence.

Stablecoin issuers, together with Tether and Circle, intensified their efforts, leading to $1.3 billion value of stablecoins being frozen on the Ethereum and TRON networks in 2024. That is double the quantity frozen over the past three years mixed.

The report attributes the milestone to laws being developed globally, notably in Hong Kong, the place clear authorized frameworks and enforcement actions have considerably diminished the proportion of dangerous stablecoin inflows because the third quarter of 2023.