Cryptocurrency Basics: Pros, Cons and How It Works

Cryptocurrency (or “crypto”) is a digital forex, resembling Bitcoin, that’s used as a substitute fee technique or speculative funding. Cryptocurrencies get their title from the cryptographic strategies that allow individuals spend them securely with out the necessity for a central authorities or financial institution.

Bitcoin was initially developed primarily to be a type of fee that is not managed or distributed by a central financial institution. Whereas monetary establishments have historically been essential to confirm {that a} fee has been processed efficiently, Bitcoin accomplishes this securely, with out that central authority.

Ethereum makes use of the identical underlying expertise as Bitcoin, however as an alternative of strictly peer-to-peer funds, the cryptocurrency is used to pay for transactions on the Ethereum community. This community, constructed on the Ethereum blockchain, permits complete monetary ecosystems to function with out a government. To visualise this, assume insurance coverage with out the insurance coverage firm, or actual property titling with out the title firm.

Scores of altcoins (broadly outlined as any cryptocurrency apart from Bitcoin) arose to capitalize on the varied — and at instances promising — use instances for blockchain expertise.

Meme coins, a subcategory of altcoins, are joke cryptocurrencies that signify web memes. Some meme cash, resembling Dogecoin, have risen to substantial market caps, regardless of having no critical use instances.

Commercial

NerdWallet score NerdWallet’s rankings are decided by our editorial group. The scoring method for on-line brokers and robo-advisors takes into consideration over 15 elements, together with account charges and minimums, funding selections, buyer assist and cell app capabilities. 4.6 /5 | NerdWallet score NerdWallet’s rankings are decided by our editorial group. The scoring method for on-line brokers and robo-advisors takes into consideration over 15 elements, together with account charges and minimums, funding selections, buyer assist and cell app capabilities. 4.3 /5 |

Charges 0% – 4% varies by sort of transaction; different charges might apply | |

Promotion Get $200 in crypto once you enroll. Phrases Apply. | Promotion None no promotion obtainable at the moment |

Why do individuals put money into cryptocurrencies?

Folks put money into cryptocurrencies for a similar motive anybody invests in something. They hope its worth will rise, netting them a revenue.

If demand for Bitcoin grows, for instance, the interaction of provide and demand may push up its worth. If individuals started utilizing Bitcoin for funds on an enormous scale, demand for Bitcoin would go up, and in flip, its worth in {dollars} would improve. So, in the event you’d bought one Bitcoin earlier than that improve in demand, you would theoretically promote that one Bitcoin for extra U.S. {dollars} than you acquire it for, making a revenue.

The identical rules apply to Ethereum. “Ether” is the cryptocurrency of the Ethereum blockchain, the place builders can construct monetary apps with out the necessity for a third-party monetary establishment. Builders should use Ether to construct and run functions on Ethereum, so theoretically, the extra that’s constructed on the Ethereum blockchain, the upper the demand for Ether.

Nonetheless, it is vital to notice that to some, cryptocurrencies aren’t investments in any respect. Bitcoin fanatics, for instance, hail it as a much-improved financial system over our present one and would like we spend and settle for it as on a regular basis fee. One frequent chorus — “one Bitcoin is one Bitcoin” — underscores the view that Bitcoin should not be measured in USD, however fairly by the worth it brings as a brand new financial system.

How does cryptocurrency work?

Cryptocurrencies are supported by a expertise generally known as blockchain, which maintains a tamper-resistant report of transactions and retains monitor of who owns what. Using blockchains addressed an issue confronted by earlier efforts to create purely digital currencies: stopping individuals from making copies of their holdings and trying to spend it twice.

Particular person items of cryptocurrencies will be known as cash or tokens, relying on how they’re used. Some are meant to be items of alternate for items and companies, others are shops of worth, and a few can be utilized to take part in particular software program packages resembling video games and monetary merchandise.

How are cryptocurrencies created?

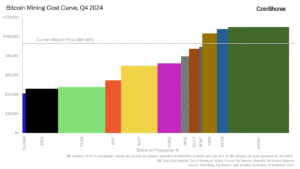

One frequent approach cryptocurrencies are created is thru a course of generally known as mining, which is utilized by Bitcoin. Bitcoin mining will be an energy-intensive course of through which computer systems clear up complicated puzzles to be able to confirm the authenticity of transactions on the community. As a reward, the homeowners of these computer systems can obtain newly created cryptocurrency. Different cryptocurrencies use totally different strategies, resembling proof of stake, to create and distribute tokens, and lots of have a considerably lighter environmental influence.

For most individuals, the simplest option to get cryptocurrency is to purchase it, both from an alternate or one other consumer.

Why are there so many sorts of cryptocurrency?

It’s vital to do not forget that Bitcoin is totally different from cryptocurrency usually. Whereas Bitcoin is the primary and most respected cryptocurrency, the market is massive — there are literally thousands of cryptocurrencies. And whereas some cryptocurrencies have whole market valuations within the a whole bunch of billions of {dollars}, others are obscure and primarily nugatory.

In case you’re enthusiastic about entering into cryptocurrency, it may be useful to begin with one that’s generally traded and comparatively well-established out there. These cash sometimes have the most important market capitalizations.

Thoughtfully deciding on your cryptocurrency, nonetheless, is not any assure of success in such a risky area. Typically, a problem within the deeply interconnected crypto business can spill out and have broad implications on asset values. For instance, when crypto alternate FTX collapsed in November 2022, the value of Bitcoin fell greater than 20% over the next two months.

Are cryptocurrencies monetary securities, like shares?

Whether or not or not cryptocurrency is a safety is a little bit of a grey space proper now. To again up a little bit, usually, a “safety” in finance is something that represents a worth and will be traded. Shares are securities as a result of they signify possession in a public firm. Bonds are securities as a result of they signify a debt owed to the bondholder. And each of those securities will be traded on public markets.

Regulators have more and more signaled that cryptocurrencies ought to be regulated equally to different securities, resembling shares and bonds. Nonetheless, with the June 2024 Loper Bright Enterprises v. Raimondo Supreme Court ruling, that will change — Congress might have to obviously outline crypto regulation via legislation making fairly than permitting the SEC to implement guidelines based mostly on its interpretation. That might have main implications for the asset class sooner or later.

Execs and cons of cryptocurrency

Cryptocurrency conjures up passionate opinions throughout the spectrum of traders. Listed here are a couple of causes that some individuals imagine it’s a transformational expertise, whereas others fear it is a fad.

Cryptocurrency professionals

Cryptocurrency is a risky funding, however in the long run, many cash have risen in worth significantly. Bitcoin’s worth has elevated roughly tenfold over the past 5 years, regardless of a number of bull and bear markets over that point. It topped $100,000 for the primary time in December 2024, though it has since fallen under that degree.

Some supporters like the truth that cryptocurrency removes central banks from managing the cash provide since over time these banks have a tendency to scale back the worth of cash by way of inflation.

In communities which were underserved by the standard monetary system, some individuals see cryptocurrencies as a promising foothold. Pew Analysis Heart information from 2021 discovered that Asian, Black and Hispanic individuals “are extra doubtless than White adults to say they’ve ever invested in, traded or used a cryptocurrency.”

Different advocates just like the blockchain expertise behind cryptocurrencies, as a result of it’s a decentralized processing and recording system and will be safer than conventional fee techniques. It could additionally present a less expensive option to ship cash internationally; though crypto networks sometimes cost transaction charges, many conventional worldwide cash switch companies cost substantial charges themselves.

Some cryptocurrencies provide their homeowners the chance to earn passive income via a course of known as staking. Crypto staking entails utilizing your cryptocurrencies to assist confirm transactions on a blockchain protocol. Although staking has its dangers, it might let you develop your crypto holdings with out shopping for extra.

Cryptocurrency cons

Many cryptocurrency initiatives are untested, and blockchain expertise usually has but to achieve huge adoption. If the underlying concept behind cryptocurrency doesn’t attain its potential, long-term traders might by no means see the returns they hoped for.

For shorter-term crypto traders, there are different dangers. Its costs have a tendency to vary quickly, and whereas that signifies that many individuals have made cash shortly by shopping for in on the proper time, many others have misplaced cash by doing so simply earlier than a crypto crash.

These wild shifts in worth can also lower towards the essential concepts behind the initiatives that cryptocurrencies have been created to assist. For instance, individuals could also be much less doubtless to make use of Bitcoin as a fee system if they don’t seem to be certain what it is going to be well worth the subsequent day.

The environmental influence of Bitcoin and different initiatives that use comparable mining protocols is important. A comparability by the College of Cambridge, for example, mentioned worldwide Bitcoin mining consumes greater than twice as a lot energy as all U.S. residential lighting. Some cryptocurrencies use totally different expertise that calls for much less power.

Governments world wide haven’t but totally reckoned with methods to deal with cryptocurrency, so regulatory adjustments and crackdowns have the potential to have an effect on the market in unpredictable methods.

Many cryptocurrency networks cost a charge for any transaction, together with shopping for or promoting crypto as an investor. These can fluctuate wildly, and excessive charges can lower into returns. Bitcoin transaction fees, for instance, have diverse between lower than 50 cents and greater than $100 per transaction over the past yr, during times of exceptionally low or excessive transaction exercise.

Need a low-risk funding?

This Treasury account has as much as a 4.37% APY on T-Payments – plus tax benefits.

Cryptocurrency authorized and tax points

There’s no query that cryptocurrencies are authorized within the U.S. In the end whether or not they’re authorized worldwide is determined by every particular person nation.

The query of whether or not cryptocurrencies are legally allowed, nonetheless, is just one a part of the authorized query. Different issues to think about embrace how crypto is taxed and what you should purchase with cryptocurrency.

Authorized tender: You may name them cryptocurrencies, however they differ from conventional currencies in a single vital approach: there is not any requirement in most locations that they be accepted as “authorized tender.” The U.S. greenback, against this, have to be accepted for “all money owed, private and non-private.” International locations world wide are taking varied approaches to cryptocurrency. For now, just one nation, El Salvador, accepts Bitcoin as authorized tender. Within the U.S., what you should purchase with cryptocurrency is determined by the preferences of the vendor.

Crypto taxes: Once more, the time period “forex” is a little bit of a crimson herring in terms of taxes within the U.S. Cryptocurrencies are taxed as property, fairly than forex. That signifies that once you promote them, you will pay tax on the capital beneficial properties, or the distinction between the value of the acquisition and sale. And in the event you’re given crypto as fee — or as a reward for an exercise resembling mining — you will be taxed on the worth on the time you obtained them.

Your choice: Is cryptocurrency a very good funding?

Cryptocurrency is a comparatively dangerous funding, irrespective of which approach you slice it. Typically talking, high-risk investments ought to make up a small a part of your general portfolio — one frequent guideline is not more than 10%. You could need to look first to shore up your retirement financial savings, repay debt or put money into less-volatile funds made up of shares and bonds.

There are different methods to handle danger inside your crypto portfolio, resembling by diversifying the vary of cryptocurrencies that you just purchase. Crypto belongings might rise and fall at totally different charges, and over totally different time durations, so by investing in a number of totally different merchandise you may insulate your self — to a point — from losses in one in every of your holdings.

Maybe an important factor when investing in something is to do your homework. That is notably vital in terms of cryptocurrencies, which are sometimes linked to a selected technological product that’s being developed or rolled out. While you purchase a inventory, it’s linked to an organization that’s topic to well-defined monetary reporting necessities, which can provide you a way of its prospects.

With cryptocurrencies, then again, discerning which initiatives are viable will be more difficult. You probably have a monetary advisor who’s conversant in cryptocurrency, it might be price asking for enter.

For starting traders, it will also be worthwhile to look at how broadly a cryptocurrency is getting used. Most respected crypto initiatives have publicly obtainable metrics displaying information resembling what number of transactions are being carried out on their platforms. If use of a cryptocurrency is rising, that could be an indication that it’s establishing itself out there. Cryptocurrencies additionally usually make “white papers” obtainable to elucidate how they’re going to work and the way they intend to distribute tokens.

In case you’re trying to put money into much less established crypto merchandise, listed here are some extra questions to think about:

Who’s heading the challenge? An identifiable and well-known chief is a optimistic signal.

Are there different main traders who’re investing in it? It’s a very good signal if different well-known traders need a piece of the forex.

Will you personal a portion within the firm or simply forex or tokens? This distinction is vital. Being an element proprietor means you get to take part in its earnings (you’re an proprietor), whereas shopping for tokens merely means you are entitled to make use of them, like chips in a on line casino.

Is the forex already developed, or is the corporate trying to increase cash to develop it? The additional alongside the product, the much less dangerous it’s.

It will possibly take numerous work to comb via a prospectus; the extra element it has, the higher your probabilities it’s authentic. However even legitimacy doesn’t imply the forex will succeed. That’s a wholly separate query, and that requires numerous market savvy. You’ll want to take into account methods to defend your self from fraudsters who see cryptocurrencies as a possibility to bilk traders.

Steadily requested questions

How does a blockchain work?

What does proof of labor imply?

How do you mine cryptocurrency?

How do you pull your cash out of crypto?

What is the take care of the Strategic Bitcoin Reserve?