DeFi Development Files for $1 Billion Offering to Buy More SOL

DeFi Growth Corp. (JNVR), previously generally known as Janover, is doubling down on its plan to purchase extra Solana for its treasury because it appears to be like to supply as much as $1 billion price of securities.

The agency, previously a industrial actual property lending tech platform, revealed in a U.S. Securities and Trade Fee (SEC) filing that it plans on utilizing the funds for “normal company functions, together with the acquisition of Solana.” The providing will embody widespread and most popular inventory, debt devices, warrants, and items.

DeFi Growth has already acquired approximately $48.2 million of SOL and plans to function validators on the Solana blockchain to earn staking rewards.

Taking a playbook out of Michael Saylor’s bitcoin shopping for technique, firms have been more and more shopping for SOL for his or her steadiness sheets to offer TradFi traders with publicity to the token.

SOL Methods, the publicly traded firm helmed by CEO Leah Wald—former co-founder of digital asset supervisor Valkyrie Investments—spearheaded the motion. Not too long ago, the agency announced that it had secured an as much as $500 million convertible word facility to ramp up its investments within the Solana community.

DeFi Growth’s new providing comes after a big management shakeup earlier this month. Former Kraken govt Joseph Onorati took over as CEO and chairman, and Parker White, one other ex-Kraken engineer, was named chief working officer and chief funding officer. The corporate additionally introduced on John Han, a former Binance and Kraken govt, as CFO. DeFi Growth adopted a treasury technique centered round Solana as a part of its new route.

Along with the $1 billion shelf registration, DeFi Growth additionally filed to register 1.24 million shares on behalf of early traders, together with Pantera Capital, Payward (father or mother firm of Kraken), and Arrington Capital.

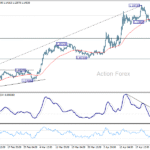

Shares of DeFi Growth Corp surged greater than 970% following the management shakeup and moved up roughly 4% in after-hours buying and selling on Friday to now stand at $54 per share.

Disclaimer: This text, or components of it, was generated with help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Policy.

Source link