Forex reserves steadily rise over $27b now

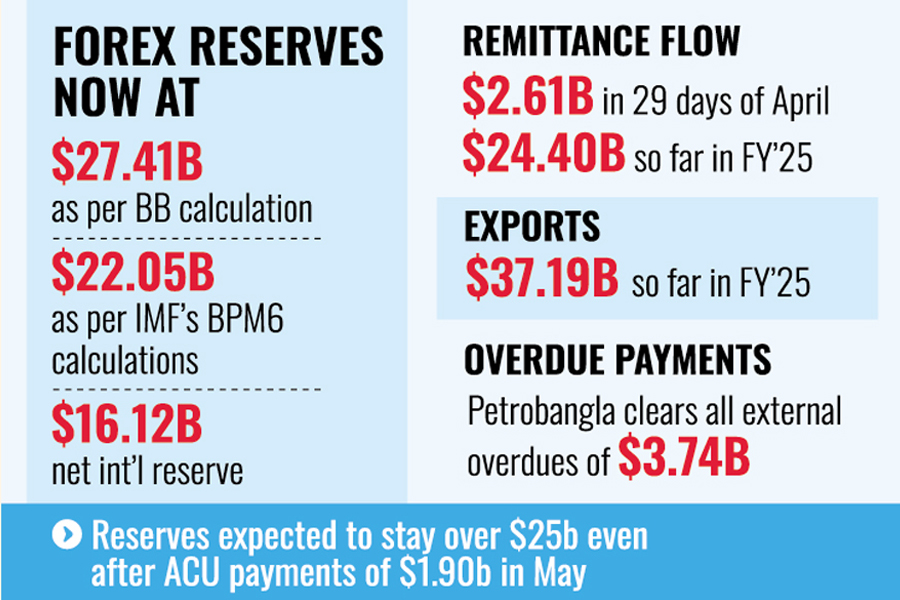

Bangladesh financial system feels some respite because the nation’s foreign-exchange reserves rebound to a 20-month excessive of US$27.41 billion by the top of April 2025 by official rely, regardless of main payouts.

Bangladesh Financial institution (BB) sources say the recorded reserves dimension was the very best since August 2023 when the determine was $29.26 billion.

Regardless of the federal government having to make substantial fee in clearing amassed exterior overdue payments in current months, they add, the foreign exchange reserves continued rising, which supplies a sign of regular rebound in foreign-exchange reserves.

As a matter of truth, the quantity of web worldwide reserves (NIR) additionally crossed $16.0-billion mark by the top of this previous month of April.

Officers and money-market analysts say vital rises in influx of remittances and export receipts largely prop up the nation’s foreign-exchange reserves however a gentle enhance in import orders and settlements.

In keeping with the newest statistics of the BB, the nation’s central financial institution, the gross foreign exchange reserves stood at $27.41 billion and $22.05 billion in BB and IMF’s BPM6 calculations respectively.

Then again, the NIR rose to $16.12 billion after April 30, 2025, in keeping with the official information.

Searching for anonymity, a BB official says the nation’s foreign exchange reserves continued to develop to cross $27 billion even after paying off too many exterior overdue payments, which is a “vital achievement”.

“And this outstanding turnaround comes with out help of the IMF (Worldwide Financial Fund),” the official advised The Monetary Specific-a day after the finance adviser of the post-uprising authorities mentioned Bangladesh’s financial system is not IMF-World Financial institution-dependent because the Fund nonetheless stored mortgage launch on the backburner.

The central banker mentioned BB Governor Dr Ahsan H. Mansur, quickly after +taking cost of the banking regulator in August final yr, instructed them to clear all of the overdue payments to enhance picture of the nation globally.

As a part of the directions, the official mentioned, they cleared all exterior funds backlog, like funds to Chevron and Qatar Vitality. Regardless of the most important funds, the reserves carry on the upturn.

Giving full credit score to the place credit score is due–remitters and exporters–for bolstering the reserves, the BB official mentioned, “The best way the remittance is coming in current days, the reserves will keep over $25 billion even after paying ACU liabilities amounting to $1.90 billion due in Could.”

The BB information confirmed remitters despatched foreign currency equal to $2.61 billion till April 29, 2025. With the newest injections, the nation bagged $24.40 billion in remittances to this point this fiscal (FY’25), the second-highest within the historical past after the FY’21 receipt of $24.77 billion.

By way of export, the nation registered a ten.52-percent enhance in export earnings with $37.19 billion bagged within the first 9 months of the FY’25 from $33.65 billion earned through the corresponding interval of the final fiscal (FY’24).

Because the feel-good mode prevails, Petrobangla in a press launch Wednesday mentioned that they had managed to clear all exterior money owed amounting to $3.74 billion two months earlier than the cutoff time until June 2025.

The company talked about that it cleared liabilities value $1.45 billion of 4 varieties of collectors within the final two months (March and April).

The precise import by way of settlement of letters of credit score (LCs) grew by 4.07 per cent to US$45.99 billion through the July-February interval of the present fiscal yr (FY) 2024-25, from $44.19 billion in the identical interval of the earlier fiscal yr.

Then again, the opening of recent LCs, commonly known as import orders, rose by 4.62 per cent to $47.28 billion within the first eight months of this fiscal from $45.19 billion in the identical interval of FY’24.

Speaking to the FE, Chairman of Coverage Alternate Bangladesh Dr M Masrur Reaz mentioned the regular rise in foreign exchange reserves offers an early however clear indication that the nation’s exterior sector like BoP is on proper monitor for restoration.

“And the rise comes at a time when the import orders and settlements hold rising, which is sort of encouraging, and the expansion is strong,” says the economist.

He notes that the considerably rising inflows of foreign currency by way of remittance and export assist bolster the reserves.