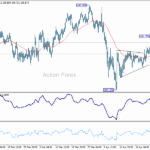

Gains are Nothing Special (Chart)

My previous BTC/USD signal on 7th April produced a dropping quick commerce from the bearish reversal on the resistance stage of $79,599.

In the present day’s BTC/USD Alerts

Danger 0.50% per commerce.

Trades could solely be taken earlier than 5pm Tokyo time Friday.

Lengthy Commerce Concepts

- Lengthy entry after a bullish worth motion reversal on the H1 timeframe following the following contact of $81,203, $78,079, or $74,725.

- Place the cease loss $100 under the native swing low.

- Alter the cease loss to interrupt even as soon as the commerce is $100 in revenue by worth.

- Take away 50% of the place as revenue when the commerce is $100 in revenue by worth and go away the rest of the place to experience.

Brief Commerce Concepts

- Brief entry after a bearish worth motion reversal on the H1 timeframe following the following contact of $84,807, $86,215, or $88,958.

- Place the cease loss $100 above the native swing excessive.

- Alter the cease loss to interrupt even as soon as the commerce is $100 in revenue by worth.

- Take away 50% of the place as revenue when the commerce is $100 in revenue by worth and go away the rest of the place to experience.

The perfect methodology to establish a traditional “worth motion reversal” is for an hourly candle to shut, resembling a pin bar, a doji, an outdoor and even simply an engulfing candle with the next shut. You possibly can exploit these ranges or zones by watching the price action that happens on the given ranges.

BTC/USD Evaluation

I wrote in my earlier BTC/USD forecast final Monday that I’d solely search for quick trades in Bitcoin right now. This wasn’t a fantastic name and didn’t work out effectively, with the quick commerce alternative that arrange producing a loss.

Bitcoin has been one thing of a sideshow currently, with markets dominated by dramatic developments regarding the US imposing massive tariffs on imports of overseas items. This produced a bit risk-off transfer available in the market. Then, yesterday, the Trump administration introduced that tariffs on all nations can be set at a flat and comparatively low charge of 10% for 90 days whereas talks have been carried out with many buying and selling companions. This information despatched danger belongings strongly larger, though costs are nonetheless significantly decrease than when all this tariff speak actually got here into focus about two weeks in the past.

Bitcoin has been no exception and fell then rose identical to shares and all different danger belongings did.’

Nevertheless, what’s technically important, is {that a} longer-term worth chart exhibits that even the latest worth will increase have been technically maintained inside the multi-month downwards pattern. It is a bearish signal for Bitcoin.

On shorter-term time frames, there was a bullish signal: the double backside on the assist stage of $74,725 which may be very confluent with the main spherical quantity at $75,000. So, you may see this as sturdy assist and an space the place you would possibly really feel assured about shopping for if you’re ready to carry for some time. This was additionally a breakout space when Trump was elected President, so it seems to be very more likely to be pivotal, key assist.

A brief commerce from $84,612 following a bearish reversal there is also commerce.

There may be nothing of excessive significance due right now concerning Bitcoin. In regards to the US Greenback, there might be a launch of CPI (inflation) and Unemployment Claims knowledge at 1:30pm London time.