How stability in crypto market could spark XRP price rally to $3

- XRP value regularly extends features because the cryptocurrency market holds regular.

- XRP holds above important assist at $2.22, strengthened by the 100-day EMA.

- A breakout from the descending channel may spark vital bullish momentum, probably driving a rally previous $3.

- The surge in long-position liquidations whereas Open Curiosity stays unchanged alerts declining curiosity and a possible pullback.

Ripple (XRP) value consolidates features on the time of writing on Tuesday, following three consecutive every day inexperienced candles. Buying and selling at $2.26, XRP is down over 1% on the day, mirroring the soundness within the broader crypto market. A pullback from the present market stage appears attainable, however it might not deter traders from searching for publicity, thereby rising the tailwind for a breakout aiming for $3.00.

Bitcoin (BTC) stays above $94,000, with its uptrend pushed by surging web inflows into spot BTC ETFs, easing commerce tensions between the USA (US) and China, in addition to quick squeezes.

Choose altcoins, together with Virtuals Protocol, Floki, and Hyperliquid (HYPE), are extending their lead, suggesting that traders are shifting their consideration to lesser-known cash that obtain greater revenue margins.

XRP value nurtures potential breakout to $3

XRP’s value usually drops inside the confines of a descending channel. Nonetheless, for the reason that cross-border cash remittance token rebounded from its yearly low at $1.61 on April 7, the potential for a rally past $3.00 considerably elevated.

Regardless of the rejection of $2.36, a stage examined on Monday, XRP maintains its place above the 50, 100, and 200-day Exponential Shifting Averages (EMAs), confirming bullish momentum. The EMAs are sloping upward, additional reinforcing a powerful bullish pattern.

The 50-day and 100-day EMAs present speedy assist at $2.20 and $2.22, respectively. A reversal to those ranges is feasible, and XRP may gather extra liquidity as merchants purchase the dip.

The Relative Power Index (RSI) indicator’s impartial place at 58.11 may maintain the scales within the bulls’ favor, particularly if it stays above the midline of fifty. This might enhance the potential for a breakout above the descending channel.

Past the vendor congestion at $2.40, provide zones at $2.80 and $3.00 are price remembering as they might sluggish the potential XRP rally. Larger quantity on upward strikes will likely be essential in pushing XRP towards $3.00.

XRP/USDT every day chart

Elements that might maintain XRP value elevated

A number of developments may assist XRP’s bullish outlook within the close to time period, together with ongoing talks between Ripple and the Securities and Trade Fee (SEC) relating to a possible settlement. Earlier this month, Ripple and the SEC had been granted a brief keep of the appeals course of, permitting for settlement negotiations and enabling the SEC’s commissioners to vote on the matter.

The lately permitted futures XRP ETFs may assist bolster the token’s bullish outlook over the approaching months. Furthermore, Ripple’s intentional push to the stablecoin market and tokenization companies boosts sentiment.

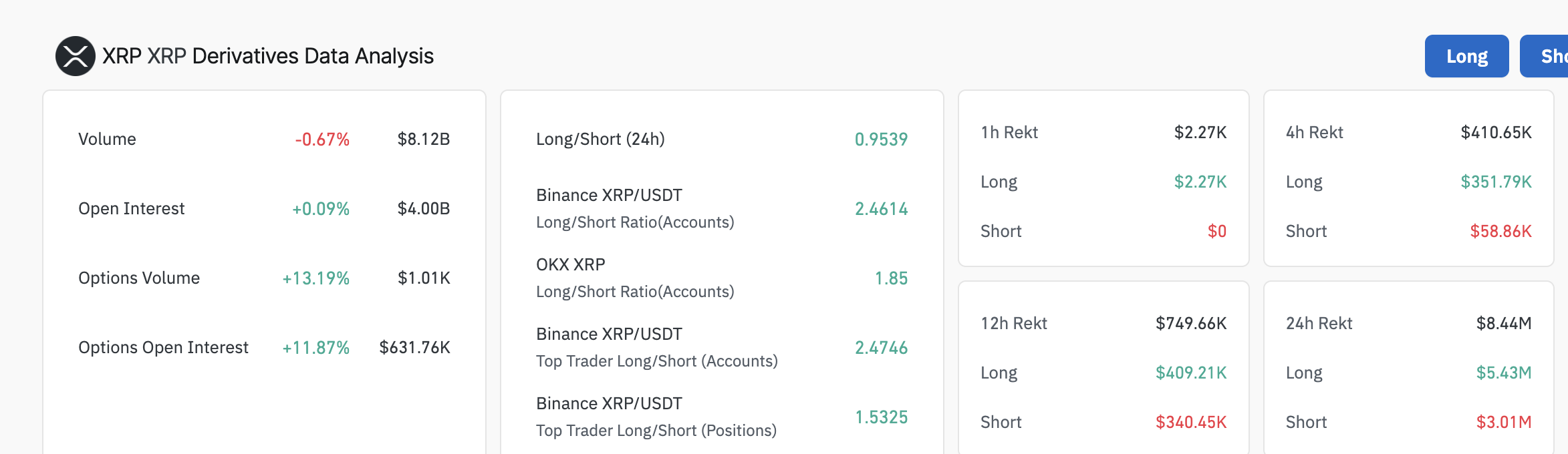

The derivatives knowledge from Coinglass highlights a slight enhance in Open Curiosity (OI) of 0.09% to $4 billion, indicating that new positions are being opened, which displays rising dealer curiosity.

The lengthy/quick ratio of 0.9559 leans in direction of shorts fairly than longs, indicating that confidence amongst merchants is waning. Over $350,000 was liquidated in lengthy positions in comparison with roughly $59,000 briefly positions previously 4 hours, suggesting that bulls are being shaken out, which can probably weaken the bullish outlook.

XRP derivatives’ Open Curiosity | Supply: Coinglass

Past the assist supplied by the 50-day and the 100-day EMAs, XRP may lengthen the down leg to retest the 200-day EMA at $1.98. A deeper correction to $1.80 is feasible if the broader crypto market sentiment turns bearish.