ICE registers steep increase in revenues in Q1 2025

Intercontinental Alternate (NYSE:ICE), a number one world supplier of know-how and information, immediately reported its monetary outcomes for the primary quarter of 2025.

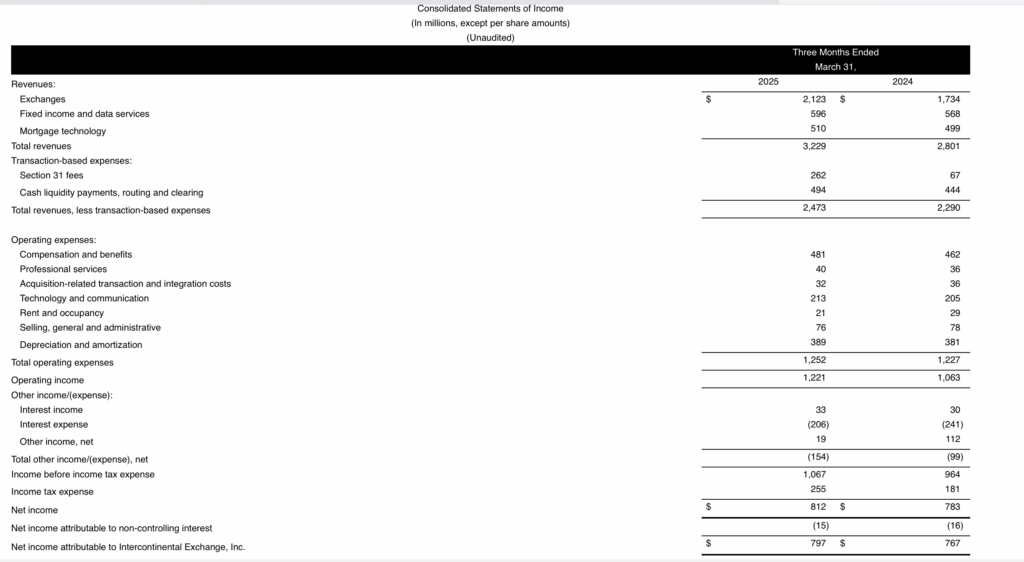

First quarter consolidated internet revenues have been $2.5 billion together with trade internet revenues of $1.4 billion, mounted earnings and information providers revenues of $596 million and mortgage know-how revenues of $510 million.

Consolidated working bills have been $1.3 billion for the primary quarter of 2025. On an adjusted foundation, consolidated working bills have been $964 million.

Consolidated working earnings for the primary quarter was $1.2 billion, and the working margin was 49%. On an adjusted foundation, consolidated working earnings for the primary quarter was $1.5 billion, and the adjusted working margin was 61%.

Working money circulate within the first quarter of 2025 was $966 million and adjusted free money circulate was $833 million.

Unrestricted money was $783 million and excellent debt was $20.3 billion as of March 31, 2025.

Via the primary quarter of 2025, ICE repurchased $241 million of its frequent inventory and paid $278 million in dividends.

Warren Gardiner, ICE Chief Monetary Officer, commented:

“ICE’s first quarter efficiency underscores the standard and sturdiness of our enterprise mannequin, reporting document revenues and document working earnings. This efficiency enabled us to put money into our enterprise whereas additionally returning $519 million to stockholders by way of dividends and share repurchases, in addition to make progress on deleveraging. As we glance to the stability of the 12 months, we stay targeted on disciplined funding in help of our strategic progress initiatives and on creating worth for our stockholders.”