Institutional FX trading volumes soar 13% in April 25 thanks to currency volatility

Wild volatility within the forex markets (and the monetary markets as a complete) following the introduction of US President Donald Trump’s aggressive commerce tariffs on April 2 “Liberation Day” has led to some of the lively months ever in institutional FX buying and selling.

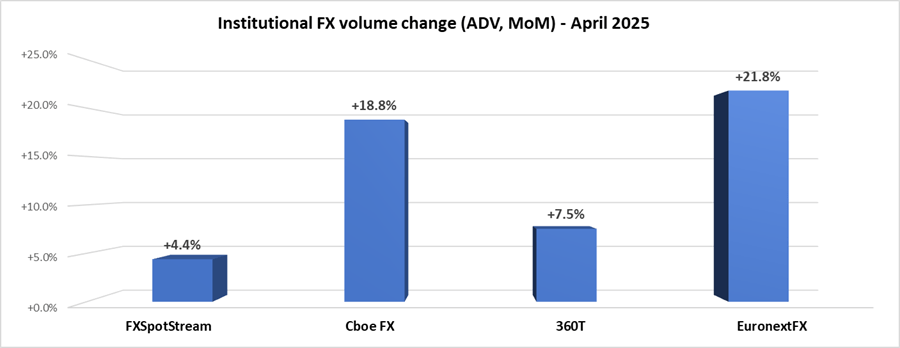

Following a robust Q1 ending with a record March in the institutional FX markets, April was even higher with buying and selling volumes up 13%. Every of the main eFX venues surveyed by FNG – FXSpotStream, Cboe FX, EuronextFX and 360T – noticed exercise will increase of between 4-21% throughout April 2025.

Cboe FX (previously HotspotFX)

- April 2025 common day by day volumes had been $61.90 billion, +18.8% from March’s $52.11 billion.

EuronextFX (previously FastMatch)

- April 2025 ADV $38.16 billion, +21.8% from March’s ADV of $31.33 billion.

FXSpotStream

- April noticed FXSpotStream set a brand new excessive when it comes to Total ADV at USD122.02billion. This marked a 4.4% improve MoM (when in comparison with March 2025) and 32.8% YoY (vs. April 2024). April’s ADV surpasses its earlier excessive of USD116.89billion set final month (March 2025).

- April’s Total ADV consisted of USD91.41billion in Spot (a brand new excessive on the Service) and USD30.61billion throughout different merchandise.

360T

- Common day by day volumes (ADV) at 360T got here in at $39.58 billion in April 2025, up 7.5% from March’s $36.81 billion.

Reviews

0 %