Maintains position near 0.8250 near nine-day EMA support

- USD/CHF might method fast resistance on the higher boundary of its consolidation vary round 0.8350.

- The 14-day RSI has moved above the 30 mark, signaling a continued short-term corrective rebound.

- A break beneath key assist on the nine-day EMA of 0.8251 might weaken short-term momentum.

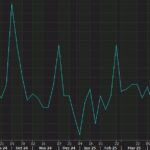

The USD/CHF pair holds floor for the third successive session, buying and selling round 0.8270 in the course of the Asian hours on Thursday. The every day chart suggests a impartial market bias, with the pair consolidating inside a just lately established rectangular sample.

Moreover, USD/CHF stays close to its nine-day Exponential Transferring Common (EMA), indicating impartial short-term momentum. The 14-day Relative Power Index (RSI) has climbed above 30, suggesting an ongoing short-term corrective rebound. Nonetheless, because the RSI stays beneath the 50 threshold, the general bearish development stays intact.

On the upside, the USD/CHF pair might check fast resistance on the higher fringe of the consolidation vary close to 0.8350. A transparent breakout above this degree might set off short-term bullish momentum, opening the door for a possible transfer towards the 50-day EMA at 0.8545. Further resistance lies on the month-to-month excessive of 0.8848, marked on April 2.

Key assist is discovered on the nine-day EMA of 0.8251. A break beneath this degree might undermine short-term momentum, doubtlessly pushing the USD/CHF pair towards the rectangle’s decrease boundary at 0.8140. An additional decline might reinforce bearish bias and pave the way in which for a retest of 0.8039 — the bottom degree since November 2011, final seen on April 21.

USD/CHF: Each day Chart

Swiss Franc PRICE As we speak

The desk beneath reveals the share change of Swiss Franc (CHF) towards listed main currencies at this time. Swiss Franc was the weakest towards the New Zealand Greenback.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.16% | 0.22% | 0.52% | -0.02% | -0.01% | -0.15% | 0.10% | |

| EUR | -0.16% | 0.07% | 0.36% | -0.22% | -0.17% | -0.31% | -0.07% | |

| GBP | -0.22% | -0.07% | 0.27% | -0.26% | -0.24% | -0.38% | -0.17% | |

| JPY | -0.52% | -0.36% | -0.27% | -0.56% | -0.52% | -0.72% | -0.51% | |

| CAD | 0.02% | 0.22% | 0.26% | 0.56% | 0.03% | -0.13% | 0.10% | |

| AUD | 0.00% | 0.17% | 0.24% | 0.52% | -0.03% | -0.14% | 0.08% | |

| NZD | 0.15% | 0.31% | 0.38% | 0.72% | 0.13% | 0.14% | 0.22% | |

| CHF | -0.10% | 0.07% | 0.17% | 0.51% | -0.10% | -0.08% | -0.22% |

The warmth map reveals proportion adjustments of main currencies towards one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, in the event you choose the Swiss Franc from the left column and transfer alongside the horizontal line to the US Greenback, the share change displayed within the field will signify CHF (base)/USD (quote).

BRANDED CONTENT

Selecting a dealer that aligns along with your buying and selling wants can considerably influence efficiency. Our listing of the best regulated brokers highlights the very best choices for seamless and cost-effective buying and selling.