Navigating the DeFi Wave: Top 5 Most Promising DEX Tokens for 2025

As DeFi accelerates in 2025, DEX tokens like UNI, SUSHI, and CAKE are rising as key gamers—providing management, rewards, and a front-row seat to the way forward for decentralized buying and selling.

The world of cryptocurrency is continually shifting, and Decentralized Exchanges (DEXs) are proper on the coronary heart of the motion. Not like conventional exchanges (just like the inventory market or centralized crypto platforms), DEXs permit customers to commerce digital property immediately with one another, without having a intermediary. This presents extra management and entry, but it surely additionally comes with its personal set of alternatives and dangers.

On the core of those DEX platforms are their native tokens. These tokens typically give holders voting rights on the platform’s future, potential rewards, and different advantages. As Decentralized Finance (DeFi) continues to develop, selecting the correct DEX token may very well be a key transfer for crypto fans. However which of them present probably the most promise heading into the remainder of 2025 and past?

Based mostly on present analysis, ecosystem power, and revolutionary options, right here’s a take a look at 5 DEX tokens grabbing consideration: Uniswap (UNI), SushiSwap (SUSHI), PancakeSwap (CAKE), 1inch Community (1INCH), and the newer contender, Stabull (STABUL).

1. Uniswap (UNI): The DeFi Pioneer

The Story: Launched again in 2018 by Hayden Adams, Uniswap actually modified the sport by introducing the Automated Market Maker (AMM) mannequin on the Ethereum blockchain in 2019. Consider an AMM as a system that makes use of mathematical formulation and swimming pools of tokens, provided by customers, to robotically set costs and permit trades, as a substitute of matching particular person purchase and promote orders like conventional exchanges. In 2020, Uniswap launched its UNI token, giving it away to early customers and empowering the group to control the platform.

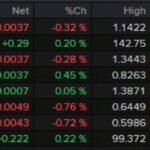

The place it Stands: As of April 2025, UNI is buying and selling round $6.00 USD (CoinMarketCap). Whereas that is down from its all-time highs, Uniswap stays a large within the DEX house, dealing with a large quantity of buying and selling quantity.

Why it’s Promising: Uniswap continues to innovate with updates like Uniswap V3, which permits liquidity suppliers (customers who lend their tokens to the swimming pools) to pay attention their funds in particular value ranges, probably incomes extra charges. Its sturdy repute, excessive liquidity (which means a lot of tokens accessible for buying and selling), and central function within the Ethereum DeFi ecosystem place it effectively. Some analysts predict vital long-term development, with forecasts suggesting UNI might probably attain spectacular highs by the early 2030s, pushed by general DeFi adoption.

Key Options: Peer-to-peer token swaps, liquidity swimming pools the place customers earn charges, group governance through UNI tokens.

2. SushiSwap (SUSHI): The Neighborhood-Pushed Innovator

The Story: SushiSwap made waves when it launched in 2020. It began as a “fork” (a duplicate with modifications) of Uniswap however added further incentives, significantly “yield farming,” the place customers might earn beneficiant SUSHI token rewards for offering liquidity. It had a controversial begin involving its nameless founder, “Chef Nomi,” however shortly transitioned to group management and has since expanded its options.

The place it Stands: SUSHI is presently priced round $0.67 USD (CoinMarketCap). It confronted challenges however stays a well-liked multi-chain DEX.

Why it’s Promising: SushiSwap isn’t only a Uniswap clone. It has developed distinctive options like BentoBox, a form of vault that helps handle liquidity extra effectively and reduces gasoline charges for sure actions. It has additionally expanded to function on a number of blockchains past Ethereum, probably attracting extra customers. Whereas its value historical past is risky, long-term predictions recommend potential for restoration and development because it continues to construct out its cross-chain capabilities.

Key Options: DEX buying and selling, yield farming, staking SUSHI for rewards, BentoBox for environment friendly liquidity, multi-chain help.

3. PancakeSwap (CAKE): The Binance Sensible Chain Chief

The Story: Launched in 2020 on the BNB Chain (previously Binance Sensible Chain), PancakeSwap shortly turned the dominant DEX on that community. Its important draw was considerably decrease transaction charges and sooner speeds in comparison with Ethereum on the time. It has since expanded its attain to different blockchains like Ethereum and Aptos.

The place it Stands: CAKE is buying and selling at roughly $1.99 USD (CoinMarketCap). It boasts a big consumer base and excessive buying and selling quantity, significantly on the BNB Chain.

Why it’s Promising: PancakeSwap presents extra than simply token swaps. It has a vibrant ecosystem that includes yield farming, staking swimming pools (referred to as Syrup Swimming pools), lotteries, prediction markets, and even an NFT market. This numerous providing attracts a variety of customers. Its multi-chain technique and steady updates, like its V3 model enhancing capital effectivity (just like Uniswap V3), recommend ongoing improvement. Worth predictions see potential for regular development within the coming years.

Key Options: Multi-chain DEX, yield farming, Syrup Swimming pools for staking CAKE, lottery, NFTs, governance.

The Story: Based in 2019, 1inch Community isn’t a DEX itself within the conventional sense. It’s a DEX aggregator. This implies it scans a number of DEXs (like Uniswap, SushiSwap, and lots of others) throughout totally different blockchains to search out the consumer the very best value for his or her desired token swap, factoring in charges and slippage (the distinction between the anticipated value and the executed value). It raised vital funding in 2020 and 2021 to gasoline its enlargement.

The place it Stands: The 1INCH token is presently priced round $0.19 USD (CoinMarketCap). The platform facilitates billions of {dollars} in buying and selling quantity by routing orders effectively.

Why it’s Promising: In a world with a whole bunch of DEXs, discovering the very best swap fee will be advanced. 1inch solves this downside, providing comfort and probably saving customers cash. It helps a rising variety of blockchains and presents superior options like restrict orders (permitting customers to set a selected value at which they wish to commerce, just like conventional exchanges). Because the DeFi panorama turns into extra fragmented throughout totally different chains, aggregators like 1inch change into more and more priceless. Future development is predicted because it continues its multi-chain enlargement.

Key Options: DEX aggregation for greatest costs, restrict orders, staking for rewards, governance through 1INCH token, multi-chain help.

5. Stabull Finance (STABUL): Specializing in New Frontiers – Non-USD Stablecoins & RWAs

The Story: A more moderen participant launched in late 2024, Stabull Finance is carving out a selected area of interest. It focuses on facilitating swaps between non-USD stablecoins (digital tokens pegged to currencies just like the Euro or New Zealand Greenback) and tokenized Actual-World Property (RWAs), reminiscent of gold represented by tokens like PAXG. It’s DEX is already reside on Ethereum and Polygon, with Base introduced because it’s third chain, it goals to bridge conventional overseas change (FX) and commodity markets with DeFi.

The place it Stands: STABUL is making ready for its public debut. A public sale commenced in April 2025 on ProBit Global’s Launchpad priced at $3 – $3.20 USD per token and a most provide of 10,000,000 tokens, of which 2,000,000 is locked completely in unsellable protocol owned liquidity, and three,000,000 are to be distributed through their Liquidity Mining Program over 10 years, with a confirmed itemizing to comply with the tip of the sale in mid-late Could.

Why it’s Promising: Whereas most DEXs give attention to crypto-to-crypto or USD-stablecoin trades, Stabull targets the large, comparatively untapped market of non-USD foreign money change and RWAs inside DeFi. It makes use of refined strategies, together with off-chain value feeds (oracles), to make sure correct pricing, which is essential for stablecoins. By specializing in this particular space and aiming for institutional-grade infrastructure, Stabull has the potential to draw vital liquidity and quantity if the demand for non-USD stablecoins and tokenized property grows as predicted.

Key Options: Low-slippage swaps for stablecoins and RWAs, give attention to non-USD pairs, liquidity swimming pools with rewards, governance through STABUL token, use of value oracles.

The Regulatory Maze: A World Problem

The way forward for DEXs and their tokens isn’t nearly know-how; it’s additionally closely influenced by rules, which fluctuate considerably throughout the globe.

European Union (EU): The Markets in Crypto-Property (MiCA) regulation is bringing complete guidelines. Whereas offering readability, particularly for stablecoin issuers, it may also impose stricter necessities on DEX platforms, probably impacting how they function inside the EU. This might have an effect on DEXs dealing closely in stablecoins, requiring them to make sure the stablecoins they listing adjust to MiCA requirements.

United States (US): The US remains to be figuring issues out. Companies just like the Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) are debating which tokens depend as securities or commodities. This uncertainty impacts DEXs, as itemizing tokens later deemed unregistered securities might result in authorized bother. There’s additionally growing strain concerning Know Your Buyer (KYC) and Anti-Cash Laundering (AML) guidelines – historically difficult for permissionless DEXs to implement with out compromising their decentralized nature.

Asia: The method varies broadly. Some nations like Singapore are creating licensing frameworks for crypto companies, providing a path to legitimacy. Others, like China, preserve strict bans. This patchwork method means DEXs must fastidiously contemplate which markets they aim and the way they adjust to native guidelines.

For DEX tokens, regulation is a double-edged sword. Clear guidelines might carry legitimacy and appeal to extra cautious institutional traders. Nevertheless, overly strict rules, significantly these demanding centralization or heavy surveillance (like necessary KYC on all customers), might stifle innovation and push exercise in the direction of much less regulated jurisdictions or actually decentralized, harder-to-regulate platforms. The result will possible form which DEXs thrive and the way their tokens are valued.

Conclusion: A Dynamic Panorama

The DEX token panorama in 2025 is numerous and thrilling. Established gamers like Uniswap, SushiSwap, and PancakeSwap proceed to innovate and command vital market share. Aggregators like 1inch present important effectivity, whereas newcomers like Stabull are exploring specialised niches like non-USD stablecoins and RWAs.

Whereas these 5 tokens present appreciable promise, the crypto market stays risky and unpredictable. Technological developments, shifting consumer preferences, and the ever-present query of regulation will all play essential roles. As at all times, potential traders ought to conduct thorough analysis (Do Your Personal Analysis – DYOR), perceive the dangers concerned, and contemplate their very own funding objectives earlier than diving in. The DeFi wave is highly effective, and these DEX tokens are definitely ones to look at because it continues to reshape finance.

Source link