Popular ways to earn passive income with crypto in 2025

Whereas cryptocurrencies are recognized for his or her substantial positive factors, there are lots of different methods to earn cash with them past the widespread buy-and-hold methods. When you favor hands-on buying and selling, it is fully okay to go for lively buying and selling strategies; nevertheless, passive methods can help you develop your crypto holdings with out gluing your eyes to the market and going as a substitute at a extra relaxed tempo. There are some hard-to-ignore the explanation why everyone seems to be buzzing round cryptocurrencies as a method to earn passive revenue, from international accessibility and decentralized management to the numerous incomes potential.

Concerning the strategies to earn passive revenue from crypto, you may select from easy methods, like crypto financial savings accounts, to strategies that require extra technical expertise, resembling mining. And when you’ve ever come throughout airdrop news, you could have observed which you could declare free crypto tokens by finishing particular duties. However the checklist is longer than that, so with out additional ado, let’s dive into the very best crypto passive revenue strategies.

Staking

Crypto staking means utilizing your tokens as collateral to safe PoS networks resembling Ethereum and Solana. Normally, yields from staking rewards differ from 3% to six%, however some cryptocurrencies present extra important yields based mostly on demand. Nevertheless, there are different methods to stake cryptocurrencies, as some platforms present staking through which the alternate lends the belongings or deploys them in DeFi. When you lock crypto for a selected time-frame, the platform pays a yield. Among the finest cryptocurrencies to think about for staking embody Cardano, Ethereum 2.0, and Solana. As an illustration, with Ethereum 2.0, you will get an estimated return of 5% to six% yearly, which is safer than different high-risk options in crypto.

The very best factor about staking is that it is extremely accessible, because it solely takes a number of clicks on centralized platforms. Nevertheless, the phrase “staking” is usually used within the broader sense, which may create confusion, in order that’s one thing to bear in mind.

Yield farming

When you’re in search of larger returns with crypto, look no additional than yield farming. This technique includes offering liquidity to DEXs (decentralized exchanges), which basically means depositing your crypto into liquidity swimming pools so you may earn curiosity (and typically tokens) in alternate. Yield farming can typically present large returns of as much as 50% + APY; nevertheless, sure dangers are concerned. For instance, when the worth of the tokens you provided adjustments in comparison with the time if you deposited them, impermanent loss is usually a actual consequence, which means that you might find yourself with considerably fewer rewards. You will discover platforms that automate yield farming, which means that they are going to do the whole job of taking your crypto and farming it throughout varied platforms to extend income. However remember the fact that there aren’t any ensures on the subject of yields, they usually can expertise wild fluctuations typically.

Crypto mining

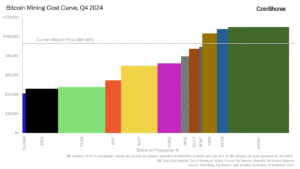

Crypto mining is likely one of the most typical methods to earn passive revenue, however it’s extra difficult than it could appear. It’s because you want {hardware} resembling Graphics Processing Items to have the ability to mine, as these units are designed to resolve advanced mathematical issues to safeguard blockchain networks, providing cryptocurrency in return to miners. Bitcoin mining has been extremely profitable, however it’s important to have low cost electrical energy and the precise tools to succeed with it. Mining rings are usually fairly pricey, and as extra miners be part of the community, mining turns into much more troublesome. Nevertheless, with an environment friendly mining course of in place and the precise setup, this technique of constructing passive revenue with crypto can generate important income.

Crypto lending

When you do not need to take care of the volatility related to cryptocurrencies, crypto lending could also be the very best technique to think about when producing passive revenue. This technique includes lending your crypto to debtors by means of a platform of your selection – both centralized or decentralized- and incomes curiosity in return. Understand that centralized platforms can help you earn regular returns with out coping with an excessive amount of volatility, whereas decentralized platforms allow better management and are usually extra clear, however they could have decrease charges. A great rule of thumb earlier than you think about lending is to test the platform’s fame and safety. DeFi platforms are usually riskier, whereas centralized platforms are extra regulated, however additionally they elevate issues about platform insolvency and the opportunity of hacks.

Airdrops

Crypto airdrops have develop into a standard means for blockchain tasks to supply free tokens to customers. The needs of airdrops are to enhance adoption, create pleasure round a particular undertaking, and reward early supporters. When you’re seeking to earn passive revenue with no large upfront funding, airdrops often is the go-to technique for you. All through the years, many traders have earned appreciable returns from airdrops, however keep in mind that not all airdrops can provide such positive factors, so cautious choice is paramount. Counting on airdrops could be thrilling, however on the similar time, it presents some challenges. As an illustration, airdropped tokens usually see worth fluctuations, which may make it difficult to foretell whether or not or not you’ll make a revenue from them. Furthermore, faux airdrops are one other concern, as some tasks make the most of them to steal person information. That being stated, you should not keep away from them altogether when you assume they might help you meet your monetary targets. The secret is to safeguard your private information, analysis the tasks rigorously, and make strategic choices about when to promote or maintain tokens.

Play-to-Earn video games

Gaming has lengthy been a method to wind down and have enjoyable, however these days, it’s greater than that. You may as well earn passive revenue by way of P2E ( Play-to-Earn) video games, which allow you to earn NFTs, cryptos, and different digital belongings whereas taking part in. Among the hottest P2E video games embody Decentraland and Axie Infinity, which let you earn rewards by constructing, battling, or taking part within the ecosystem. Whereas it may be thrilling to play and earn cash concurrently, keep in mind that the P2E video games market could be risky. Some gamers have certainly earned substantial returns up to now, however the mannequin’s sustainability is unsure, and the profitability of the video games is linked to the neighborhood of the sport and the tokens’ market worth.

The underside line

When you’ve been searching for methods to generate passive revenue with crypto, hopefully, now you’ll really feel extra assured to start. Simply bear in mind to do your analysis so you may completely perceive the strategy of your selection – in the end, the important thing to defending your income is taking part in it protected.

Associated Hyperlinks

Space Technology News – Applications and Research

Source link