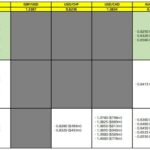

Rally Takes a Breather (Chart)

Bearish view

- Promote the EUR/USD pair and set a take-profit at 1.1310.

- Add a stop-loss at 1.1575.

- Timeline: 1-2 days.

Bullish view

- Set a buy-stop at 1.1440 and a take-profit at 1.1550.

- Add a stop-loss at 1.1310.

The EUR/USD exchange rate pulled again and trimmed among the earlier positive aspects as hopes of a commerce deal rose. After hovering to a excessive of 1.1575 on Monday, the pair retreated to 1.1437 forward of the upcoming flash PMI numbers.

Commerce jitters ease after IMF warning

The EUR/USD pair pulled again after the IMF warned that the US and European economies can be harm by Donald Trump’s tariffs. In a press release, the company trimmed the US development for the yr to 1.5%, down by 0.9% from the January forecast.

The IMF additionally trimmed the European development goal to 0.7%, down by 0.7% from the final estimate. It expects the Chinese language financial system to develop by 3.2%, down by 1.3%.

These numbers imply that Trump’s tariffs may have a serious implication, resulting in both a recession or stagflation in some international locations.

The EUR/USD pair retreated after Treasury Secretary, Scott Bessent, hinted that the commerce conflict between the US and China would de-escalate. He cited the 145% and 125% tariff as unsustainable and that some deal will ultimately be made. Nevertheless, he expects {that a} complete deal will take between two to a few years.

The following key catalyst for the pair would be the upcoming flash manufacturing and companies PMI numbers. Economists expec the info to indicate that the European companies PMI dropped from 51 in March to 50.7 in April, whereas the manufacturing determine moved downwards from 48.6 to 47.5.

Within the US, the anticipated manufacturing and companies PMI figures are 49.5 and 52, a drop from the earlier month. The EUR/USD pair will react to statements from a number of Fed officers like Austan Goolsbee, Beth Hammack, and Christopher Waller.

EUR/USD technical evaluation

The EUR/USD change price soared to a excessive of 1.1575 on Tuesday after which pulled again to 1.1435. This retreat occurred as buyers took revenue after Bessent’s assertion.

The pair stays above the necessary assist level at 1.1212, the higher facet of the cup and deal with sample. It has moved above all shifting averages, and the second resistance of the Woodie pivot level.

Subsequently, the most probably situation is the place the latest robust rally takes a breather and drops to the second resistance stage at 1.1310. A drop beneath that stage will level to extra declines to 1.1212. It can then resume its uptrend.

Able to commerce our daily Forex signal? Try the best forex brokers in Europe value utilizing.