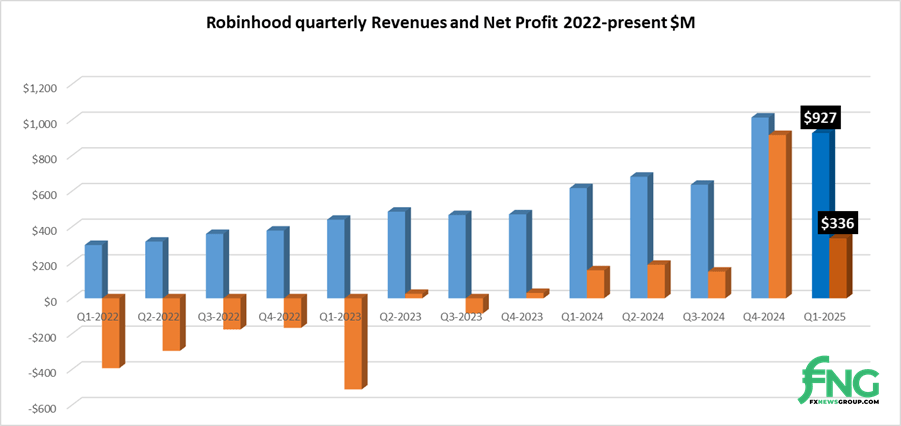

Robinhood Revenues fall 9% QoQ in Q1 2025

Following a report setting, blistering This fall led by soaring Crypto trading following Donald Trump’s election, US neobroker Robinhood reported outcomes for Q1 2025 that weren’t fairly nearly as good because the earlier quarter, however nonetheless very spectacular from a historic perspective.

After seeing Revenues high $1 billion and Internet Revenue hit $916 million in This fall (thanks partially to a $358 million realized tax profit), Robinhood reported Revenues of $927 million (-9% QoQ) and Internet Revenue of $336 million (-63%) in Q1 2025. Nonetheless, Robinhood’s greatest ever quarter excluding This fall.

Robinhood shares reacted positively to the information, with aftermarket buying and selling late Wednesday and into early Thursday seeing a 1% rise in NASDAQ:HOOD. Robinhood shares (at about $49) are nonetheless effectively off their 52 week excessive of $66.08, set in mid February, earlier than the inventory (and crypto) market started its latest decline.

Robinhood’s Board of Administrators elevated the corporate’s share repurchase authorization by $500 million, to $1.5 billion.

Vlad Tenev, Chair and CEO of Robinhood stated,

“This quarter, we considerably accelerated product innovation throughout our key initiatives, highlighted by the announcement of Robinhood Methods, Banking, and Cortex. Prospects have clearly responded — demonstrated by record-breaking web deposits, Robinhood Gold subscriptions, and choices quantity, in addition to strong year-over-year development in buying and selling throughout all asset lessons.”

Jason Warnick, Chief Monetary Officer of Robinhood stated,

Jason Warnick, Chief Monetary Officer of Robinhood stated,

“We began the 12 months off sturdy, driving market share beneficial properties, closing the acquisition of TradePMR, and remaining disciplined on bills,” stated Jason Warnick, Chief Monetary Officer of Robinhood. “Because of this, in Q1 we grew revenues by 50 % year-over-year and EPS by over one hundred pc. It’s additionally nice to see sturdy buyer engagement to begin Q2. Moreover, we proceed to return capital to shareholders and elevated our share repurchase authorization by $500 million to $1.5 billion, reflecting administration and the board’s confidence in our monetary power and future development prospects.”

Robinhood Q1 2025 Outcomes

- Whole web revenues elevated 50% year-over-year to $927 million.

- Transaction-based revenues elevated 77% year-over-year to $583 million, primarily pushed by cryptocurrencies income of $252 million, up 100%, choices income of $240 million, up 56%, and equities income of $56 million, up 44%.

- Internet curiosity revenues elevated 14% year-over-year to $290 million, primarily pushed by development in interest-earning belongings and securities lending exercise, partially offset by decrease short-term rates of interest.

- Different revenues elevated 54% year-over-year to $54 million, primarily resulting from elevated Robinhood Gold subscribers.

- Internet revenue elevated 114% year-over-year to $336 million.

- Diluted earnings per share (EPS) elevated 106% year-over-year to $0.37.

- Whole working bills elevated 21% year-over-year to $557 million.

- Adjusted Working Bills and Share-Based mostly Compensation (SBC) (non-GAAP) elevated 16% year-over-year to $533 million, which incorporates prices associated to TradePMR.

- Adjusted EBITDA (non-GAAP) elevated 90% year-over-year to $470 million.

- Funded Prospects elevated by 1.9 million, or 8%, year-over-year to 25.8 million.

- Funding Accounts elevated by 2.6 million, or 11%, year-over-year to 27.0 million.

- Whole Platform Belongings elevated 70% year-over-year to $221 billion, primarily pushed by continued Internet Deposits and the acquisition of TradePMR.

- Internet Deposits have been $18.0 billion, an annualized development price of 37% relative to Whole Platform Belongings on the finish of This fall 2024. Over the previous twelve months, Internet Deposits have been $57.3 billion, a development price of 44% relative to Whole Platform Belongings on the finish of Q1 2024.

- Common Income Per Person (ARPU) elevated 39% year-over-year to $145.

- Robinhood Gold Subscribers elevated by 1.5 million, or 90%, year-over-year to three.2 million.

- Money and money equivalents totaled $4.4 billion in contrast with $4.7 billion on the finish of Q1 2024.

- Share repurchases have been $322 million, representing 7.2 million shares of our Class A standard inventory at a median value per share of $44.87. This greater than offset the two.0 million shares of Class A standard inventory issued in reference to the acquisition of TradePMR.

Robinhood Q1 Highlights

Robinhood stated it executed on technique with strong product velocity in Q1, releasing cutting-edge merchandise for patrons, with extra within the pipeline.

- Enhanced Merchandise for Energetic Merchants – Robinhood continues to roll out superior capabilities and instruments for energetic merchants geared toward making buying and selling sooner, clearer, and extra intuitive. The desktop buying and selling platform, Robinhood Legend, now options elevated pace, help for index choices and crypto, and new indicators and charts. In March, Robinhood expanded its prediction markets providing by launching a hub and giving clients the chance to commerce on the outcomes of a few of the world’s greatest occasions. Over the past six months clients have traded greater than 1 billion occasion contracts.

- Growing Pockets Share by Serving the Entirety of Prospects’ Monetary Wants – Throughout its second annual Gold keynote occasion in March, Robinhood unveiled new advisory, banking, and AI choices: Robinhood Methods, Robinhood Banking, and Robinhood Cortex. With plans to roll out to all clients within the coming weeks, Robinhood Methods is already serving greater than 40 thousand clients and managing greater than $100 million in buyer belongings as of April 25, 2025. In February, Robinhood additionally closed its acquisition of TradePMR, an RIA custodial platform, with roughly $41 billion in belongings managed by RIAs as of March 31, 2025.

- Constructing a World Monetary Ecosystem – Robinhood continues to make progress internationally, with over 150 thousand clients throughout the UK and EU. The acquisition of globally-scaled cryptocurrency alternate Bitstamp Ltd. is on monitor to shut in the course of this 12 months, topic to customary closing circumstances.

- Robinhood Board of Administrators Authorizes Extra $500 million in Share Repurchases – Following the authorization of a $1 billion share repurchase program introduced in Might 2024, the Robinhood board of administrators has approved an extra $500 million, bringing this system whole to $1.5 billion. By April 25, 2025, 20 million shares of Class A standard inventory have been repurchased at a median value of $33.40, representing a complete $667 million. The remaining authorization now totals roughly $833 million which administration expects to execute over the subsequent roughly two years, with flexibility to speed up if market circumstances warrant.

Extra Q1 2025 Working Information

- Robinhood Retirement AUC elevated over 200% year-over-year to a report $14.4 billion.

- Money Sweep elevated 48% year-over-year to a report $28.2 billion.

- Margin E book elevated 115% year-over-year to a report $8.8 billion.

- Fairness Notional Buying and selling Volumes elevated 84% year-over-year to $413 billion.

- Choices Contracts Traded elevated 46% year-over-year to a report 500 million.

- Crypto Notional Buying and selling Volumes elevated over 28% year-over-year to $46 billion.

Robinhood’s full Q1 2025 results report might be seen right here.