SAIHEAT Reports FY2024: Mining Revenue Surges 125% Amid Strategic Pivot

SAIHEAT reported its fiscal 12 months 2024 outcomes with complete revenues of $5.54 million, displaying an 18% lower from 2023’s $6.78 million. The corporate confronted challenges however noticed important progress in mining income, which elevated 125% year-over-year.

Key monetary highlights:

- Web loss improved barely to $5.89 million from $6.12 million in 2023

- Mining income doubled to $2.92 million

- Different revenue rose 62% to $2.02 million

- Product gross sales declined 48% to $2.50 million

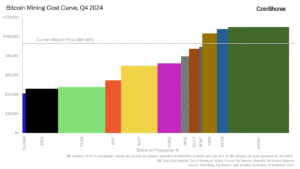

The corporate is specializing in three predominant areas: Bitcoin mining companies, Affiliate Petroleum Fuel (APG) options, and Small Modular Reactor (SMR) expertise. Notable developments embrace promoting 40MW of liquid-cooling containers to Bitdeer and launching HEATNUC, a sophisticated SMR system for AI computing facilities. Regardless of challenges from the Bitcoin halving occasion, SAIHEAT maintains its technique of mixing cryptocurrency mining with clear vitality options.

SAIHEAT ha riportato i risultati dell’anno fiscale 2024 con ricavi totali di 5,54 milioni di dollari, registrando una diminuzione del 18% rispetto ai 6,78 milioni di dollari del 2023. L’azienda ha affrontato delle difficoltà, ma ha registrato una crescita significativa nei ricavi derivanti dal mining, aumentati del 125% su base annua.

Punti salienti finanziari:

- La perdita netta è leggermente migliorata, passando da 6,12 milioni di dollari nel 2023 a 5,89 milioni di dollari

- I ricavi dal mining sono raddoppiati raggiungendo 2,92 milioni di dollari

- Altri introiti sono aumentati del 62%, arrivando a 2,02 milioni di dollari

- Le vendite di prodotti sono diminuite del 48%, attestandosi a 2,50 milioni di dollari

L’azienda si concentra su tre aree principali: servizi di mining Bitcoin, soluzioni per il fuel associato al petrolio (APG) e tecnologia dei reattori modulari di piccole dimensioni (SMR). Tra gli sviluppi più rilevanti si segnalano la vendita di 40MW di container a liquido refrigerati a Bitdeer e il lancio di HEATNUC, un avanzato sistema SMR per centri di calcolo AI. Nonostante le sfide legate all’evento di halving del Bitcoin, SAIHEAT mantiene la sua strategia di combinare il mining di criptovalute con soluzioni energetiche pulite.

SAIHEAT reportó sus resultados del año fiscal 2024 con ingresos totales de 5,54 millones de dólares, mostrando una disminución del 18% respecto a los 6,78 millones de dólares de 2023. La compañía enfrentó desafíos, pero experimentó un crecimiento significativo en los ingresos por minería, que aumentaron un 125% interanual.

Puntos financieros clave:

- La pérdida neta mejoró ligeramente a 5,89 millones de dólares desde los 6,12 millones en 2023

- Los ingresos por minería se duplicaron hasta 2,92 millones de dólares

- Otros ingresos aumentaron un 62% a 2,02 millones de dólares

- Las ventas de productos disminuyeron un 48% hasta 2,50 millones de dólares

La empresa se enfoca en tres áreas principales: servicios de minería de Bitcoin, soluciones de fuel asociado al petróleo (APG) y tecnología de reactores modulares pequeños (SMR). Entre los desarrollos destacados se incluyen la venta de 40MW de contenedores con refrigeración líquida a Bitdeer y el lanzamiento de HEATNUC, un sistema SMR avanzado para centros de computación de IA. A pesar de los desafíos del evento de halving de Bitcoin, SAIHEAT mantiene su estrategia de combinar la minería de criptomonedas con soluciones de energía limpia.

SAIHEAT는 2024 회계연도 실적을 보고하며 총매출 554만 달러를 기록했으며, 이는 2023년 678만 달러 대비 18% 감소한 수치입니다. 회사는 어려움을 겪었지만, 채굴 수익이 전년 대비 125% 증가하는 등 큰 성장을 보였습니다.

주요 재무 하이라이트:

- 순손실이 2023년 612만 달러에서 589만 달러로 다소 개선됨

- 채굴 수익이 292만 달러로 두 배 증가

- 기타 수익이 62% 증가하여 202만 달러 기록

- 제품 판매는 48% 감소하여 250만 달러에 머뒀음

회사는 비트코인 채굴 서비스, 부생석유가스(APG) 솔루션, 소형 모듈 원자로(SMR) 기술 세 가지 주요 분야에 집중하고 있습니다. 주요 발전 사항으로는 Bitdeer에 40MW 액체 냉각 컨테이너를 판매한 것과 AI 컴퓨팅 센터용 첨단 SMR 시스템인 HEATNUC을 출시한 점이 있습니다. 비트코인 반감기 이벤트로 인한 어려움에도 불구하고, SAIHEAT는 암호화폐 채굴과 청정 에너지 솔루션을 결합하는 전략을 유지하고 있습니다.

SAIHEAT a annoncé ses résultats pour l’exercice 2024 avec un chiffre d’affaires complete de 5,54 hundreds of thousands de {dollars}, soit une baisse de 18 % par rapport aux 6,78 hundreds of thousands de {dollars} de 2023. L’entreprise a rencontré des difficultés, mais a enregistré une croissance significative de ses revenus miniers, en hausse de 125 % sur un an.

Factors financiers clés :

- La perte nette s’est légèrement améliorée, passant de 6,12 hundreds of thousands de {dollars} en 2023 à 5,89 hundreds of thousands de {dollars}

- Les revenus miniers ont doublé, atteignant 2,92 hundreds of thousands de {dollars}

- Les autres revenus ont augmenté de 62 %, atteignant 2,02 hundreds of thousands de {dollars}

- Les ventes de produits ont diminué de 48 %, s’établissant à 2,50 hundreds of thousands de {dollars}

L’entreprise se concentre sur trois domaines principaux : les companies de minage de Bitcoin, les options de gaz associé au pétrole (APG) et la technologie des petits réacteurs modulaires (SMR). Parmi les développements notables figurent la vente de 40 MW de conteneurs à refroidissement liquide à Bitdeer et le lancement de HEATNUC, un système SMR avancé pour les centres de calcul IA. Malgré les défis liés à l’événement de réduction de moitié du Bitcoin, SAIHEAT maintient sa stratégie de combiner le minage de cryptomonnaies avec des options énergétiques propres.

SAIHEAT meldete seine Ergebnisse für das Geschäftsjahr 2024 mit einem Gesamtumsatz von 5,54 Millionen US-Greenback, was einem Rückgang von 18 % gegenüber den 6,78 Millionen US-Greenback im Jahr 2023 entspricht. Das Unternehmen hatte Herausforderungen zu bewältigen, verzeichnete jedoch ein deutliches Wachstum bei den Mining-Einnahmen, die im Jahresvergleich um 125 % stiegen.

Wichtige finanzielle Eckdaten:

- Der Nettoverlust verbesserte sich leicht von 6,12 Millionen US-Greenback im Jahr 2023 auf 5,89 Millionen US-Greenback

- Mining-Einnahmen verdoppelten sich auf 2,92 Millionen US-Greenback

- Sonstige Einnahmen stiegen um 62 % auf 2,02 Millionen US-Greenback

- Produktverkäufe sanken um 48 % auf 2,50 Millionen US-Greenback

Das Unternehmen konzentriert sich auf drei Hauptbereiche: Bitcoin-Mining-Dienste, Lösungen für assoziiertes Erdgas (APG) und Small Modular Reactor (SMR)-Technologie. Zu den bemerkenswerten Entwicklungen zählen der Verkauf von 40 MW flüssigkeitsgekühlten Containern an Bitdeer und die Einführung von HEATNUC, einem fortschrittlichen SMR-System für KI-Rechenzentren. Trotz der Herausforderungen durch das Bitcoin-Halving-Occasion verfolgt SAIHEAT weiterhin seine Strategie, Kryptowährungs-Mining mit sauberen Energielösungen zu kombinieren.

Optimistic

- Mining income elevated 125% to $2.92 million resulting from greater common Bitcoin costs

- Different revenue grew 62% to $2.02 million from crypto asset worth appreciation

- Web loss improved barely to $5.89 million from $6.12 million in 2023

- Secured sale of 40MW liquid-cooling container merchandise to Bitdeer subsidiary

- Began accepting Bitcoin funds for services

- No impairment of long-lived belongings recorded in 2024, in comparison with $0.14 million in 2023

Damaging

- Complete income decreased 18% to $5.54 million

- Gross lack of $1.01 million in comparison with gross revenue of $0.46 million in 2023

- Product gross sales declined 48% to $2.50 million

- Internet hosting service income fell 86% to $0.05 million

- Mining pool income decreased 78% to $0.07 million

- Value of revenues elevated 4% regardless of decrease gross sales

- Gross margin turned damaging at -18% in comparison with optimistic 7% in 2023

- Money and money equivalents decreased to $1.04 million from $3.18 million

Insights

SAIHEAT studies important income decline, gross loss, and regarding working metrics regardless of strategic pivots towards Bitcoin mining and new expertise initiatives.

SAIHEAT Restricted’s fiscal 12 months 2024 outcomes reveal substantial monetary deterioration. Complete revenues 18% to $5.54 million, with the corporate reporting a gross lack of $1.01 million in comparison with a gross revenue in 2023. Their gross margin turned damaging at -18% versus +7% beforehand.

The corporate skilled income declines throughout a number of enterprise segments:

- Product gross sales decreased 48% to $2.50 million

- Internet hosting companies plummeted 86% to $0.05 million

- Mining pool income fell 78% to $0.07 million

The lone shiny spot was mining income, which elevated 125% to $2.92 million, although this was primarily pushed by greater Bitcoin costs moderately than operational enhancements (day by day manufacturing elevated marginally from 0.12 to 0.13 bitcoin).

Money place weakened considerably, declining from $3.18 million to $1.04 million, whereas the corporate added $2.12 million in short-term borrowings. Stock ranges surged from $44,000 to $772,000, whereas accounts receivable dropped from $900,000 to $237,000, suggesting potential challenges in product gross sales.

Administration is making an attempt to pivot towards three focus areas: Bitcoin cloud mining, Related Petroleum Fuel utilization, and Small Modular Reactor expertise. Current developments embrace a sale of 40MW liquid-cooling containers to Bitdeer and participation in electrical energy price discount applications.

SAIHEAT’s expertise pivot faces important headwinds as monetary outcomes present weak point throughout core enterprise segments regardless of Bitcoin mining beneficial properties.

SAIHEAT’s expertise technique reveals an organization in transition amid difficult market circumstances. The April 2024 Bitcoin halving occasion considerably impacted their enterprise mannequin, forcing a strategic pivot towards what administration describes as their “technologically main space” – Bitcoin cloud computing energy mining.

The corporate’s new technological focus spans three domains:

- Bitcoin Mining: Providing computing energy companies to small/medium buyers

- Affiliate Petroleum Fuel (APG): Offering vitality digitization options to grease/fuel enterprises

- Small Modular Reactor (SMR): Growing modular nuclear energy infrastructure options

Their liquid-cooling container sale to Bitdeer represents a tangible validation of their {hardware} capabilities. The HEATWIT liquid cooling system and HEATNUC small modular reactor initiatives show makes an attempt to distinguish by way of technological innovation, significantly in warmth recycling and energy effectivity.

Nevertheless, the monetary outcomes contradict this technological optimism. The steep decline in internet hosting companies (-86%) and mining pool revenues (-78%) signifies clients are abandoning their platform. Product gross sales decreased by almost half, suggesting restricted market traction for his or her {hardware} options regardless of showcasing at trade occasions.

The pivot towards accepting Bitcoin funds and showcasing new merchandise just like the A-series line for AI infrastructure demonstrates an try and align with rising technological developments, however these initiatives have but to show monetary influence to offset the numerous income declines throughout core enterprise segments.

SINGAPORE, April 28, 2025 (GLOBE NEWSWIRE) — SAIHEAT Restricted (“SAIHEAT” or the “Firm”) (NASDAQ: SAIH), as we speak reported audited monetary outcomes for the fiscal 12 months ended December 31, 2024.

Monetary Highlights for the Yr Ended December 31, 2024

- Complete revenues had been US$5.54 million, representing a lower of 18% in comparison with US$6.78 million in 2023 primarily resulting from income decreases throughout enterprise segments of gross sales of merchandise, internet hosting service and mining pool, which was partially offset by 125% income improve from mining income for the 12 months ended December 31, 2024.

- Gross loss was US$1.01 million, in comparison with gross revenue of US$0.46 million in 2023.

- Web loss was US$5.89 million, barely improved from a internet lack of US$6.12 million in 2023.

- Different revenue elevated 62% to from US$1.25 million in 2023 to US$2.02 million in 2024, primarily resulting from a rise within the truthful worth of crypto belongings for the 12 months ended December 31, 2024.

Administration Commentary

Mr. Arthur Lee, Chairman and Chief Govt Officer of SAIHEAT, commented, “Whereas 2024 introduced notable challenges following the April Bitcoin halving occasion, we tailored shortly to shifting market dynamics. Our mining income confirmed robust resilience, doubling income year-over-year on the again of upper common Bitcoin costs. Trying forward, we stay targeted on enhancing operational effectivity, progressing our sustainable bitcoin currency-mining technique, and deepening our innovation in affiliate petroleum fuel and nuclear integration.

In 2025, we are going to place a higher emphasis on our technologically main space – Bitcoin cloud computing energy mining. By specializing in this course, we plan to supply the next three classes of companies for purchasers to determine a connection between humanity and clear vitality.

The primary is Bitcoincurrency mining. We plan to supply an array of companies from Bitcoincurrency joint mining to relative asset custody companies by offering improved computing energy to small and medium-sized eligible buyers.

The second is Affiliate Petroleum Fuel (APG). We purpose to supply related fuel reutilization to vitality asset house owners, to assist the massive enterprises within the oil and fuel fields meet the demand of making worth from idle vitality by way of vitality digitization and monetarization options. These applied sciences contribute to lowering the carbon footprint and supplies progressive options for vitality enterprises.

The third is Small Modular Reactor (SMR). We are going to present sovereign international locations with built-in options primarily based on modular nuclear energy to help them in constructing new era of digital vitality infrastructures. Via computing energy bitcoin forex mining, we clear up issues comparable to the shortage of secure clients on the preliminary stage of infrastructure building or the comparatively lengthy price restoration in funding cycle, thus, accelerating the funding restoration cycle and attaining greater financial advantages.

Current Developments

On-Website Challenge & Program Growth Replace

- The sale of 40MW of cutting-edge liquid-cooling container merchandise to one of many subsidiaries of Bitdeer Applied sciences Group (“Bitdeer”) (NASDAQ: BTDR). The liquid-cooling containers are designed to host Bitdeer’s high-performance SEALMINER mining rigs and can be deployed at Bitdeer’s new information middle.

- Participation within the 1CP (AEP’s Crucial Peak) program, a strategic initiative designed to cut back electrical energy prices for energy-intensive industries. This initiative aligns with SAIHEAT’s mission to boost operational effectivity and sustainability within the digital asset sector.

- Began accepting funds in Bitcoin for its vary of services, together with (1) the Firm’s HEATWIT liquid cooling Superior Computing Middle Ecosystem (ACCE) for Bitcoin mining operations and AI computing, and (2) the Firm’s HEATNUC small modular reactor services.

Internet hosting & Presence at Business Occasions

- Participation on the Supercomputing 2024 (SC24) Convention, happening from November 18-21 in Atlanta, Georgia. SAIHEAT showcased its Superior Computing Middle Ecosystem (ACCE), a confirmed suite of liquid-cooling system that allow carbon-negative information middle operations by repurposing waste computing warmth.

- Hosted its 2024 BIT HEAT DAY on November 14, 2024, on the Firm’s U.S. R&D Middle in Marietta, Ohio. The occasion was co-hosted with the Group of Clear Vitality and Local weather (OCEC), a non-profit group, with full help from native governmental workplace and group and targeted on selling next-generation edge information middle infrastructure and the environmental, social, and governance (ESG) advantages of computing warmth recycling by way of liquid-cooling applied sciences. SAIHEAT additionally showcased its new A-series product line, designed to handle the rising calls for of the AI trade.

HEATNUC Enterprise Line Replace

- Strategic Progress in HEATNUC Initiatives

Introduced the mixing of HEATNUC, a sophisticated Small Modular Reactor (SMR) system devoted to energy AI computing facilities. Designed as a secure, high-capacity vitality supply, HEATNUC addresses the distinctive energy wants of AI-driven infrastructure, offering an answer that conventional renewable and fossil-fuel-based vitality sources can’t match.

Audited Monetary Outcomes for the Yr Ended December 31, 2024

Revenues

Gross sales of Merchandise: Decreased by 48% from $4.80 million for 2023 to US$2.50 million for 2024, resulting from fewer buyer orders of high-performance crypto asset mining machines and out of doors computing infrastructure container secured throughout fiscal 12 months 2024.

Internet hosting Service: Declined 86% from $0.37 million year-over-year to US$0.05 million, which was resulting from machines shutdowns requested by internet hosting shoppers since their excessive power-consumption miners don’t ship revenue when block reward halving occurred in April 2024.

Mining Pool: Decreased by 78%, from $0.30 million for 2023 to US$0.07 million for 2024, as some internet hosting clients utilizing our pool selected to close down miners resulting from block reward halving occasions in 12 months 2024.

Mining Income: Elevated by 125% to US$2.92 million, pushed by elevated common worth of bitcoin mined, which was 130% greater than the common worth within the prior 12 months. The typical day by day bitcoin manufacturing was 0.13 bitcoin in 2024, in contrast with 0.12 within the prior 12 months.

Value of Revenues

Value of revenues elevated by 4% year-over-year to US$6.55 million, primarily resulting from expanded self-mining exercise and vitality consumption. This offset reductions in hardware-related prices for gross sales and internet hosting.

Gross (Loss)/Revenue

Gross revenue was a gross lack of US$1.01 million for the 12 months ended December 31, 2024, in comparison with a gross revenue of US$0.46 million in 2023.

Gross Margin

The gross margin was damaging 18% in 2024, in comparison with a optimistic gross margin of seven% within the prior 12 months.

The decline was primarily pushed by greater prices related to self-mining operations and a shift in income combine.

Working Bills

Promoting and Advertising and marketing Bills: Decreased 75% to US$0.28 million, reflecting diminished share-based compensation bills, depreciation and amortization bills, and journey prices.

Common and Administrative Bills: Barely elevated by 5% to US$5.97 million, which was primarily pushed by an increase in share-based fee bills to US$3.15 million.

Analysis and Growth Bills: Decreased by 25% to US$0.64 million, resulting from decrease employee-related and incentive bills.

Impairment of Lengthy-Lived Property: No impairment recorded in 2024, in comparison with US$0.14 million in 2023, reflecting improved BTC market valuations.

Different Earnings

Different revenue was US$2.02 million in 2024, in comparison with US$1.25 million in 2023, pushed primarily by unrealized beneficial properties from adjustments within the truthful worth of crypto belongings.

Web loss

Because of the above, SAIHEAT reported a internet lack of US$5.89 million, barely improved from a US$6.12 million internet loss within the prior 12 months.

Non-GAAP Monetary Measures

We’re offering supplemental monetary measures for non-GAAP internet revenue from operations that excludes the influence of share-based compensation expense, loss from disposal of property and tools, impairment losses on crypto belongings, depreciation of fastened belongings and amortization of intangible belongings. This supplemental monetary measure will not be measurement of monetary efficiency underneath typically accepted accounting rules within the United States (“GAAP”) and, consequently, this supplemental monetary measure is probably not corresponding to equally titled measures of different corporations. Administration makes use of this non-GAAP monetary measure internally to assist perceive, handle, and consider our enterprise efficiency and to assist make working selections.

We imagine that this non-GAAP monetary measure can also be helpful to buyers and analysts in evaluating our efficiency throughout reporting intervals on a constant foundation. Non-GAAP monetary measures are topic to materials limitations as they aren’t in accordance with, or an alternative to, measurements ready in accordance with GAAP. For instance, we anticipate that share-based compensation expense, which is excluded from non-GAAP monetary measures, will proceed to be a major recurring expense over the approaching years and is a crucial a part of the compensation offered to sure workers, officers, and consultants. Equally, we anticipate that depreciation of fastened belongings and amortization of intangible belongings will proceed to be a recurring expense over the time period of the helpful lifetime of the belongings. We additionally will exclude impairment losses on crypto belongings from the non-GAAP monetary measure, which can happen in future intervals on account of our continued holdings of great quantities of bitcoin. Our non-GAAP monetary measure will not be meant to be thought of in isolation and must be learn solely along side our Consolidated Monetary Statements, which have been ready in accordance with GAAP. We rely totally on such Consolidated Monetary Statements to grasp, handle, and consider our enterprise efficiency and use the non-GAAP monetary measure solely supplementally.

The next is a reconciliation of our non-GAAP internet (loss) revenue for the years ended December 31, 2024, 2023 and 2022 respectively, which excludes the influence of (i) share-based compensation expense, (ii) loss from disposal of property and tools, (iii) depreciation of fastened belongings and amortization of intangible belongings ({dollars} in hundreds):

| For the 12 months ended December 31, | ||||||||

| 2023 | 2024 | |||||||

| Reconciliation of non-GAAP internet (loss) revenue: | ||||||||

| Web (loss) revenue | $ | (6,120 | ) | $ | (5,886 | ) | ||

| Share-based Compensation Expense | 2,641 | 3,458 | ||||||

| Loss from disposal of property and tools | 402 | 2 | ||||||

| Depreciation and amortization bills | 1,347 | 1,655 | ||||||

| Non-GAAP internet (loss) revenue | $ | (1,730 | ) | $ | (771 | ) | ||

About SAIHEAT

SAIHEAT (NASQAQ: SAIH) is a worldwide distributed computing energy operator. By leveraging a modular computing energy system, we assist vitality house owners tackle the problems of native vitality consumption and environment friendly useful resource utilization. The corporate supplies BTC cloud mining companies by joint computing energy, in addition to vitality digitization and monetarization options for vitality asset house owners. These applied sciences contribute to lowering the carbon footprint and supplies progressive options for vitality enterprises.

Secure Harbor Assertion

This press launch could comprise forward-looking statements throughout the which means of the Non-public Securities Litigation Reform Act of 1995. The phrases “imagine”, “anticipate”, “anticipate”, “venture”, “targets”, “optimistic”, “assured that”, “proceed to”, “predict”, “intend”, “purpose”, “will” or comparable expressions are supposed to determine forward-looking statements. All statements apart from statements of historic truth are statements which may be deemed forward-looking statements. These forward-looking statements embrace, however not restricted to, statements regarding SAIHEAT and the Firm’s operations, monetary efficiency, and situation are primarily based on present expectations, beliefs and assumptions that are topic to vary at any time. SAIHEAT cautions that these statements by their nature contain dangers and uncertainties, and precise outcomes could differ materially relying on quite a lot of vital components comparable to authorities and inventory alternate laws, competitors, political, financial, and social circumstances all over the world together with these mentioned in SAIHEAT’s Kind 20-F underneath the headings “Danger Components”, “Outcomes of Operations” and “Enterprise Overview” and different studies filed with the Securities and Alternate Fee every so often. All forward-looking statements are relevant solely as of the date it’s made and SAIHEAT particularly disclaims any obligation to keep up or replace the forward-looking data, whether or not of the character contained on this launch or in any other case, sooner or later.

| SAIHEAT LIMITED | ||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||

| (In hundreds, apart from variety of shares and per share information) | ||||||||

| As of December 31, 2023 | As of December 31, 2024 | |||||||

| (US$) | (US$) | |||||||

| Property | ||||||||

| Present belongings: | ||||||||

| Money and money equivalents | 3,176 | 1,038 | ||||||

| Restricted money | — | 41 | ||||||

| Accounts receivable | 900 | 237 | ||||||

| Inventories | 44 | 772 | ||||||

| Crypto belongings | 6,709 | 6,905 | ||||||

| Stablecoin belongings | 81 | 20 | ||||||

| Deposits, prepayments and different present belongings, internet | 1,341 | 1,882 | ||||||

| Complete present belongings | 12,251 | 10,895 | ||||||

| Property and tools, internet | 4,994 | 3,974 | ||||||

| Working lease right-of-use belongings, internet | 830 | 585 | ||||||

| Intangible belongings, internet | — | — | ||||||

| Long run Property | — | 3,080 | ||||||

| Complete belongings | 18,075 | 18,534 | ||||||

| Liabilities and fairness | ||||||||

| Present liabilities: | ||||||||

| Accounts payable | 45 | 438 | ||||||

| Working lease liabilities-current | 241 | 82 | ||||||

| Accrued and different liabilities | 358 | 122 | ||||||

| Advance from clients | — | 870 | ||||||

| Brief-term Borrowings | — | 2,115 | ||||||

| Different payable and accrued liabilities | 42 | 55 | ||||||

| Complete present liabilities | 686 | 3,682 | ||||||

| Working lease liabilities-non-current | 569 | 486 | ||||||

| Complete non-current liabilities | 569 | 486 | ||||||

| Complete Liabilities | 1,255 | 4,168 | ||||||

| Commitments and contingencies – Notice 12 | ||||||||

| Shareholders’ fairness: | ||||||||

| * Class A Frequent Shares, $0.0015 par worth; 22,024,624 shares approved, 1,110,907 and 1,013,163 shares issued and excellent in December 31, 2024 and December 31, 2023. | 1 | 1 | ||||||

| * Class B Odd shares ($0.0015 par worth; 642,043 shares approved and excellent on December 31, 2024 and December 31, 2023) | 1 | 1 | ||||||

| Further paid-in capital | 48,680 | 52,137 | ||||||

| Gathered deficit | (31,345 | ) | (37,231 | ) | ||||

| Gathered different complete revenue/(loss) | (517 | ) | (542 | ) | ||||

| Complete shareholders’ fairness | 16,820 | 14,366 | ||||||

| Complete Liabilities and shareholders’ fairness | 18,075 | 18,534 | ||||||

| SAIHEAT LIMITED | ||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS)/INCOME | ||||||||||||

| (In hundreds, apart from variety of shares and per share information) | ||||||||||||

| For the 12 months ended December 31, | ||||||||||||

| 2022 | 2023 | 2024 | ||||||||||

| (US$) | (US$) | (US$) | ||||||||||

| Revenues | 10,638 | 6,776 | 5,543 | |||||||||

| Value of revenues | 9,498 | 6,319 | 6,553 | |||||||||

| Gross Revenue | 1,140 | 457 | (1,010 | ) | ||||||||

| Gross sales and advertising bills | 1,098 | 1,134 | 284 | |||||||||

| Common and administrative bills | 6,080 | 5,703 | 5,973 | |||||||||

| Analysis and growth bills | 476 | 853 | 642 | |||||||||

| Impairment of long-lived belongings | 951 | 138 | — | |||||||||

| Complete working bills | 8,605 | 7,828 | 6,899 | |||||||||

| Loss from operations | (7,465 | ) | (7,371 | ) | (7,909 | ) | ||||||

| Different revenue/(expense), internet | (1,380 | ) | 1,251 | 2,023 | ||||||||

| Loss earlier than revenue tax | (8,845 | ) | (6,120 | ) | (5,886 | ) | ||||||

| Earnings tax profit(bills) | — | ) | — | — | ||||||||

| Web loss | (8,845 | ) | (6,120 | ) | (5,886 | ) | ||||||

| Different complete loss | ||||||||||||

| International forex translation loss | (544 | ) | (56 | ) | (25 | ) | ||||||

| Complete complete loss | (9,389 | ) | (6,176 | ) | (5,911 | ) | ||||||

| Loss per abnormal share* | ||||||||||||

| Primary and diluted | (6.7189 | ) | (3.7916 | ) | (3.4582 | ) | ||||||

| Weighted common variety of abnormal shares excellent*: | ||||||||||||

| Primary & diluted | 1,316,440 | 1,614,089 | 1,702,018 | |||||||||

| * The shares and per share information are introduced on a retroactive foundation to replicate the reverse inventory break up. | ||||||||||||

FAQ

How a lot did SAIH (NASDAQ: SAIH) income lower in 2024?

SAIH’s complete income decreased by 18% to US$5.54 million in 2024, down from US$6.78 million in 2023, primarily resulting from declines in product gross sales, internet hosting companies, and mining pool income.

What precipitated SAIH’s mining income to extend by 125% in 2024?

SAIH’s mining income progress was pushed by a 130% greater common Bitcoin worth in 2024 in comparison with 2023, with day by day Bitcoin manufacturing growing to 0.13 Bitcoin from 0.12 Bitcoin the earlier 12 months.

What are SAIH’s three predominant enterprise focus areas for 2025?

SAIH will give attention to: 1) Bitcoin forex mining companies for small and medium buyers, 2) Affiliate Petroleum Fuel (APG) options for oil and fuel corporations, and three) Small Modular Reactor (SMR) options for sovereign international locations.

How did SAIH’s gross revenue efficiency change in 2024?

SAIH reported a gross lack of US$1.01 million in 2024, in comparison with a gross revenue of US$0.46 million in 2023, with gross margin declining from optimistic 7% to damaging 18%.

What main deal did SAIH safe with Bitdeer (NASDAQ: BTDR) in 2024?

SAIH offered 40MW of superior liquid-cooling container merchandise to Bitdeer Applied sciences Group, designed to host Bitdeer’s SEALMINER mining rigs at their new information middle.