Top 5 crypto charts that define Trump’s first 100 days in office

Crypto costs retreated within the first 100 days of Trump’s administration as his tariff insurance policies impacted market sentiment.

Bitcoin (BTC) and most altcoins have dropped at the same time as Donald Trump’s administration carried out constructive insurance policies, together with supportive strikes on crypto reserves. The Securities and Change Fee has ended lawsuits towards distinguished corporations, together with Uniswap (UNI), Coinbase, and Ripple Labs.

Nevertheless, crypto costs have fallen primarily resulting from macro elements, as Trump reignited a commerce warfare with international locations like Canada, Mexico, and China.

This text highlights the highest 5 crypto charts which have outlined Donald Trump’s first 100 days in workplace.

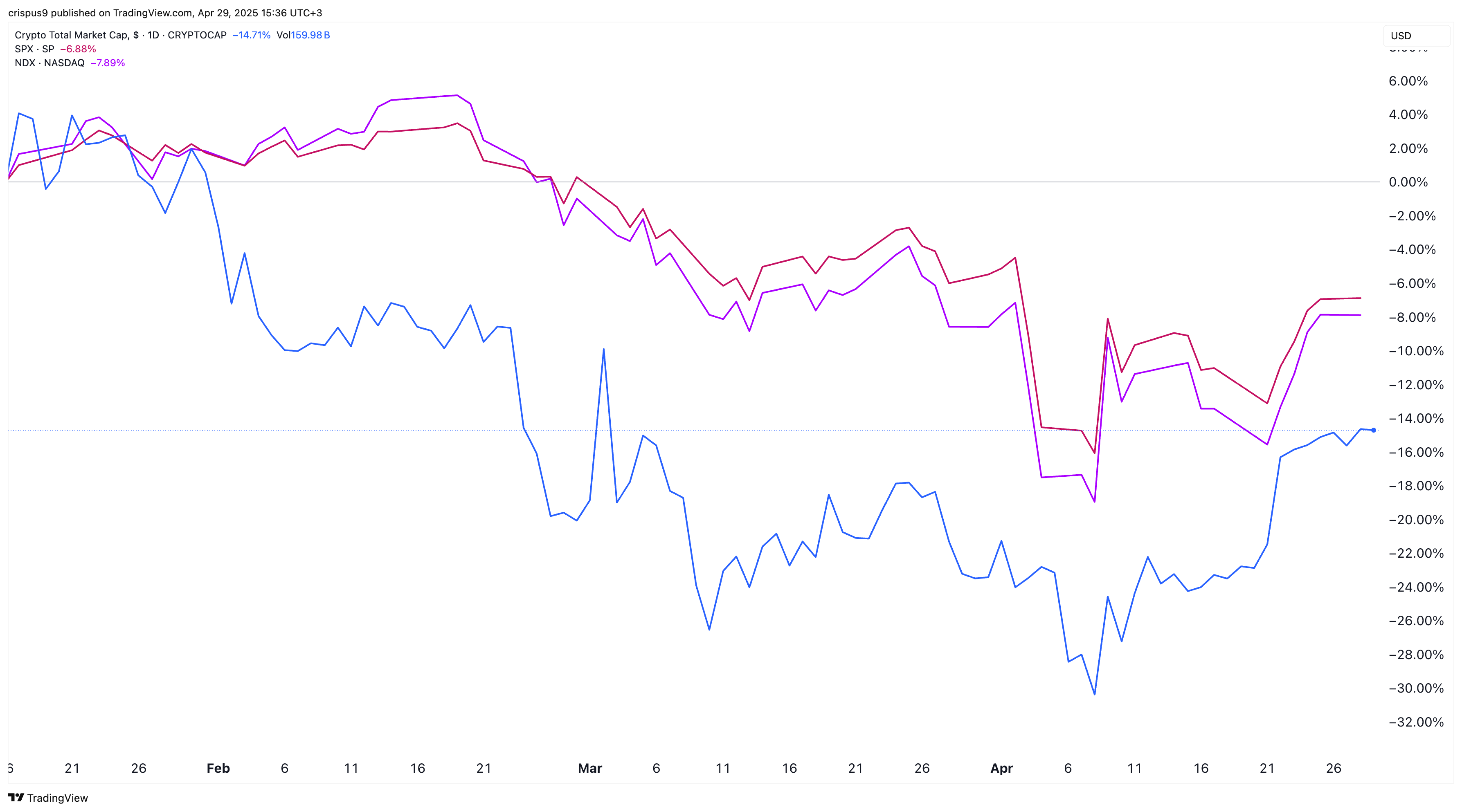

Crypto market cap has crashed by 14.7%

The primary chart beneath exhibits that the broader crypto market has considerably lagged behind the inventory market since Trump took workplace. The overall market capitalization of all cryptocurrencies has dropped by 14.7%, in comparison with declines of 6.9% for the S&P 500 and seven.9% for the Nasdaq 100.

This efficiency is notable, contemplating Trump campaigned on being the “most pro-crypto president” in U.S. historical past, and his insurance policies have been largely supportive. On a constructive be aware, the crypto market cap has recovered considerably, rising from $2.39 trillion earlier this month to $2.9 trillion.

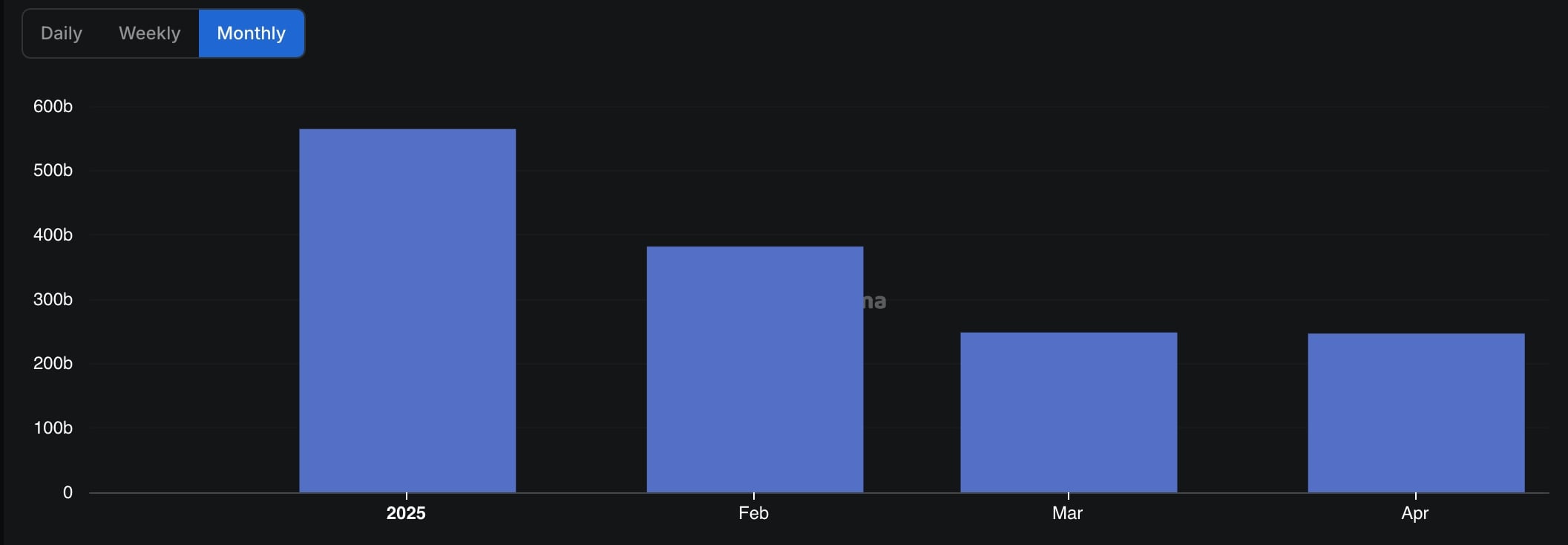

DEX quantity has moderated

Decentralized exchanges noticed a powerful efficiency in January, fueled by a surge in meme cash. A lot of this preliminary rally was pushed by Donald and Melania Trump launching their very own tokens forward of the inauguration.

DEX quantity peaked at $564 billion in January, earlier than moderating to $382 billion in February and $248 billion in each March and April as meme coin enthusiasm light.

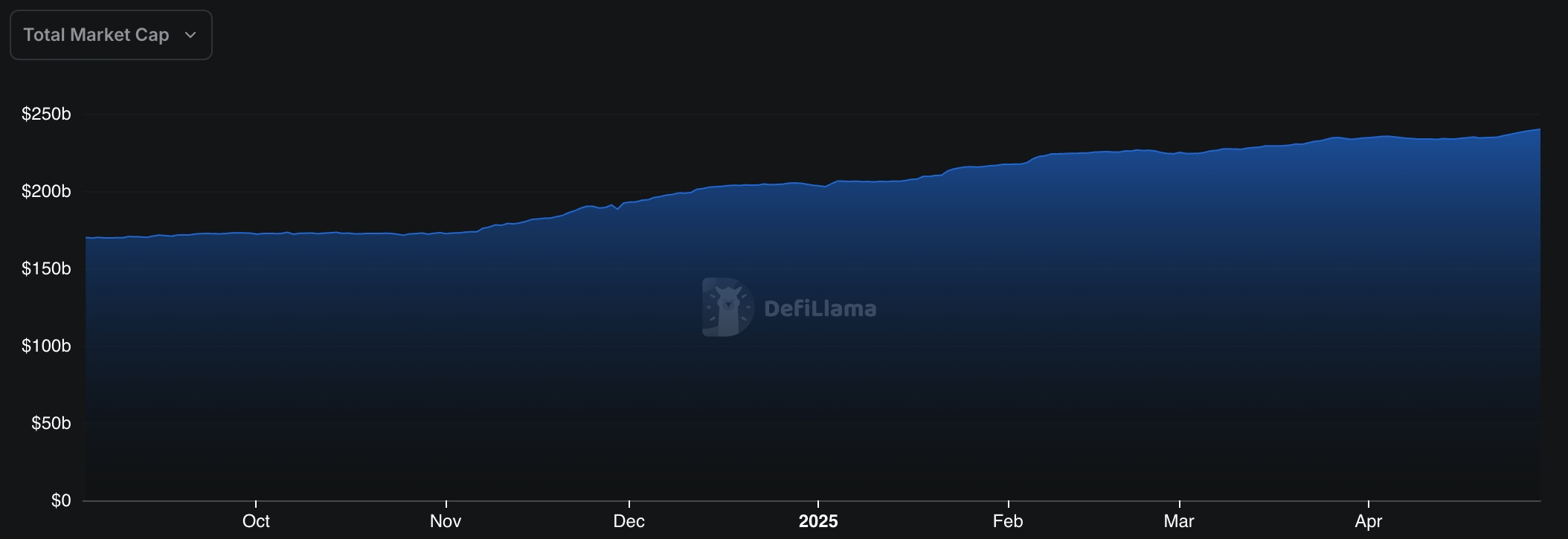

Stablecoin market cap has jumped

Stablecoins have continued to develop beneath Trump’s administration. Knowledge exhibits that the full stablecoin market cap has risen to over $240 billion, led by Tether, USD Coin, Dai, Sky Greenback, and Athena. Since Trump took workplace, stablecoins have added $40 billion in whole market capitalization.

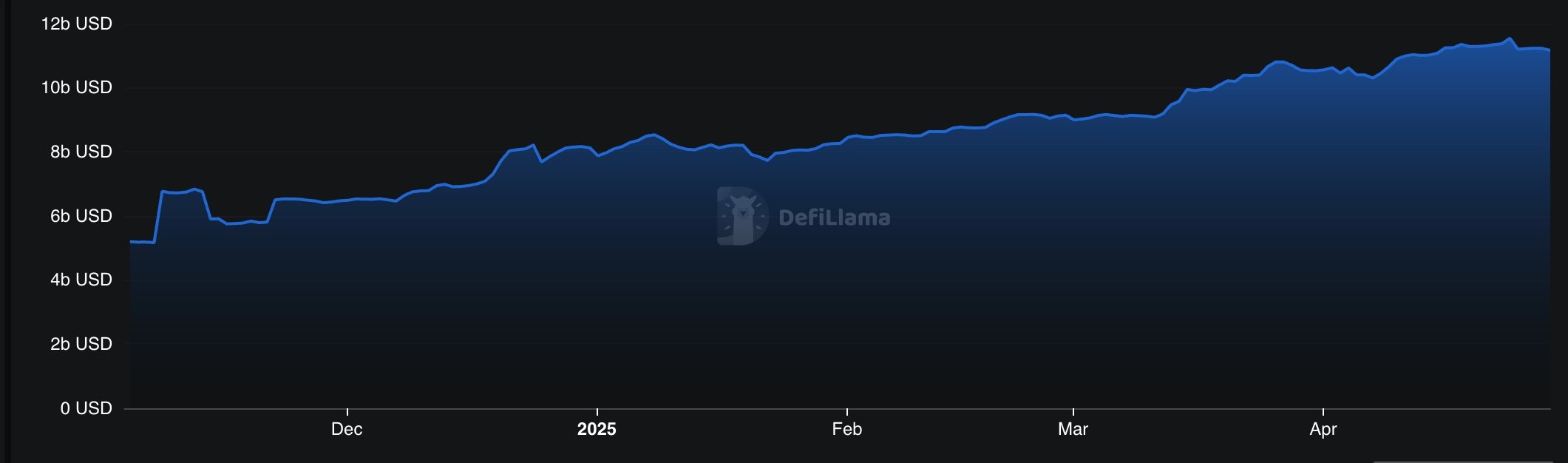

RWA development has accelerated

In the meantime, demand for Actual World Asset tokenization has grown to a document excessive. The market worth of all RWA tokens has jumped to over $11.17 billion, up from $7.92 billion when Trump took workplace. The largest gamers within the RWA business are BlackRock BUIDL, Athena USDtb, Ondo Finance, Tether Gold, and Paxos Gold.

One of many prime tales in RWA was the collapse of Mantra, one of many greatest chains within the business.

Bitcoin ETFs had web inflows of $3.73 billion

Spot Bitcoin ETFs have recorded $3.85 billion in web inflows up to now beneath Trump’s administration. After seeing $5.25 billion in inflows in January, the ETFs skilled two months of outflows, however bounced again with $2.85 billion in inflows this month.

Ethereum ETFs, then again, have had net outflows of $132 million. This occurred because the Ethereum value plummeted towards the US greenback and different belongings, together with Bitcoin and Solana.