USD/CAD Weekly Forecast: Down GDP Urges for June Rate Cut

- The USD/CAD weekly forecast exhibits a slowdown within the US financial system.

- The US financial system added 177,000 jobs in April, above estimates of 138,000.

- Canada’s financial system unexpectedly contracted by 0.2%.

The USD/CAD weekly forecast exhibits a slowdown within the US financial system that might strain the Fed to chop charges in June.

Ups and downs of USD/CAD

The USD/CAD value had a bearish week as most US financial experiences signaled an financial slowdown. Nevertheless, the greenback briefly rebounded on Friday after an upbeat jobs report.

-Are you on the lookout for forex robots? Examine our detailed guide-

All through the week, US information pointed to weak point, with vacancies, jobless claims and personal employment all lacking forecasts. Nevertheless, the financial system added 177,000 jobs in April, above estimates of 138,000. Nonetheless, it was slower than the earlier studying of 185,000.

In the meantime, the Canadian financial system unexpectedly contracted by 0.2%, rising strain on the Financial institution of Canada to renew its easing cycle.

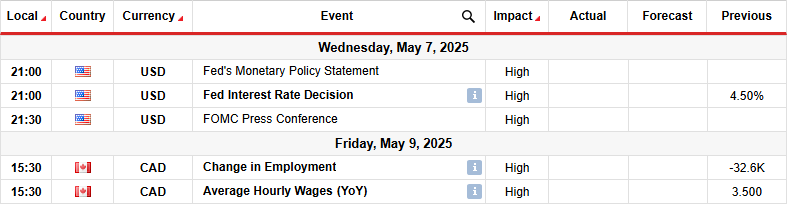

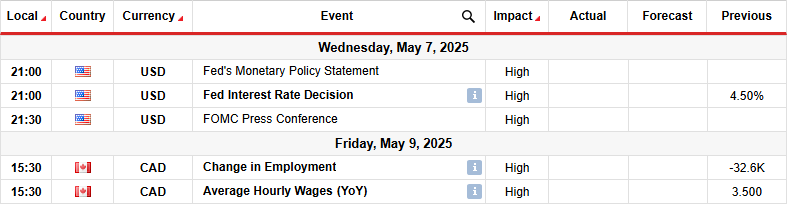

Subsequent week’s key occasions for USD/CAD

Subsequent week, market contributors will deal with the FOMC coverage assembly. In the meantime, Canada will launch its essential month-to-month employment report. The Fed will possible hold rates of interest unchanged as policymakers anticipate extra proof of a deteriorating financial system. Information on Friday revealed that the labor market stays stronger than anticipated. Nevertheless, merchants are more and more pricing a price lower in June.

In the meantime, Canada’s employment report will present the state of its labor market, shaping the outlook for Financial institution of Canada price cuts.

USD/CAD weekly technical forecast: Bears lose momentum close to channel assist

On the technical aspect, the USD/CAD value trades under the 22-SMA with the RSI below 50, indicating a bearish bias. Since its peak on the prime of the chart, the value has made decrease highs and lows. On the identical time, it has revered strong resistance and assist traces, making a bearish channel.

-Are you on the lookout for one of the best CFD broker? Examine our detailed guide-

In the meanwhile, bears are difficult the 1.3800 assist stage. Nevertheless, value motion exhibits the decline has weakened close to the channel assist. The candle our bodies are smaller. On the identical time, the RSI has made a bullish divergence, suggesting fading momentum.

If bulls return, the value will possible break above the SMA to retest the channel resistance and the 1.4200 stage. The decline will proceed so long as the value stays within the channel. The subsequent goal might be on the 1.3400 stage. Alternatively, a bullish channel breakout would sign a bullish shift in sentiment.

Seeking to commerce foreign exchange now? Make investments at eToro!

67% of retail investor accounts lose cash when buying and selling CFDs with this supplier. It is best to think about whether or not you’ll be able to afford to take the excessive threat of dropping your cash.