Using principal components to construct macro trading signals

Principal Parts Evaluation (PCA) is a dimensionality discount approach that condenses the important thing data from a big dataset right into a smaller set of uncorrelated variables known as “principal parts.” This smaller set usually features higher as options for predictive regressions, stabilizing coefficient estimates and lowering the affect of noise. On this approach, principal parts can enhance statistical studying strategies that optimize buying and selling indicators.

This submit reveals how principal parts can function constructing blocks of buying and selling indicators for developed market rate of interest swap positions, condensing the knowledge of macro-quantamental indicators on inflation stress, exercise development, and credit score and cash growth. In comparison with a easy mixture of those classes, PCA-based statistical studying strategies have produced materially larger predictive accuracy and backtested buying and selling income. PCA strategies have additionally outperformed non-PCA-based regression studying. PCA-based statistical studying in backtesting leaves little scope for knowledge mining or hindsight, and the invention of buying and selling worth has excessive credibility.

The submit beneath is predicated on Macrosynergy’s proprietary analysis.

Please quote as “Gholkar, Rushil and Sueppel, Ralph, ‘Utilizing principal parts to assemble macro buying and selling indicators,’ Macrosynergy analysis submit, October 2024.”

A Jupyter notebook for audit and replication of the analysis outcomes might be downloaded right here. The pocket book operation requires entry to J.P. Morgan DataQuery to obtain knowledge from JPMaQS. Everybody with DataQuery entry can obtain knowledge, aside from the final 6 months. Furthermore, J.P. Morgan presents free trials on the complete dataset for institutional shoppers. For others, an academic research support program sponsors knowledge units for related initiatives.

This submit ties in with this website’s abstract of “Quantitative Methods For Macro Information Efficiency”.

The fundamentals of principal parts evaluation

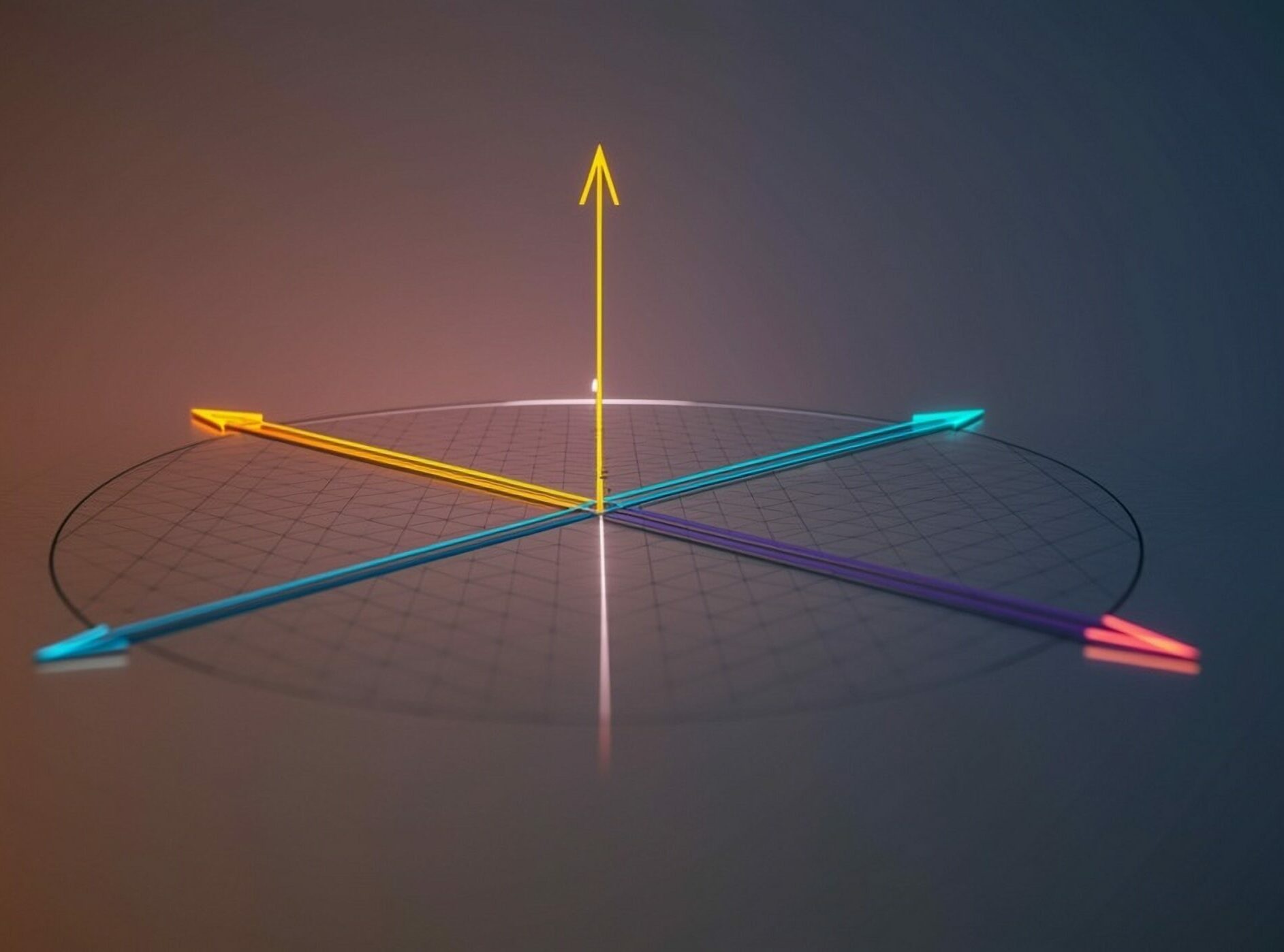

Principal Parts Evaluation (PCA) is a dimension-reduction approach for big datasets. It transforms a large number of authentic knowledge collection right into a lowered dataset by detecting a very powerful patterns within the historic knowledge. The remodeled collection are “principal parts”. They’re all the time linear combos of the unique collection and retain a big a part of the knowledge of the unique knowledge set. The principal parts are uncorrelated and ordered such that the primary few parts seize many of the variability within the knowledge. Mathematically, they’re derived from the eigenvectors of the covariance matrix of the unique knowledge. The eigenvalues symbolize the quantity of general variance defined by every principal element. Geometrically, PCA transforms the unique knowledge into a brand new coordinate system the place the axes, which symbolize the principal parts, are aligned within the course of most variance.

The computational a part of principal element evaluation sometimes proceeds in 5 steps:

- Standardize the unique knowledge collection so that every has a imply of 0 and a regular deviation of 1.

- Compute the covariance matrix of those collection.

- Discover Eigenvalues and Eigenvectors. Eigenvectors point out the course of the principal parts, whereas eigenvalues present how a lot variance happens in that course.

- Choose Principal Parts primarily based on these eigenvalues. One can both repair the variety of chosen parts or the share of variation that they’re to symbolize.

- Challenge the unique knowledge onto the brand new principal parts, which symbolize a decrease dimensional house. It is a easy matrix multiplication.

Observe that standardization and centring knowledge are essential for PCA. If one doesn’t centre, the primary principal element can level within the course of the imply moderately than capturing the biggest supply of variation. The extent of this impact is determined by the space of the unique knowledge from the origin. The principal parts evaluation on this submit makes use of the PCA class of the scikit-learn package deal. It employs Singular Worth Decomposition of the information to undertaking collection to a decrease dimensional house.

The advantages and downsides of principal parts as macro buying and selling indicators

Principal parts might be gainfully utilized in predictive regressions that estimate the connection between issue candidates and goal returns. Predictive regressions, in flip, are an essential foundation of statistical studying for the event of macro buying and selling elements (view post here). Principal parts are a substitute for big, correlated units of options in predictive regressions. Using principal parts in predictive regressions presents numerous advantages:

- As principal parts are orthogonal, they take away the multicollinearity of options. Multicollinearity undermines the reliability and interpretability of predictive regressions via unstable coefficient estimates, inflated normal errors of parameter estimates, and overfitting.

- PCA identifies parts that designate many of the variance of the unique knowledge set, permitting you to deal with a very powerful patterns and filter out noise. This usually ends in a extra secure and generalizable mannequin. The mannequin is much less prone to overfit to irrelevant fluctuations.

- If time collection knowledge symbolize underlying latent elements (similar to financial indicators or market forces), PCA will help uncover these hidden elements.

- Lastly, fewer predictors additionally make the mannequin easier and scale back coaching time in statistical studying. This could result in sooner computation instances and improved efficiency in machine studying.

When weighing the selection and particular type of the PCA, one should additionally pay attention to the drawbacks of the strategy:

- The principal parts which might be handed to predictive regressions don’t have any clear interpretation. Uncorrelatedness doesn’t imply independence, and correlations between principal parts and the unique knowledge collection can usually be confounding. With no clear interpretation of regressors, one can’t introduce theoretical priors to predictive regression, similar to non-negativity of coefficients, and the selection of fashions and indicators in statistical studying is all as much as the information, lowering bias however rising variance.

- A statistical disadvantage of PCA is that it will increase the variance of the statistical studying indicators by including estimated coefficients which might be inclined to episodic peculiarities. Financial time collection, similar to inflation and cash development, could also be correlated in a single surroundings and never in one other.

These drawbacks indicate that the selection of authentic knowledge units issues and that it’s usually applicable to construction the unique collection into “conceptual teams” primarily based on the which means of the collection. Principal parts of homogenous teams, similar to numerous forms of inflation metrics, usually tend to show secure correlation and interpretable parts than parts of a heterogeneous knowledge set of conceptually unrelated indicators whose correlation might be adventitious and unstable.

A sensible utility of PCA to extract fixed-income buying and selling indicators

On this submit, we apply regression-based studying with PCA to mix numerous macro-quantamental classes into buying and selling indicators for length publicity in developed international locations’ rate of interest swap markets. We think about financial indicators and rate of interest swap returns for ten developed markets foreign money areas: AUD (Australian greenback), CAD (Canadian greenback), CHF (Swiss franc), EUR (Euro), GBP (British pound), JPY (Japanese yen), NOK (Norwegian krone), NZD (New Zealand greenback), SEK (Swedish krona), and (U.S. greenback).

The target is to develop macro-quantamental buying and selling indicators to handle rate of interest swap positions throughout developed markets. The resultant technique would implicitly handle each directional and cross-currency length danger. The formal targets of the evaluation are returns on 5-year fixed-rate receiver places, additionally known as length returns (view documentation).

For all these foreign money areas we think about generally watched financial indicators as constituents of a buying and selling sign. For significant historic evaluation and backtesting, these knowledge should come within the type of macro-quantamental indicators. Macro-quantamental indicators are point-in-time data states of financial developments particularly generated and up to date for the backtesting and operation of buying and selling methods. Comparable indicators throughout a number of international locations might be known as macro-quantamental classes. The indications have been downloaded from the J.P. Morgan Macrosynergy Quantamental System (JPMaQS).

Particularly, we think about three teams of macro-quantamental classes as predictors of fastened revenue returns: inflation stress, extra mixture demand and output, and extra cash and credit score development. The aim of this choice is to feed a balanced set of classes throughout ideas which might be generally monitored by the market to the PCA and statistical studying course of moderately than a “kitchen sink” of all obtainable collection on JPMaQS. The good thing about choice and balancing is that (i) all classes have confirmed relevance for the market, (ii) we don’t enable the idea with probably the most obtainable statistical collection to crowd out the others, and (iii) we protect a modicum of interpretability of principal parts as dimensions of a consultant data set of the market.

Group 1: Inflation stress classes

This group accommodates ten classes that point out extreme (or inadequate) worth stress within the macroeconomy. Extra inflation is meant to point upward stress on coverage charges and inflation danger premia. The time period “extra” for all worth inflation indicators means relative to the efficient inflation goal of the foreign money space’s central financial institution (view documentation). Extra for wage inflation indicators means relative to efficient inflation targets plus medium-term productiveness development, whereby the latter is the distinction between the 5-year medians of GDP development (view documentation) and workforce development (view documentation).

- Two extra headline shopper worth index (CPI) development charges, measured as % over a 12 months in the past (view documentation) and as % of the final 6 months over the earlier 6 months, seasonally and leap adjusted, at an annualized fee (view documentation).

- Two extra core CPI development charges, once more as % over a 12 months in the past (view documentation) and as % of the final 6 months over the earlier 6 months seasonally and leap adjusted and annualized (view documentation), whereby the core inflation fee is calculated in response to native conference.

- Two extra producer worth index (PPI) development charges, measured as % over a 12 months in the past and as % of the final 6 months over the earlier 6 months, seasonally adjusted and annualized (view documentation).

- Economic system-wide estimated extra output worth development, % over a 12 months in the past, 3-month shifting common. Output worth developments for the general financial system resemble GDP deflators in precept however are estimated at a month-to-month frequency with a easy nowcasting technique and primarily based on a restricted early set of worth indicators (view documentation).

- Estimated extra CPI inflation expectations of market contributors for two years after the most recent reported CPI knowledge (view documentation). It is a formulaic estimate that assumes that market contributors type their inflation expectations primarily based on the current inflation fee (adjusted for jumps and outliers) and the efficient inflation goal.

- Extra wage development, important native measure, % over a 12 months in the past, 3-month shifting common or quarterly (view documentation).

- Extra residential actual property worth development over a 12 months in the past, 3-month shifting common or quarterly (view documentation).

For the aim of principal parts evaluation and the calculation of the benchmark conceptual parity, all classes are sequentially normalized round their theoretical impartial stage, and values are winsorized at three normal deviations to de-emphasize outliers.

Group 2: Extra demand and exercise development classes

This group accommodates 9 classes that point out mixture demand or exercise development relative to pattern or potential. Constructive extra development data is meant to exert upward stress on coverage charges and equilibrium actual rates of interest. Extra for exercise and actual demand development is relative to the 5-year median GDP development (view documentation). Extra for employment development is relative to the 5-year median workforce development (view documentation). Enterprise sentiment scores and unemployment fee adjustments want no benchmark since their pure impartial stage is zero.

- Extra intuitive GDP development, i.e., the most recent estimable GDP development pattern primarily based on precise nationwide accounts and month-to-month exercise knowledge, utilizing units of regressions that replicate typical charting strategies in markets, % over a 12 months in the past, 3-month shifting common (view documentation).

- Extra technical GDP development, i.e., the most recent estimable GDP development pattern primarily based on precise nationwide accounts and month-to-month exercise knowledge, utilizing a regular generic nowcasting mannequin whose hyperparameters are up to date over time, % over a 12 months in the past, 3-month shifting common (view documentation).

- Extra industrial manufacturing development, % over a 12 months in the past, 3-month shifting common or quarterly (view documentation).

- Extra actual retail gross sales development, % over a 12 months in the past, 3-month shifting common or quarterly (view documentation).

- Extra employment development, % over a 12 months in the past, 3-month shifting common or quarterly (view documentation).

- Two measures of adverse adjustments within the unemployment fee are the distinction over a 12 months in the past, the 3-month shifting common or quarterly (view documentation), and the distinction of the newest 3 months over the earlier 3 months or quarter on quarter (view documentation).

- Manufacturing confidence rating, normalized round theoretical and empirical impartial stage, primarily based on important native surveys and utilizing updating parameters for normalization (view documentation).

- Client confidence rating, normalized across the theoretical and empirical impartial stage, primarily based on important native surveys and utilizing updating parameters for normalization (view documentation).

Group 3: Extra credit score and cash development classes

This group accommodates six classes: extra personal credit score, cash, and liquidity development. The benchmark for extra credit score and cash development is the sum of 5-year median GDP development and efficient inflation targets. No benchmark has been utilized to liquidity development since impartial ranges are extra depending on the structural developments of the monetary sector.

- Two extra personal credit score growth charges, measured as % change over a 12 months in the past, seasonally and jump-adjusted (view documentation) and as a change of personal credit score over 1 12 months in the past, seasonally and jump-adjusted, as % of nominal GDP (view documentation).

- Two extra cash development charges, each measured as % change over a 12 months in the past, seasonally and jump-adjusted, however one for a slender cash idea (view documentation) and one for a broad cash idea (view documentation).

- Two measures of central financial institution liquidity development, each measured as change over the previous 6 months, one measuring solely the growth of central financial institution liquidity that’s associated to FX interventions and securities buy programmes (view documentation), the opposite capturing the complete financial base growth (view documentation)

All quantamental classes above have been formulated such that their predictive relation with subsequent length returns ought to be adverse, Nonetheless, correlations throughout the classes have been fairly numerous, with panel-wide cross-category Pearson coefficients between 80% and -25%,

Utilizing PCA with statistical studying

To mix the above quantamental classes into single buying and selling indicators, we use a statistical studying course of that’s just like the one proven in a earlier submit (“Optimizing macro trading signals – A practical introduction”). This studying course of proceeds depends on the scikit-learn package and quantamental wrapper features of the Macrosynergy package. Its important goal is to sequentially select optimum fashions, principal parts, and regression-based indicators. The educational course of operates in six steps.

- We extract monthly-frequency pandas knowledge frames within the scikit-learn format of the predictive options, i.e., lagged end-on-month values of quantamental classes and targets, right here cumulative month-to-month length returns. Observe that as we work with panel knowledge, the characteristic and goal return knowledge frames are double-indexed, that includes the foreign money space and the time interval.

- We outline mannequin and hyperparameter grids in response to the scikit-learn conference. Within the current case, studying usually entails selection, optimization, and utility of two fashions: a PCA and a predictive regression that makes use of the principal parts as regressors. The grid variations thought-about for this evaluation are defined additional beneath.

- We set an optimization criterion to guage skilled mannequin variations primarily based on unseen validation or check knowledge units. Right here, the criterion is the balanced accuracy of the month-to-month return predictions, i.e., the common of the accurately predicted optimistic and adverse month-to-month returns. Within the current context, balanced accuracy appears preferable to a regular R-squared criterion as a result of its implicit selections are much less geared in the direction of return outliers, i.e., in the direction of the experiences in intervals of excessive market volatility.

- We outline a cross-validation splitter for mannequin analysis in sequentially increasing knowledge units. Cross-validation is an evaluation of the predictive high quality of a mannequin primarily based on a number of splits of the information into coaching and check units, the place every pair known as a “fold.” Usually, cross-validation splitters for panel knowledge should confirm the logical cohesion of the coaching and check units primarily based on a double index of cross-sections and time intervals, making certain that each one units are sub-panels over widespread time spans. Right here, we use the ExpandingKFoldPanelSplit splitter class of the Macrosynergy package deal, the place a hard and fast variety of splits is carried out, however temporally adjoining panel coaching units all the time precede check units chronologically.

- We function sequential optimization of the PCA and predictive regression fashions and associated sign technology utilizing the SignalOptimizer class of the Macrosynergy package deal. Based mostly on this optimization, one can extract optimum indicators in a regular format and run diagnostics on the steadiness of the selection of optimum fashions over time.

- Lastly, we consider the sequentially optimized indicators primarily based on PCA and regression when it comes to predictive energy, accuracy, and naïve PnL technology.

Inside the above course of, we specify as a part of the hyperparameter grids numerous principal element analyses and extract principal element regressors in 4 kinds:

- Kitchen-sink PCA strategy: The educational course of applies PCA to the complete set of the 25 quantamental classes and extracts the parts in response to numerous standards. Then it makes use of the full-set principal parts as regressors.

- Groupwise single-stage PCA strategy: The educational course of applies PCA individually to every conceptual group. it derives principal parts of inflation stress, extra demand development, and extra credit score and cash development. Then, it makes use of all intra-group principal parts as regressors. This strategy equalizes the significance of information variation throughout teams.

- Groupwise 2-stage PCA strategy: The educational course of first identifies the principal parts for every conceptual characteristic group. Then, it identifies the principal parts of the group. Lastly, it makes use of the “principal parts of principal parts” as predictive regressors.

- Groupwise conceptual-PCA strategy: Right here, the educational course of solely applies to PCA to a few group conceptual parity indicators, i.e., inside every group, all classes are normalized and winsorized (capped at three normal deviations) after which averaged. Subsequently, PCA is utilized to the three group scores and the principal parts utilized in predictive regression.

The principle hyperparameters of all PCAs are the choice standards of the principal parts. Usually, we provide the method three standards:

- a cumulative variance criterion that selects the ordered principal parts till they seize at most 95% of the general variation within the knowledge,

- the Kaiser criterion, a rule of thumb that retains principal parts with eigenvalues larger than 1, i.e., parts that designate at the least as a lot variance as an authentic standardized collection or

- a hard and fast variety of (3) parts to be extracted.

There are finer factors within the utility of the PCA, however usually, the current evaluation makes use of the only attainable choices at every flip. For full reference, see the Jupyter Pocket book linked above.

For illustration, the chart beneath reveals the evolution of the correlation between the primary principal element and the unique (normalized and winsorized) macro-quantamental classes for the kitchen-sink PCA strategy. It reveals that this element is a standard background think about GDP, labour market, inflation, and credit score developments. This element appears to trace some type of broad enterprise cycle issue. With the return of inflation in 2020, the relative correlation of the primary principal element with CPI development elevated vis-à-vis financial exercise.

The second principal element has been associated to the distinction between development and inflation indicators, presumably reflecting some type of “trade-off” issue, distinguishing intervals of beneficial growth-inflation trade-offs (“goldilocks”) from intervals the place development is inflationary. A beneficial trade-off permits extra lenient financial coverage and helps public funds.

Lastly, as a benchmark for all three PCA-based optimized indicators, we calculate two forms of buying and selling indicators primarily based on conceptual parity.

- The primary applies conceptual parity group indicators, i.e. common scores for inflation stress, extra demand, and extra cash and credit score development, to the statistical studying regression (regression-based studying with conceptual elements).

- The second merely takes a median rating of the group common scores and requires no estimation or studying in any respect. We’ll name this two-stage conceptual parity.

What we will be taught from a simplistic PCA-based charges technique

Analysis of PCA-based and non-PCA-based indicators generated for the ten developed fixed-income markets over the past 20 years reveals essential insights.

- PCA-based strategies underperform conceptual parity strategies in easy panel correlation evaluation for a number of international locations. The PCA strategies outperform, nonetheless, in intertemporal correlation inside international locations when in comparison with non-PCA studying. This implies that a number of the data that distinguishes macro developments throughout international locations is misplaced within the transformation of indicators via the statistical studying course of.

- PCA-based strategies outperform conceptual parity with respect to predictive accuracy. That signifies that they’ve executed a greater job of predicting the course of worldwide length returns.

- PCA-based strategies have produced larger and extra constant buying and selling values in comparison with each a pure (2-stage) conceptual parity sign and a regression-based studying strategy with conceptual parity.

- Throughout specs, the outperformance of PCAs has been strong. That is exceptional because the sequential selection of regressors and optimization of indicators entails little prior judgment and offers little room for implicit or express hindsight. Merely put, PCA-based backtests have excessive credibility.

The scatter plots and panel regression assessments beneath present that all forms of indicators have displayed optimistic predictive energy with respect to subsequent length returns at a month-to-month frequency. Nonetheless, for the complete panel of 10 foreign money areas, the ahead correlation was solely important for the conceptual parity sign.

It isn’t uncommon for conceptual parity indicators to outperform optimized indicators. In spite of everything, the statistical studying course of provides loads of variation to the sign that’s associated to mannequin and parameter adjustments, neither of which has something to do with altering market circumstances.

Furthermore, right here, the decrease correlation significance of the educational and PCA-based indicators for the panel primarily displays the lack of ability of the refined statistical sign to foretell relative returns throughout the ten totally different international locations. The charts and statistics beneath for the U.S. alone present that each one indicators have displayed important energy for predicting directional returns inside a single market. The lack to foretell cross-country return variations could also be an artefact of the calculation of a single set of principal parts for all international locations, i.e., the panel, ignoring variations in cross-indicator correlations throughout international locations.

The PCA and learning-based indicators additionally submit larger predictive accuracy, signalling the course of month-to-month return accurately in 52.9% to 54.3% of all months and foreign money areas versus 51.5% for the 2-stage conceptual parity sign.

Lastly, we assess the financial worth of the varied indicators via naïve PnL efficiency metrics. The PnL simulation assumes that optimistic indicators translate into 1 USD notional fastened charges receiver positions and adverse indicators in 1 USD notional publicity fastened charges payer positions. Thus, we apply a binary +1/-1 positioning sign right here, the only attainable sign model. Positions are rebalanced in the beginning of a month primarily based on indicators on the finish of the earlier month, and at some point of slippage of buying and selling is added to the change of place. The naïve PnL doesn’t think about transaction prices or danger administration guidelines. All PnLs are scaled (not volatility focused) to 10% annualized normal deviations for joint graphical illustration.

The chart beneath reveals that the worth technology of the regression-PCA studying indicators has all outperformed the conceptual parity approaches. The most effective-performing indicators for risk-adjusted returns since 2004 have been the Groupwise 2-stage PCA strategy, with a 2004-2024 Sharpe ratio of 0.7 and a Sortino ratio of 1.0. PnL technology was seasonal, concentrated in financial downturns and recoveries. Correlation with the Treasury has been a optimistic 35%, reflecting a 66% lengthy bias of the sign. The performances of different PCA-based learnings have been related, with Sharpe ratios of 0.6-0.7 and Sortino ratios of 0.9-1.

The two-stage conceptual parity sign underperformed, with a Sharpe of simply 0.3 and worth technology on simply two episodes. This poor efficiency was due partly to a slight brief bias in the long term. The regression-based studying sign of the group conceptual parity scores fared a bit higher, with a long-term Sharpe of 0.4. Nonetheless, that sign used an 80% lengthy bias. That very lengthy bias contributed to an enormous drawdown within the 2020s.

Utilizing a barely extra elaborate sort of sign and place administration confirms the worth of the PCA-based indicators. The beneath naïve PnLs take positions proportionately to the macro-quantamental sign with a danger restrict of two normal deviations lengthy or brief. Furthermore, particular person nation IRS positions are vol-targeted at 10% with month-to-month re-estimation. Any such PnL produced barely larger Sharpe and Sortino ratios for the PCA indicators, with the 2-stage PCA reaching a Sharpe of 0.8 and a Sortino of 0.8. The conceptual parity technique improved relative to the PCA indicators on this sign model, however its worth technology was nonetheless extremely seasonal. Within the context of studying, the non-PCA technique continued to underperform the PCA indicators.

General, within the above easy technique instance, PCA delivered good predictive statistics and naïve worth technology ratios, contemplating that each one buying and selling relied on simply three forms of macro elements. Importantly, the automated, simplistic and sequential sign technology left nearly no scope for look-ahead bias. The empirical proof, subsequently, testifies to the standard of each the information and the strategies that have been used.