What Is Forex (FX) Trading? | Forex trading explained

What’s foreign currency trading and the way does it work?

International alternate buying and selling is often known as FX buying and selling or foreign currency trading supplies the chance to invest on value fluctuations inside the FX market. FX is an trade time period that’s abbreviated from foreign exchange and is often used as a substitute of foreign exchange. Nonetheless, foreign exchange can also be an abbreviation of international alternate.

The aim of FX buying and selling is to forecast if one forex’s worth will strengthen or weaken relative to a different forex. A foreign exchange dealer will encounter a number of buying and selling alternatives every day, resulting from every day information releases. They make the most of this by turning into extraordinarily receptive to market information releases after which commerce based mostly upon the suspected market sentiment.

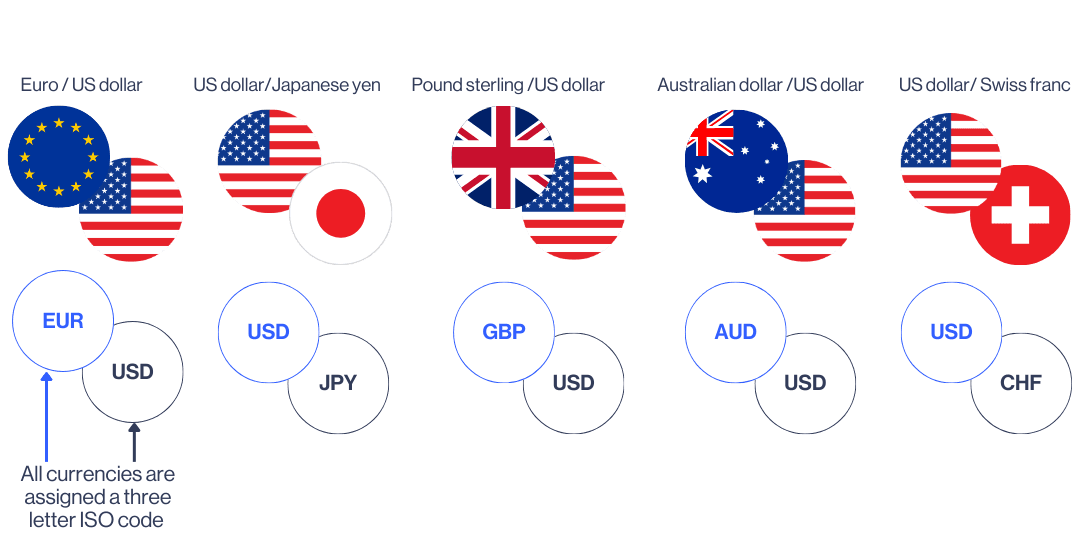

What are foreign exchange forex pairs

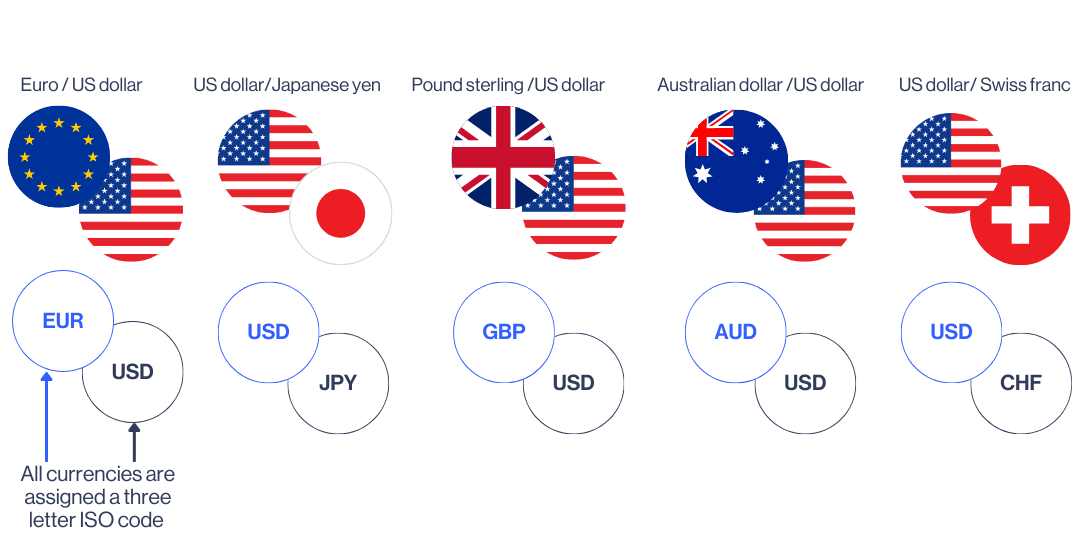

Foreign exchange is all the time traded in forex pairs – for instance, GBP/USD (Pound sterling v US greenback). Foreign currency trading works by speculating towards the distinction in valuation of two currencies.

For instance, In case you have been to commerce the GBP/USD, and thought the worth of the US greenback have been to drop decrease than GBP, you possibly can brief promote the forex pair to revenue from the distinction in worth.

Trying on the GBP/USD forex pair, the primary forex (GBP) is named the ‘base forex’ and the second forex (USD) is called the ‘counter forex’. Alternatively, should you assume GBP will fall towards USD (or that USD will rise towards GBP), you possibly can go lengthy.

Discover out what are a few of the most traded forex pairs within the foreign exchange market by studying our in-depth information.

What are the various kinds of forex pairs

There are 3 various kinds of foreign exchange pairs:

Main pairs: Contains essentially the most traded currencies globally and all the time contain the US greenback (USD) as both the bottom or quote forex. These pairs are likely to have excessive liquidity

💡 Examples:

- GBP/USD (British Pound / US Greenback)

- EUR/USD (Euro / US Greenback)

- USD/JPY (US Greenback / Japanese Yen)

Minor pairs- Don’t embrace the US greenback however contain all the opposite main economies. These are likely to commerce at reasonable liquidity

💡 Examples:

- EUR/GBP (Euro / British Pound)

- AUD/NZD (Australian Greenback / New Zealand Greenback)

- GBP/JPY (British Pound / Japanese Yen)

Unique Forex Pairs- consist of 1 main forex and one from an rising market. These pairs have greater spreads and decrease liquidity, making them extra risky.

💡 Examples:

- GBP/ZAR (British Pound / South African Rand)

- USD/TRY (US Greenback / Turkish Lira)

- EUR/SEK (Euro / Swedish Krona)

What’s a pip:

A pip (proportion in level) is the smallest value motion a foreign exchange pair could make. Most forex pairs are quoted to 4 decimal locations, and a pip is usually the fourth decimal place (0.0001). Merchants use pips to measure value actions and calculate potential earnings or losses in a commerce.

If GBP/USD strikes from 1.2500 to 1.2505, that’s a 5-pip motion.

For pairs that contain the Japanese yen (JPY), a pip is the second decimal place (0.01) as a substitute of the fourth.

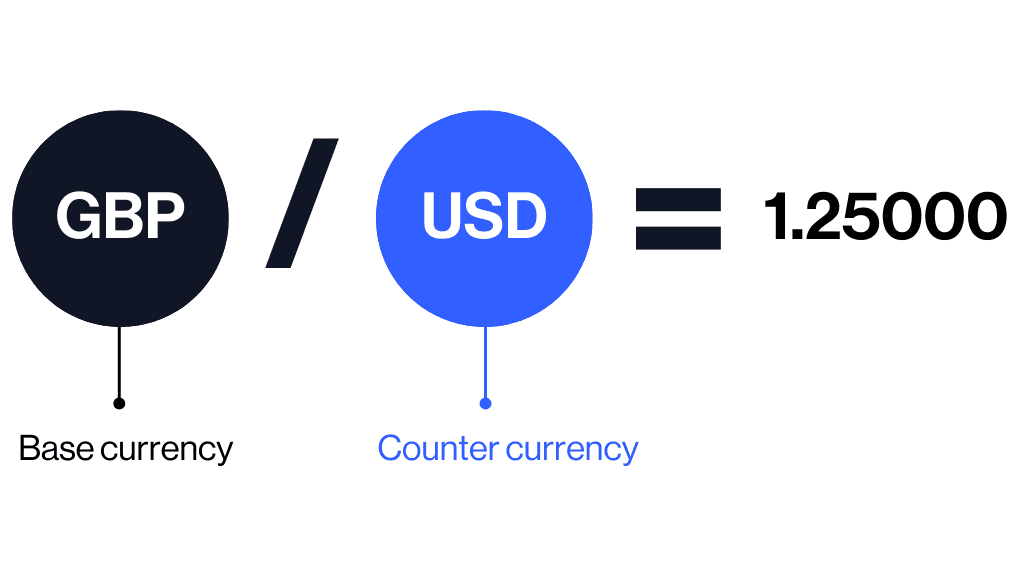

What’s rather a lot:

Lots in foreign currency trading refers back to the dimension of a commerce. Since foreign exchange is traded in massive volumes, heaps standardise how a lot of a forex you purchase or promote in a single commerce.

There are 3 various kinds of heaps sizes:

| Lot Measurement | Variety of Forex Models |

| Customary Lot | 100,000 |

| Mini Lot | 10,000 |

| Micro Lot | 1,000 |

Impact of heaps on Foreign exchange trades:

- In case you commerce 1 commonplace lot, a 5-pip transfer would imply $50 gained or misplaced.

- In case you commerce 1 mini lot, a 5-pip transfer equals $5 revenue or loss.

- In case you commerce 1 micro lot, a 5-pip transfer equals $0.5 revenue or loss.

| Lot Measurement | Variety of forex models | Pip worth |

| Customary Lot | 100,000 | $10 per pip |

| Mini Lot | 10,000 | $1 per pip |

| Micro Lot | 1,000 | $0.10 per pip |

🚨 Lot dimension instantly impacts commerce threat – bigger lot sizes imply greater potential earnings, but additionally bigger potential losses. (tile)

There are various methods to commerce on the foreign exchange market, all of which observe the beforehand talked about precept of concurrently shopping for and promoting currencies. In case you imagine an FX ‘base forex’ will rise relative to the worth of the ‘counter forex’, chances are you’ll want to ‘go lengthy’ (purchase) that forex pair. In case you imagine the other will occur and the market will fall, chances are you’ll want to ‘go brief’ (promote) the forex pair.

The foreign exchange market was traditionally traded through a foreign exchange dealer. Nonetheless, with the rise of on-line buying and selling firms, you possibly can take a place on foreign exchange value actions with a diffusion betting or CFD buying and selling account.

Each unfold betting and CFD buying and selling accounts present a type of spinoff FX buying and selling the place you don’t personal the underlying asset, however quite speculate on its value actions. By-product buying and selling can present alternatives to commerce foreign exchange with leverage. As this could be a dangerous course of, foreign exchange merchants typically select to hold out foreign exchange hedging methods, in an effort to offset any forex threat and subsequent losses.

Learn our information on begin buying and selling foreign exchange.

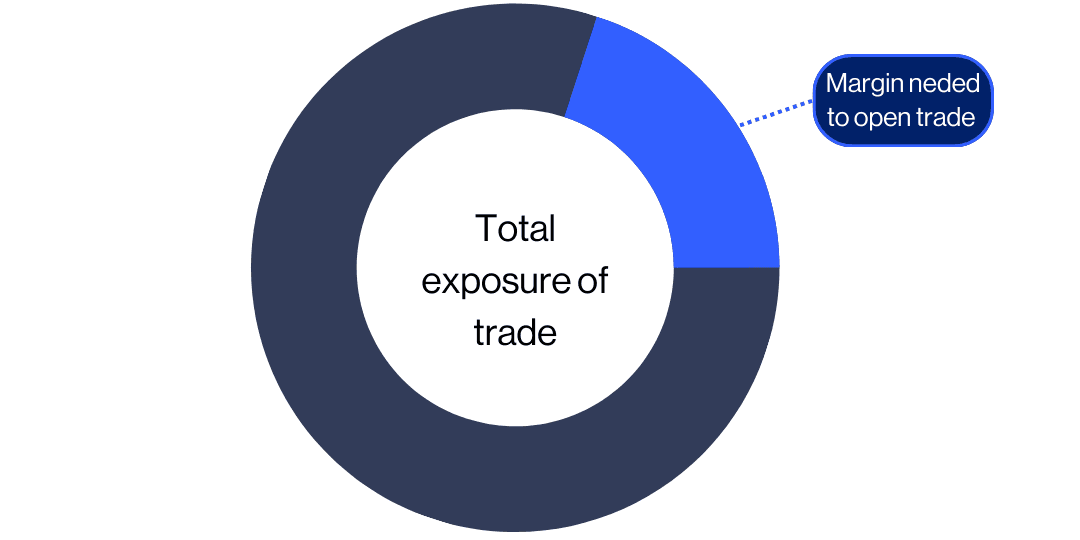

What’s leverage in foreign currency trading?

When buying and selling, foreign exchange leverage permits merchants to manage a bigger publicity with much less of their very own funds. The distinction between the overall commerce worth and the dealer’s margin requirement is normally ‘borrowed’ from the foreign exchange dealer. Merchants can normally get extra leverage on foreign exchange than different monetary devices, which means they’ll management a bigger sum of cash with a smaller deposit.

The provision of leverage is among the causes that many individuals are thinking about buying and selling FX through a foreign exchange unfold betting or CFD buying and selling account. CMC Markets’ accounts supply aggressive margin charges on foreign exchange devices beginning at simply 3.3%, or 30:1 leverage. That is greater leverage than the 20% margin charge (5:1 leverage) accessible for shares devices. Examine different variations between foreign exchange vs shares right here.

What’s unfold in foreign exchange?

The unfold in foreign currency trading is the distinction between the purchase and promote value of an FX forex pair. Whenever you commerce foreign exchange pairs, you’re introduced with a ‘purchase’ value that’s typically above the market value and a ‘promote’ value that’s typically beneath the market value. The distinction between these two costs is known as the ‘bid-ask’, or ‘buy-sell’ unfold.

Foreign currency trading has a few of the lowest spreads accessible of all monetary devices we provide, beginning at simply 0.7 factors, in comparison with a minimal unfold of 37 factors for bitcoin, or 3 factors for crude oil. See a full listing of our present foreign currency trading spreads and margins.

You’ve seemed on the information this morning and seen some information that counsel that the pound will strengthen, so that you determine to go lengthy (purchase) GBP/USD at 1.2500 with a place dimension of 10,000 models(1 mini lot).

📈 Commerce Breakdown

| Forex Pair | Purchase Value |

| GBP/USD | 1.2500 |

| Place dimension | Leverage |

| 10,000 models (1 mini lot) | 5:1 (20% margin |

| Whole place worth | Margin required (deposit) |

| $10’000 | $2,000 (20% of $1000 |

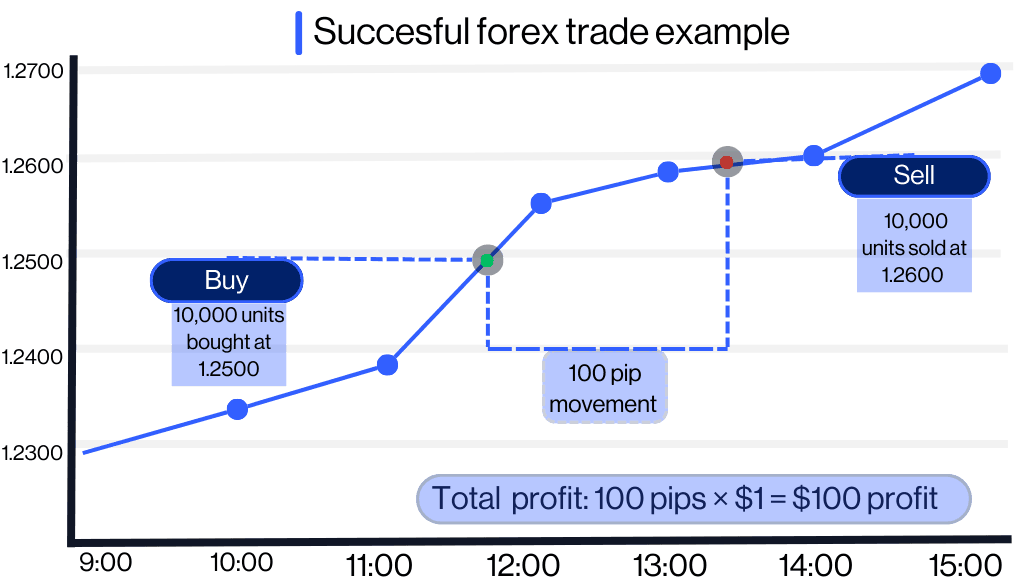

Profitable foreign exchange commerce instance

Let’s assume GBP/USD rises to 1.2600 which is a 100-pip improve (1.2600 – 1.2500 = 100 pips). From once you opened your place. You shut your commerce at 1.2600, locking in a revenue of $100.

Pip worth for 1 mini lot (10,000 models)= $1 per pip

Whole Revenue: 100 pips × $1 = $100 revenue

Your $2,000 margin deposit stays intact, and also you achieve $100, leaving you with a brand new steadiness of $2,100.

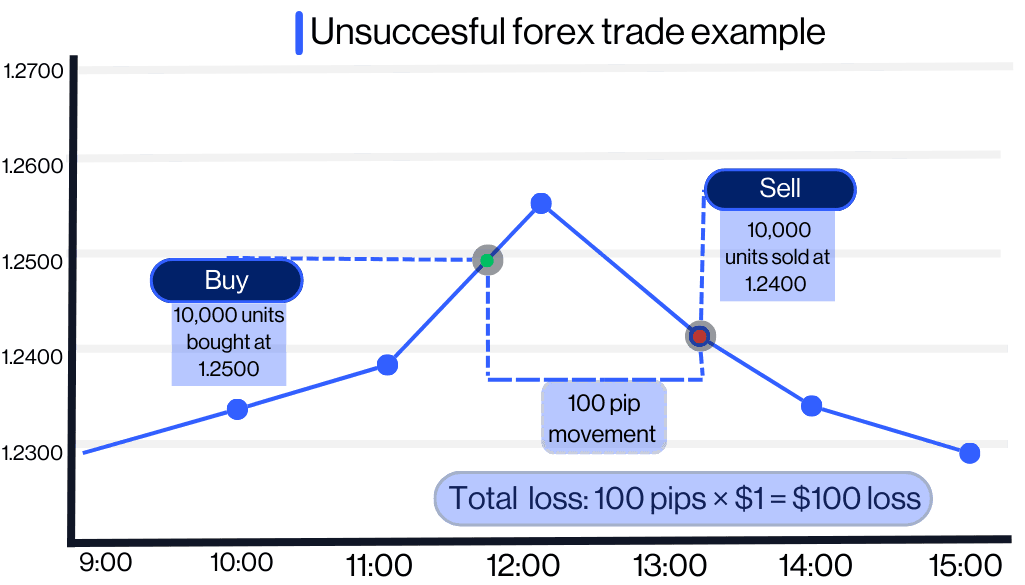

Unsuccessful foreign exchange commerce instance

Now assume GBP/USD falls to 1.2400 (a 100-pip lower 1.2500 – 1.2400 = 100 pips). You shut your commerce at 1.2400, taking a lack of $100.

- Pip Worth for 1 Mini Lot (10,000 models): $1 per pip

- Whole Loss: 100 pips × $1 = $100 loss

$100 will likely be taken out of your $2,000 deposit you’re steadiness will drop to $1,900

🚨 Leverage amplifies each earnings and losses whereas a 100-pip transfer resulted in $100 achieve/loss, a bigger place dimension (e.g., a normal lot) would have made this $1,000 as a substitute.

Who trades the international alternate market

The international alternate is among the most generally traded markets on the earth, with a complete every day common turnover reported to exceed $5 trillion a day. The foreign exchange market is just not based mostly in a central location or alternate, and is open 24 hours a day from Sunday evening by means of to Friday evening. Learn extra about forex market hours right here. A variety of currencies are always being exchanged as people, firms and organisations conduct world enterprise and try to make the most of charge fluctuations.

.The international alternate market is used primarily by central banks, retail banks, firms and retail merchants. Understanding how every of those gamers work together with the FX market might help to find out market traits as a part of your elementary evaluation.

- Central banks are answerable for managing their nation’s forex, cash provide and rates of interest. When motion is taken by central banks, it’s normally to stabilise the nation’s forex.

- Retail banks commerce massive volumes of forex on the interbank market. Banks alternate currencies between one another on behalf of huge organisations, and likewise on behalf of their accounts.

- Firms which have handled firms abroad have to participate within the international alternate market to switch funds for imports, exports or providers.

- Retail merchants account for a a lot decrease quantity of foreign exchange transactions compared to banks and organisations. Utilizing each technical evaluation and elementary evaluation, retail merchants goal to revenue from foreign exchange market fluctuations.

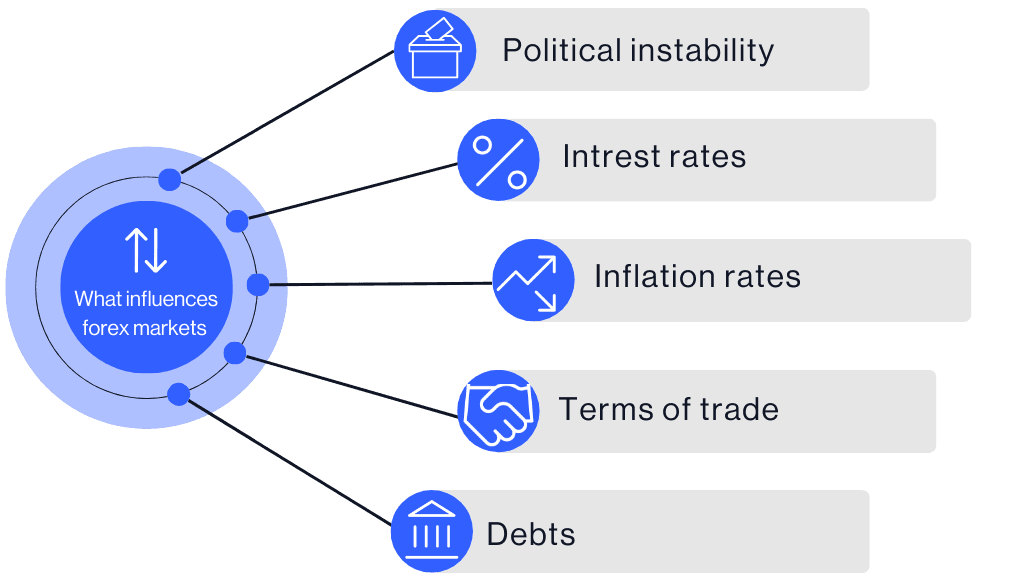

What influences the international alternate markets?

To commerce the foreign exchange market with little consciousness of the elements that affect the FX market can lead to substantial losses. Most of the macroeconomic forces at play can have large results on the valuation of a forex.

When foreign exchange markets, it is necessary to keep in mind that a stronger forex makes a rustic’s exports dearer for different international locations, whereas making imports cheaper. A weaker forex makes exports cheaper and imports dearer, so international alternate charges play a big half in figuring out the buying and selling relationship between two international locations.

Political instability and financial efficiency

Political instability and poor financial efficiency may affect the worth of a forex, reminiscent of when there are presidential elections and nationwide recessions. Politically secure international locations with sturdy financial efficiency will normally be extra interesting to international traders, so these international locations draw funding away from international locations characterised by extra financial or political threat.

Rates of interest

Rates of interest, inflation charges and international forex charges are all interconnected, and as some rise others can fall. Central banks management the rate of interest as a measure to manage inflation. If a central financial institution desires to lower inflation, it might improve rates of interest in a bid to cease spending and lending. This typically will increase the worth of cash in an financial system, as there’s much less, or ‘dearer’, cash accessible within the financial system.

However, when there’s extra money with much less worth in an financial system, companies and shoppers improve spending and lending by means of loans and different kinds of credit score. Sellers will then improve costs, inflicting inflation and a lower-valued forex. These fluctuations in forex worth are one of many causes foreign exchange merchants might look to commerce on rate of interest bulletins from central banks, just like the US Federal Reserve or the Financial institution of England. This may be finished by means of cross forex swaps, which might help to hedge forex threat on each rates of interest and alternate charges.

Inflation charges

Usually paired with rates of interest, inflation charges can have a significant affect on a nation’s international alternate charges. Rising inflation charges typically have a adverse impact on a forex’s worth. Conversely, low inflation charges normally trigger an appreciation within the worth of a forex. When inflation is excessive, the worth of products and providers will increase, which might trigger the forex to depreciate, as there’s much less spending.

Phrases of commerce

The phrases of commerce for a rustic characterize the ratio of export costs relative to import costs. If a rustic’s export costs rise and its import costs fall, the phrases of commerce have favourably improved. This will increase the nation’s income and is adopted by a rise in demand for the nation’s forex. This improve in demand could cause an increase within the forex’s worth.

Money owed

A nation’s debt could be a massive influencer within the variations of its forex value. Nations with massive money owed in relation to their gross home product (GDP) will likely be much less enticing to international traders. With out international investments, international locations can wrestle to construct their international capital, resulting in greater charges of inflation and thus, forex depreciation.

What are the advantages of foreign currency trading?

- The power to commerce on forex margin (utilizing leverage).

- Excessive ranges of liquidity imply that foreign exchange spreads keep tight and buying and selling prices keep low.

- Costs react rapidly to breaking information and financial bulletins (this could be a drawback too).

- Commerce 24 hours a day from Sunday to Friday.

- The power to go lengthy and brief.

- Wide selection of markets (unfold wager or commerce CFDs on greater than 330 foreign exchange pairs with CMC Markets).

- Market traits could be extra predictable.

What are the potential dangers of foreign currency trading?

- You may lose your whole capital – leveraged foreign currency trading signifies that each earnings and losses are based mostly on the total worth of the place.

- Danger of account shut out – market volatility and speedy adjustments in value could cause the steadiness of your account to alter rapidly, and should you do not need ample funds in your account to cowl these conditions, there’s a threat that your positions will likely be robotically closed by the platform.

- Forex pair correlations can improve the rates of interest exterior of main foreign exchange pairs.

- Market volatility and gapping – monetary markets might fluctuate quickly and gapping is a threat that arises because of market volatility, and one of many results of this will imply that stop-loss orders are executed at unfavourable costs.

- Danger of carry commerce.

- Central financial institution selections can affect rate of interest ranges.

Backside line

Foreign currency trading is a fast-paced, thrilling choice and a few merchants will focus solely on buying and selling this asset class. They might even select to specialize in only a few choose forex pairs, investing a whole lot of time in understanding the quite a few financial and political elements that transfer these currencies.