Why Bitcoin Miners Soared This Week

Bitcoin (BTC 0.51%) has been on fire this week, rising 12% over the previous seven days as of two p.m. ET on Friday. Buyers have been in “danger on” mode this week as commerce tensions between the U.S. and almost each nation on this planet appear to be easing, for now.

That helped firms downstream of Bitcoin’s value, like Bitcoin miners. TeraWulf (WULF -3.48%) is up 36% this week, Riot Platforms (RIOT -2.82%) jumped 26.1%, and MARA Holdings (MARA 1.43%) is up 17% for the week.

Bitcoin’s massive transfer

Cryptocurrencies have jumped this week as commerce tensions eased around the globe. The tensions did not technically have something to do with cryptocurrencies, however they actually affect the worth of tokens.

Bitcoin, specifically, has confirmed to be extremely correlated with development shares and magnifies the market’s transfer basically. So, when buyers purchased development shares earlier this week, it is no shock that Bitcoin was up sharply as properly.

What’s fascinating in regards to the transfer not too long ago is that Bitcoin hasn’t been a hedge to the market or a protected haven to buyers. Gold rose because the market fell, which is what many buyers would anticipate Bitcoin to do, nevertheless it did not, falling with the remainder of the market.

Why Bitcoin miners have been up a lot

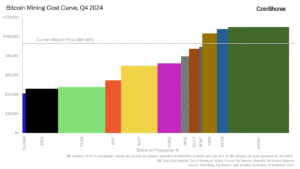

So, why have been Bitcoin miners up greater than Bitcoin itself? They are typically a leveraged guess on the worth of Bitcoin for 2 causes.

First, Bitcoin is their income, and when Bitcoin rises, all of them make more cash. The second affect is the Bitcoin they already maintain on the stability sheet. MARA Holdings had 46,000 Bitcoins at its last disclosure, Riot Platforms has 19,223 Bitcoins, and TeraWulf has $274.5 million in money and Bitcoin.

Greater Bitcoin values fairly actually enhance their stability sheets.

Leveraged development in Bitcoin mining

The opposite massive information merchandise for miners this week was Riot Platforms asserting a $100 million credit score facility with Coinbase (COIN 0.39%) backed by Bitcoin. Coinbase has begun making loans to shoppers with Bitcoin as backing, however that is the largest deal it is carried out with an organization.

If Riot and others can use Bitcoin as collateral for loans that may fund development, it might be one other catalyst for his or her companies. Bitcoin mining hasn’t been the best enterprise to finance traditionally so that is welcome information for the trade. Given the excessive worth of Bitcoin on their stability sheets, this might be an awesome funding supply long run.

Bitcoin is the important thing

In the end, the worth of Bitcoin goes to find out the fortune of those firms. It is their income and an enormous a part of their stability sheets.

Buyers additionally want to remember the leveraged nature of the mining enterprise. Values have gone up sharply as Bitcoin has risen, but when we undergo one other crypto winter we will see each stability sheets and operations deteriorate rapidly. If that form of danger is not what you are in search of, Bitcoin is a good various.

Travis Hoium has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Bitcoin. The Motley Idiot has a disclosure policy.

Source link