XTB sees record Revenues of $155M but flat Profit in Q1 2025

Following a considerably subdued Q4 2024, Poland based mostly Retail FX and CFDs dealer XTB (WSE:XTB) has reported its preliminary outcomes for Q1 2025, indicating file Revenues and new consumer acquisitions, though larger prices stored Web Revenue at roughly the identical degree as This autumn.

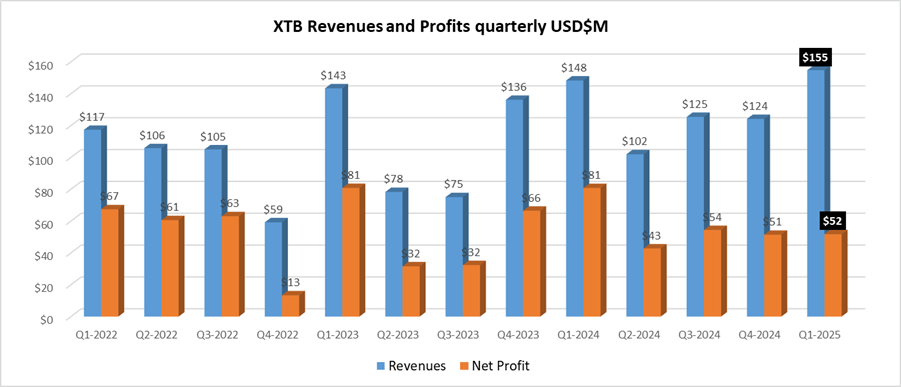

XTB Revenues and Earnings Q1 2025

Revenues at XTB for the primary quarter of 2025 got here in at PLN 580 million (USD $155 million) – a brand new all-time greatest for XTB – up by 25% from This autumn’s $124 million. Web Revenue nonetheless was up by lower than 1% QoQ, to PLN 194 million ($52 million) versus $51 million in Q3, properly off XTB’s most worthwhile quarter in Q1-2024, at $81 million.

XTB Buying and selling Volumes Q1 2025

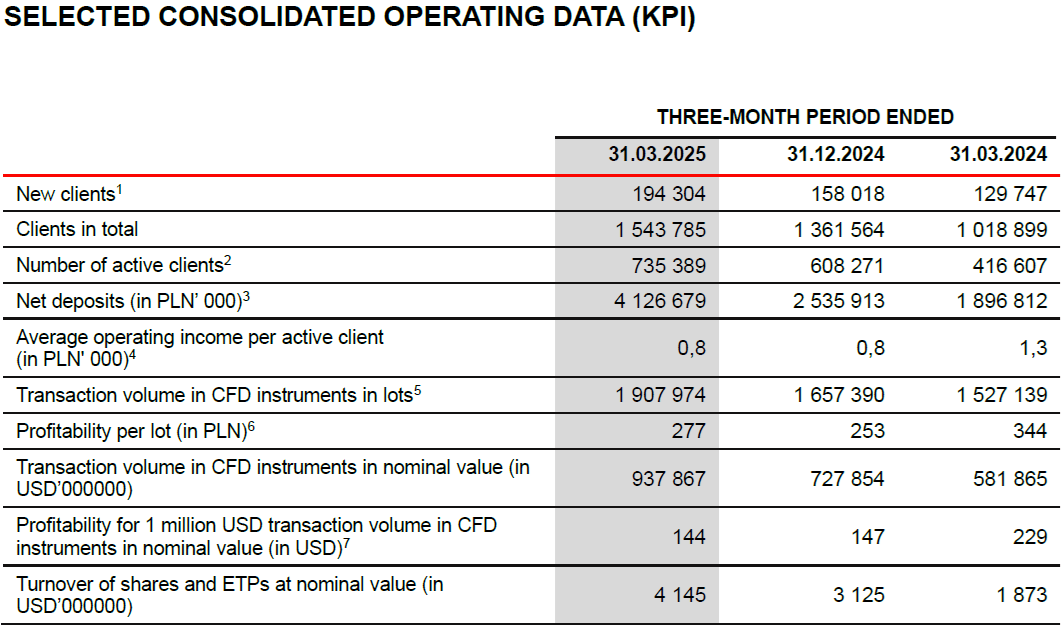

Buying and selling volumes at XTB averaged a file $313 billion month-to-month in Q1-2025, up 29% from $242 million monthly in This autumn-2024. The corporate’s profitability per 1 million USD transaction quantity in Q1 nonetheless fell to 144, from 147 in This autumn-2024.

XTB Shopper Acquisition Q1 2025

XTB stated that it has a strong basis within the type of a continuously rising base and variety of lively shoppers. In Q1 2025, the Group recorded one other file on this space, buying 194,304 new shoppers in comparison with 129,747 a yr earlier, a rise of 49.8%. Just like the variety of new shoppers, the variety of lively shoppers was additionally record-breaking, growing from 416,607 to 735,389, i.e. by 76.5% y/y.

XTB Asset Courses Traded Q1 2025

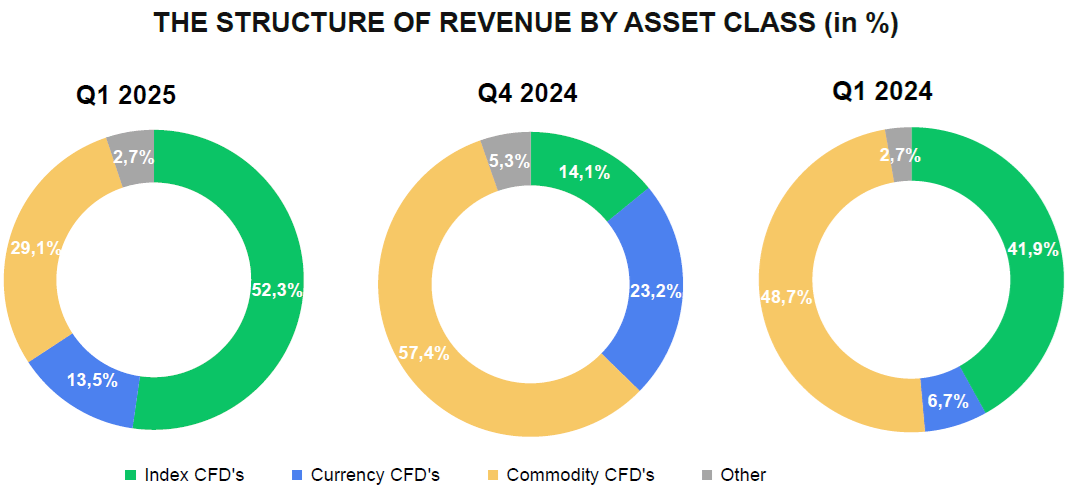

Contemplating the construction of the achieved revenues by way of instrument courses, it may be noticed that within the first quarter of 2025, CFDs (Contracts for Distinction) based mostly on indices had been the main contributor. Their share in whole revenues through the analyzed interval reached 52.3% (Q1 2024: 41.9%). This can be a results of, amongst different elements, the excessive profitability of CFDs based mostly on the German inventory index DAX (DE40), the US index US 100, and the US index US 500.

The second most worthwhile asset class was commodity-based CFDs. Their share in income construction reached 29.1%, in comparison with 48.7% the earlier yr. This was linked to the excessive profitability of buying and selling CFDs based mostly on the costs of pure fuel, gold, and occasional. Revenues from currency-based CFDs accounted for 13.5% of whole revenues, in comparison with 23.2% a yr earlier. Probably the most worthwhile monetary devices on this class had been CFDs based mostly on cryptocurrencies similar to Ripple, Bitcoin, and the EURUSD foreign money pair.

XTB Bills Q1 2025

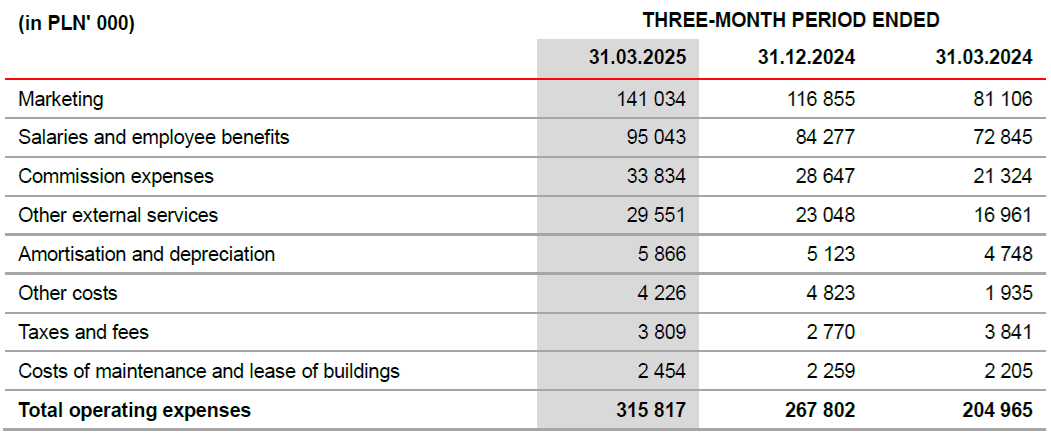

Working bills at XTB in Q1 2025 amounted to PLN 315.8 million and had been PLN 110.9 million larger than within the earlier yr (Q1 of 2024: PLN 205.0 million). Probably the most important modifications had been in:

- advertising and marketing prices, improve by PLN 59.9 million ensuing primarily from larger bills for on-line and offline advertising and marketing campaigns;

- salaries and worker advantages, a improve by PLN 22.2 million, primarily on account of a improve within the variety of staff;

- fee prices, a improve of PLN 12.5 million ensuing from larger quantities paid to cost service suppliers by which clients deposit their funds in transaction accounts;

- different exterior providers, a improve by PLN 12.6 million primarily on account of larger bills for (i) IT programs and licenses (improve by PLN 8.3 million y/y) and (ii) IT help providers (improve by PLN 1.9 million y/y).

On a q/q foundation, working prices had been larger by PLN 48.0 million, primarily pushed by a rise of PLN 24.2 million in on-line and offline advertising and marketing bills, adopted by a rise of PLN 10.8 million PLN in salaries and worker advantages, ensuing primarily from a improve in employment, and a rise by PLN 6.5 million in different exterior providers. Moreover, there was a PLN 5.2 million improve in fee prices ensuing from larger quantities paid to cost service suppliers by which shoppers deposit their funds into transactional accounts. These expenditures are regularly growing, and the actions to which the Firm allocates them are intently associated to the achievement of strategic objectives.

Because of the dynamic growth of XTB, the Administration Board estimates that in 2025 whole working prices could also be larger by as much as roughly 40% than what was noticed in 2024. The Administration Board’s precedence is to additional improve the client base and construct a worldwide model. On account of the applied actions, advertising and marketing expenditures could improve by roughly 80% in comparison with the earlier yr, whereas assuming that the common buyer acquisition price needs to be corresponding to what we noticed in 2023-2024.

Extra highlights from XTB’s Q1 2025 outcomes observe beneath.

Source link