An artificial market model for the forex market

Stylized information within the synthetic market mannequin

Earlier analysis has demonstrated that synthetic market fashions are validated by way of their means to duplicate stylized information. In quite a few research, brokers equivalent to fundamentalists and chartists have been recognized as key contributors to the emergence of those stylized information. Particularly, discussions regarding fundamentalists usually emphasize the importance of the elemental worth and its underlying data. Furthermore, throughout the context of market microstructure, which investigates the connection between worth and buying and selling quantity, the evaluation is predominantly knowledgeable by information, as exemplified by prevalent information-based fashions.

Conversely, the present research develops a man-made overseas alternate market mannequin that efficiently replicates 5 stylized information, using order stream as the only real enter and eschewing conventional reliance on brokers equivalent to fundamentalists and chartists or the presupposition of market-related data. This mannequin is framed throughout the context of market microstructure, drawing upon the foundational work of Evans and Lyons (1999), with a specific concentrate on market makers and order stream dynamics.

Particularly, the substitute market mannequin on this research makes use of actual order stream information as enter and aligns with the calendar results so as stream. We additional confirm this in Part “Verification of the mechanism for producing stylized information utilizing the substitute market mannequin”, however it’s believed that the stylized information relating to order stream function elements contributing to the incidence of different stylized information equivalent to fats tails and volatility clustering. Moreover, we verify that different stylized information, together with kurtosis/fats tails, absolutely the and squared autocorrelation of returns, the autocorrelation of returns, and scaling, are replicated within the charges generated by the substitute market. The outcomes are introduced in Desk 1 and Figs. 3 to 5.

Comparability with precise information

We calculate the correlation coefficient between the market charges generated by the substitute market mannequin and the precise information from the EBS platform, confirming that the final development of market charges is captured by the quite simple synthetic market mannequin. Moreover, we plot the scatterplot of order stream towards fee differentials and study the connection between order stream and market charges generated by the substitute market mannequin by way of regression evaluation.

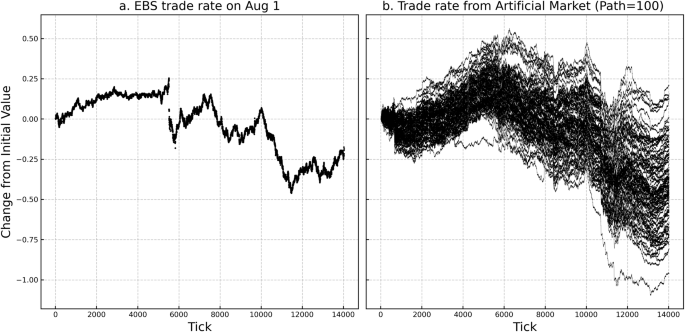

First, the correlation coefficients between the common market charges generated by the substitute market (path=100) and the corresponding precise information from the EBS platform have been 85.28% on August 1, 2014, 72.12% on August 4, 57.41% on August 5, 49.69% on August 6, 73.41% on August 7, and 51.63% on August 8. The correlation ranges from a minimal of 49.69% to a most of 85.28%, indicating its consistency. For reference, Fig. 6 exhibits the comparability between the precise buying and selling charges from the EBS platform and the generated information for August 1, 2014.

Be aware: The horizontal axis represents ticks, and the vertical axis represents the distinction from the preliminary worth of the speed. a Shows transaction worth actions noticed on the EBS platform, whereas (b) exhibits transaction costs simulated within the synthetic market.

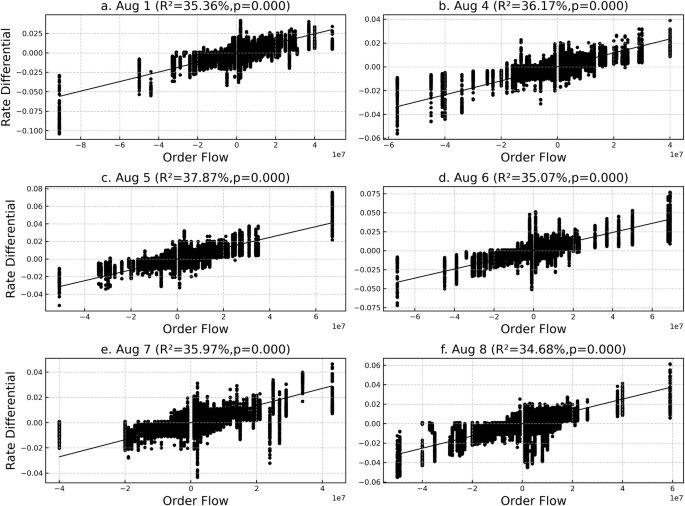

Subsequent, scatterplots are created to indicate the distinction between order stream and charges, and regression evaluation is performed. As proven in Fig. 7, a big optimistic correlation is noticed, with a coefficient of willpower (R-squared) of roughly 35%. This discovering is anticipated, because the construction of the substitute market is influenced by order stream, leading to a naturally optimistic correlation. Right here, it is very important spotlight the lack to attain a coefficient of willpower near 100%, regardless of order stream being the only real determinant of market costs, other than the conduct of uniformly generated buyer order stream and deterministic market makers. In different phrases, even when the coefficient of willpower for order stream within the precise information is roughly 30–40%, it doesn’t essentially indicate the presence of hidden elements. Basically, this end result means that whereas order stream might account for many of the worth willpower, the involvement of microstructures by way of market makers can result in a decrease coefficient of willpower than the precise impression of order stream.

Be aware: The horizontal axis represents the order stream (in million USD), and the vertical axis represents the variations in charges. The strains depict the regression strains calculated for every day, and the R2 worth is proven for every day. As well as, all p values are <0.01%. a–f Correspond to information from August 1, 4, 5, 6, 7, and eight, respectively.

Verification of the mechanism for producing stylized information utilizing the substitute market mannequin

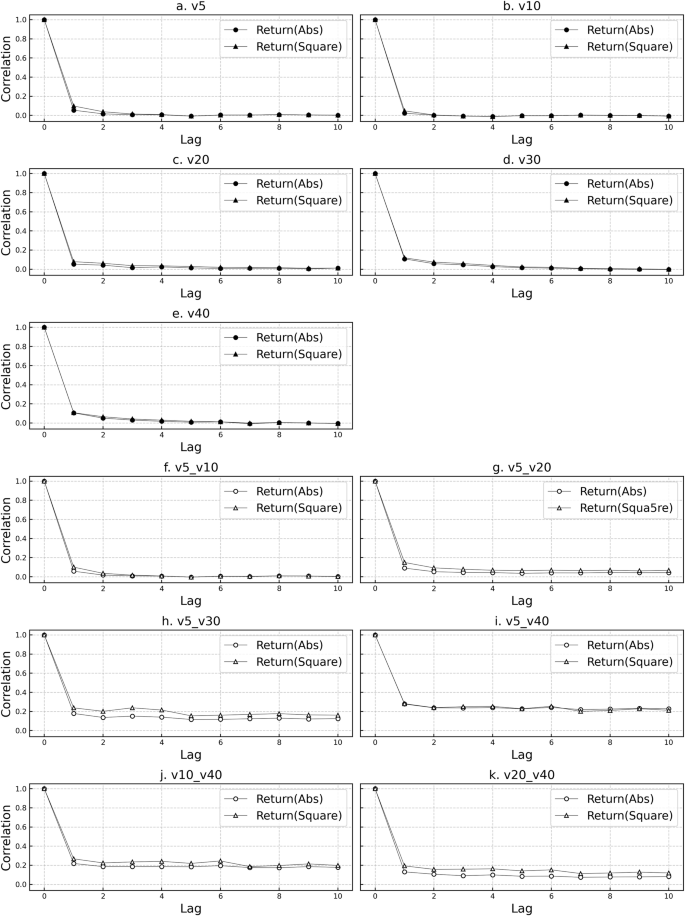

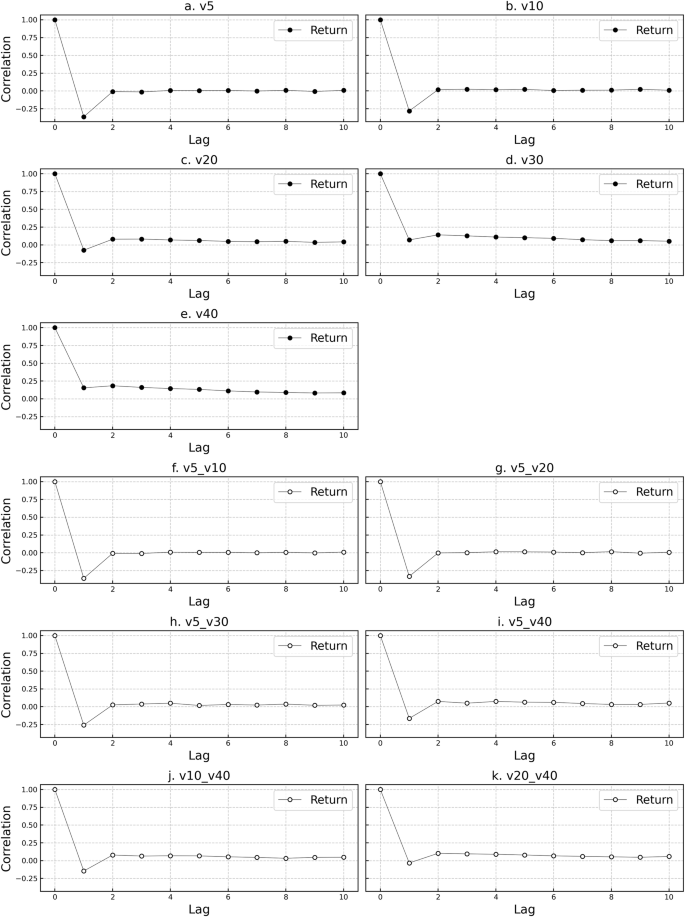

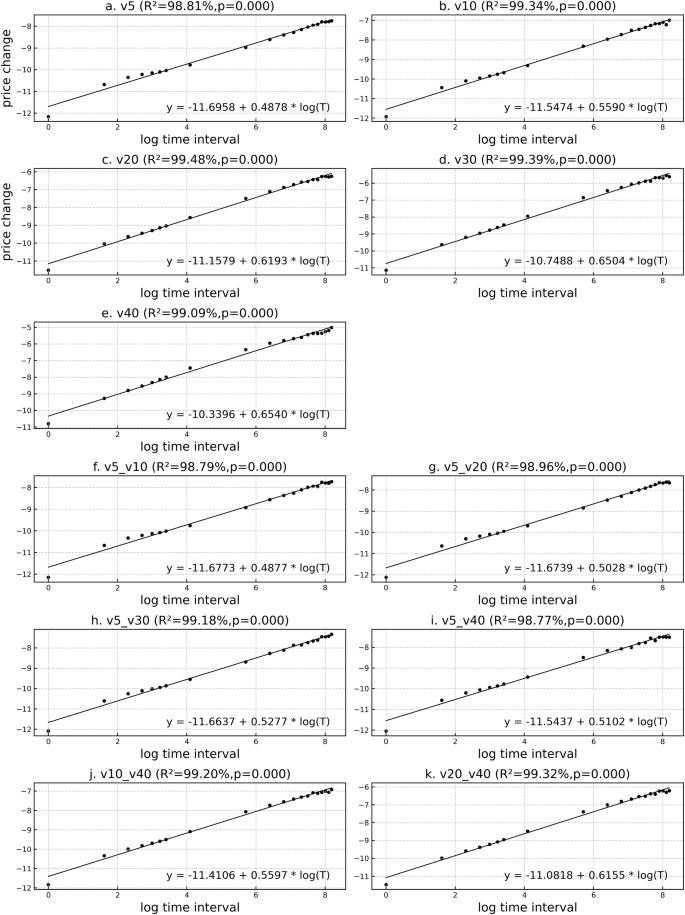

To confirm the mechanism by way of which stylized information may be generated, simulations are performed with out utilizing precise transaction information from the EBS platform. Interdealer order stream is generated utilizing uniform random numbers equivalent to buyer order stream. For this order stream, the time intervals between occurrences are generated with uniform random numbers primarily based on the minimal timestamp (100 milliseconds) utilizing the set common worth as a reference. The order stream is configured with a standard most quantity for purchasing and promoting, and uniform random numbers are generated primarily based on a minimal unit of 1 million {dollars}. The settings for order stream embrace setting the utmost worth to five million {dollars} (discrete values in increments of 1 million {dollars}, from -5 million {dollars} to five million {dollars}), 10 million {dollars}, 20 million {dollars}, 30 million {dollars}, and 40 million {dollars} (denoted as v5, v10, v20, v30, and v40, respectively). Moreover, to simulate the calendar impact of order stream, the utmost worth is ready to five million {dollars} for the bottom information after which adjusted to 10 million {dollars}, 20 million {dollars}, 30 million {dollars}, and 40 million {dollars} just for the one-hour interval from GMT 1:00 to 2:00 (denoted as v5_v10, v5_v20, v5_v30, and v5_v40, respectively). A simulation can also be performed by evaluating v5_v40 with the bottom order stream, the place the utmost worth of 5 million {dollars} is adjusted to 10 and 20 million {dollars}. These outcomes are introduced in Desk 2 and Figs. 8 to 10.

Be aware: Outcomes with most order stream values of 5, 10, 20, 30, and 40 million {dollars}, labeled as v5, v10, v20, v30, and v40, respectively, are proven in (a–e). Order stream for the 1-h time slot from GMT 1:00 to 2:00, initially set at 5 million {dollars}, is in comparison with situations with maximums of 10, 20, 30, and 40 million {dollars}, in addition to 40 million {dollars} in comparison with 10 and 20 million {dollars}, illustrated in (f–ok).

Be aware: Outcomes with most order stream values of 5, 10, 20, 30, and 40 million {dollars}, labeled as v5, v10, v20, v30, and v40, respectively, are proven in (a–e). Order stream for the 1 h time slot from GMT 1:00 to 2:00, initially set at 5 million {dollars}, is in comparison with situations with maximums of 10, 20, 30, and 40 million {dollars}, in addition to 40 million {dollars} in comparison with 10 and 20 million {dollars}, illustrated in (f–ok).

Be aware: Outcomes with most order stream values of 5, 10, 20, 30, and 40 million {dollars}, labeled as v5, v10, v20, v30, and v40, respectively, are proven in (a–e). Order stream for the 1-h time slot from GMT 1:00 to 2:00, initially set at 5 million {dollars}, is in comparison with situations with maximums of 10, 20, 30, and 40 million {dollars}, in addition to 40 million {dollars} in comparison with 10 and 20 million {dollars}, illustrated in (f–ok). The horizontal axis represents the logarithmic values of time intervals in seconds, and the vertical axis represents the logarithm of the variations in logarithmic costs.

By evaluating these simulation outcomes, it may be inferred that mechanisms equivalent to fats tails or volatility clustering happen when there’s a sure distinction in quantity between intervals of concentrated and nonconcentrated order stream. Moreover, relating to the autocorrelation of returns, a development by which the unfavourable autocorrelation occurring at lag 1 decreases in absolute worth with rising quantity is noticed. Moreover, it’s evident that the connection between this autocorrelation and scaling doesn’t come up from the focus of order stream at particular occasions however fairly from the general stage of quantity, which creates a common development of randomness.