Bitcoin hesitates at $95K while Altcoins gain momentum

BTC stalls at key resistance with bearish indicators mounting

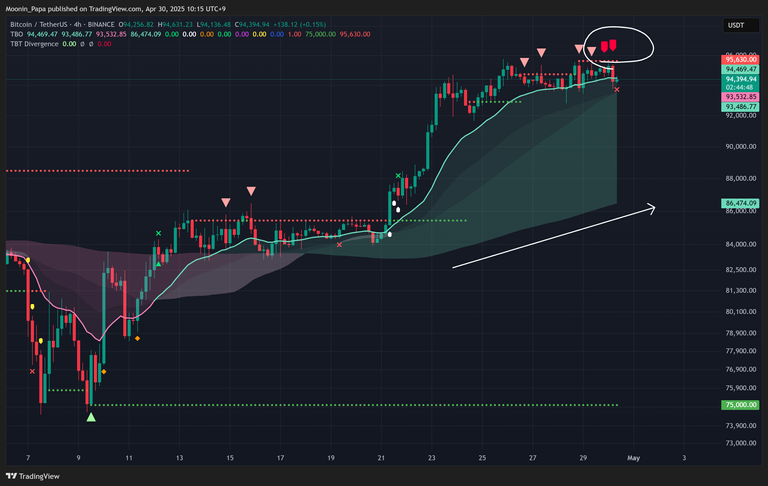

Bitcoin continues to battle slightly below the $95,000 resistance degree, with yesterday’s candle displaying a decrease low underneath $92K regardless of closing inexperienced. Each day RSI stays overbought above 70, however is trending decrease with decrease highs and lows. Quantity has not exceeded its 30-day shifting common since April 25, elevating issues about momentum.

TBT Bearish Divergence Clusters have appeared once more on the 4-hour chart, the primary since BTC’s prime at $109K in January. Whereas no TBO Shut Lengthy has printed but, the frequency and clustering of those alerts are onerous to disregard. The bullish counterpoint is that BTC stays above the every day TBO Cloud for eight straight days, and the macro weekly chart nonetheless seems strong. Nevertheless, the dearth of progress and declining power makes a pullback to $82K the most probably situation except BTC can decisively shut above $95K.

Altcoin alerts diverge as OTHERS.D and TOTAL3 print bullish confirmations

Stablecoin dominance stays weak and rangebound inside the TBO Cloud, whereas Bitcoin Dominance continues robust regardless of waning RSI. Prime 10 Dominance stays bearish, and OTHERS.D is beginning to pull again, risking a break of ascending RSI help. Nevertheless, historic precedent from November 2024 suggests some chop could happen earlier than any main push increased.

TOTAL3 confirmed a TBO Open Lengthy yesterday—its first since September—signaling the top of bearish management and the beginning of a brand new uptrend. OTHERS market cap can be within the means of printing a TBO Open Lengthy, supporting a broader altcoin restoration. These alerts, although early, are encouraging and paying homage to pre-pump setups seen in late 2024.

Market construction resembles pre-November 2024 rally

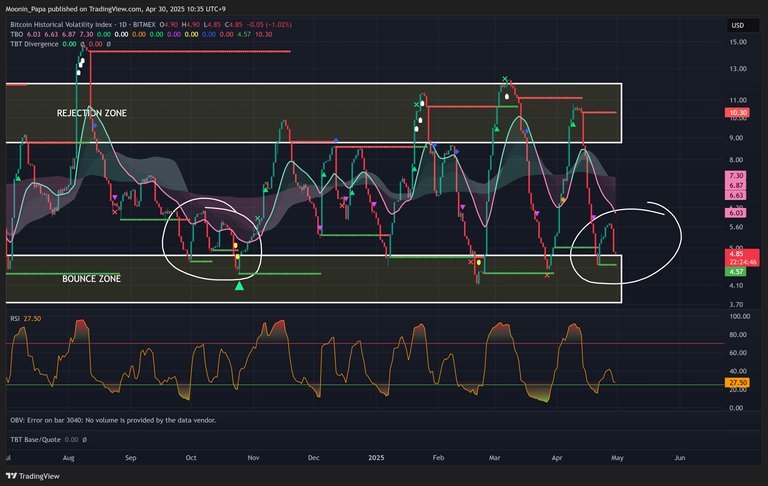

BVOL7D, which measures BTC volatility, is oddly falling again into the Bounce Zone, mirroring its habits earlier than the final huge market rally in October 2024. A number of correlations to previous market situations—particularly from September to November 2024—are rising once more, reinforcing the thought of an identical bullish breakout sample on the horizon.

Altcoins present growing power with TBO alerts lighting up

Ethereum has stalled regardless of its TBO Shut Brief final week, whereas XRP and SOL are flashing 4h TBO Shut Longs—reminders to safe revenue and look ahead to development shifts. Many altcoins at the moment are printing Open Longs on the every day timeframe, together with VET, POL, TIA, and MNT. Charts like KCS and BERA are displaying breakout clusters or early bullish divergence alerts.

Most notably, the TBT Forecaster flipped from Bearish to Bullish for ALTs 5 days in the past—its first bullish flip since January. This shift provides one other affirmation that altcoin restoration is underway, even when BTC pulls again within the brief time period.

Conclusion

BTC is at a essential tipping level. With out a shut above $95K quickly, a rejection and retracement to $82K turns into more and more probably. Nevertheless, macro bullish construction stays intact. In the meantime, altcoins are gaining power with a rising variety of TBO Open Longs and bullish affirmation alerts. Merchants ought to keep nimble—defend earnings however keep open to additional upside, particularly as historic patterns counsel {that a} bigger transfer could quickly unfold.

Get deeper market insights and schooling at The Complete Cryptocurrency Investor by Mastering Assets.

Disclaimer: The views expressed on this article are these of the creator and will not replicate these of Kitco Metals Inc. The creator has made each effort to make sure accuracy of data offered; nonetheless, neither Kitco Metals Inc. nor the creator can assure such accuracy. This text is strictly for informational functions solely. It’s not a solicitation to make any trade in commodities, securities or different monetary devices. Kitco Metals Inc. and the creator of this text don’t settle for culpability for losses and/ or damages arising from using this publication.