Bitcoin Jumps 5%, and Crypto Mining Stocks Soared Today

The worth of Bitcoin (BTC -0.82%) recovered on Tuesday as traders swung again to a risk-on commerce. Markets have feared rising commerce tensions between the U.S. and China, and that pushed shares decrease on Monday. Buyers searching for a “secure” different have pushed gold and Bitcoin greater, with the most important cryptocurrency leaping 5.2% within the final 24 hours as of two:10 p.m. ET at present.

Crypto miners adopted the transfer with TeraWulf (WULF -3.48%) leaping as a lot as 20.9%, Riot Platforms (RIOT -2.82%) rising 14.3%, and MARA Holdings (MARA 1.43%) climbing 12.2%. The shares are presently up 17.6%, 12.1%, and 11.1% respectively.

Bitcoin’s bounce and its function in world finance

The unusual factor concerning the strikes out there lately is how irregular they’re. Normally, when shares drop, it is as a result of traders are fleeing to the security of Treasuries, however Treasuries have fallen as effectively.

One potential place to retailer worth is in gold and Bitcoin, which is arguably the perfect use case for the crypto at present. That is helped push it 8.3% greater since noon on Sunday.

Why Bitcoin miners are surging

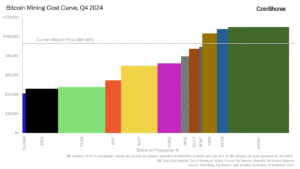

Corporations that mine Bitcoin have two methods to learn from the rising value of the cryptocurrency. First, their income and return on funding are within the type of the token. So, if the value rises, their income goes up they usually grow to be extra worthwhile.

Most corporations have additionally begun storing Bitcoin on their steadiness sheets. MARA Holdings stated it now holds over 46,000 bitcoins, and Riot now has 19,223. TeraWulf has much less held on the steadiness sheet and solely disclosed $274.5 million in money, equivalents, and Bitcoin on the finish of the fourth quarter of 2024.

The leveraged nature of Bitcoin miners will be good or unhealthy for traders. If it rises, miners will generate a fantastic return, but when it drops, it might result in vital losses.

The place does crypto go from right here?

Whereas markets are anxious about what occurs with the economic system and the place they’ve discovered security, the U.S. Securities and Trade Fee has had a change of management with Paul Atkins being sworn in at present. Atkins is seen as being crypto-friendly, a distinction to Gary Gensler, who did not set clear guidelines and did not have many followers within the crypto business.

However the brand new SEC chair might have extra of an impression outdoors of Bitcoin, the place there’s extra utility and disruption. I do not assume the crypto’s fortunes will likely be modified by the SEC. At greatest, it is going to be an alternative to gold, not a extra environment friendly type of cash.

What traders want to understand is that it hasn’t been an excellent hedge towards the greenback, inflation charges, or the market. In reality, Bitcoin fell when the market fell in 2022, simply as inflation was rising. It trades extra like a conventional dangerous asset slightly than gold, which is seen as extra of a hedge.

With that in thoughts, I believe this pop in Bitcoin and its miners could also be overdone if the economic system is headed south in 2025. The crypto is not prone to be spared if the market sell-off continues.

Travis Hoium has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Bitcoin. The Motley Idiot has a disclosure policy.