Bitcoin’s Next Price Rally Could Turn $61 Billion BTC Profitable

Bitcoin, the main cryptocurrency, has not too long ago proven indicators of restoration after a interval of consolidation. Over the previous few weeks, BTC’s value motion has begun to push greater, suggesting the potential of a rally that would propel the cryptocurrency towards the much-anticipated $100,000 mark.

This motion has sparked renewed optimism amongst traders, as a major value surge may carry appreciable earnings to these holding Bitcoin.

Bitcoin Buyers Are Keen For Income

The MVRV (Market Worth to Realized Worth) ratio has not too long ago bounced off the imply line of 1.74, which is traditionally a robust level of confidence for Bitcoin. When this ratio rebounds from the 1.74 degree, it usually alerts the early phases of a bull market. This market construction carefully mirrors the one seen throughout the earlier consolidation part in 2024, which culminated in a peak throughout the yen-carry-trade unwind in August.

Following this, Bitcoin experienced a pointy value leap in September 2024, validating the bullish sign supplied by the MVRV ratio. As Bitcoin’s value approaches this key degree as soon as once more, there may be potential for comparable value motion.

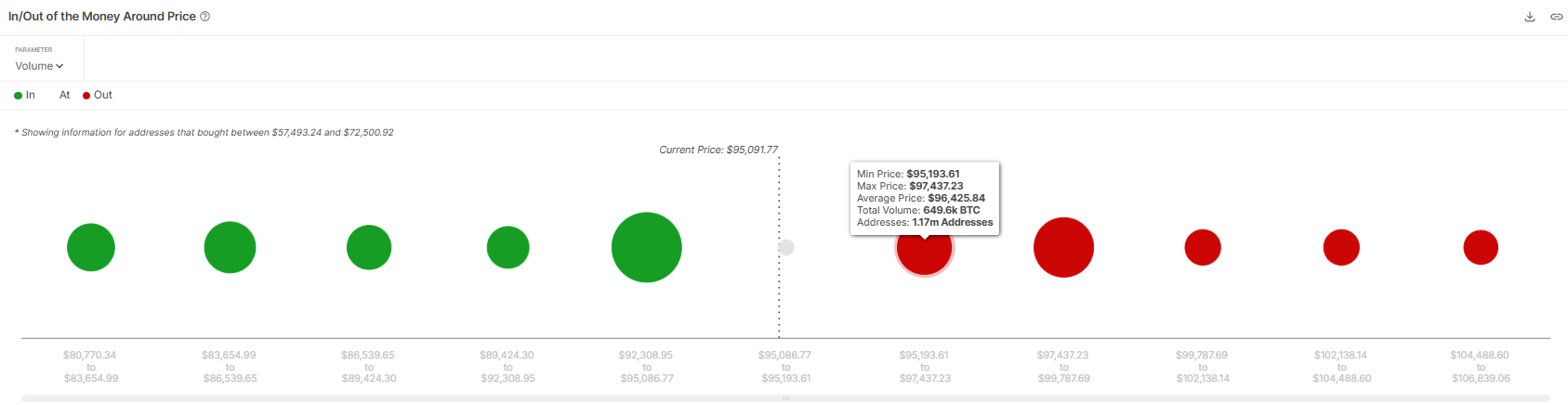

Bitcoin’s overall macro momentum can also be supported by robust demand from traders. In accordance with the IOMAP (In/Out of the Cash Round Value) knowledge, roughly 649,600 BTC, valued at over $61.6 billion, have been bought between $95,193 and $97,437. This huge accumulation by traders establishes a strong help degree for Bitcoin, ought to BTC holders chorus from promoting instantly to interrupt even. BTC may rise additional if greed drives these traders to carry as an alternative of promoting instantly.

Mixed with the early indicators of a bull market with demand for features, Bitcoin may attain the $98,000 resistance, validating the profitability of the $61.6 billion price of BTC purchased at these ranges and securing the vary as help. The rising variety of consumers on this vary creates a robust basis for Bitcoin’s value to surge additional.

BTC Value Goals At Breakout

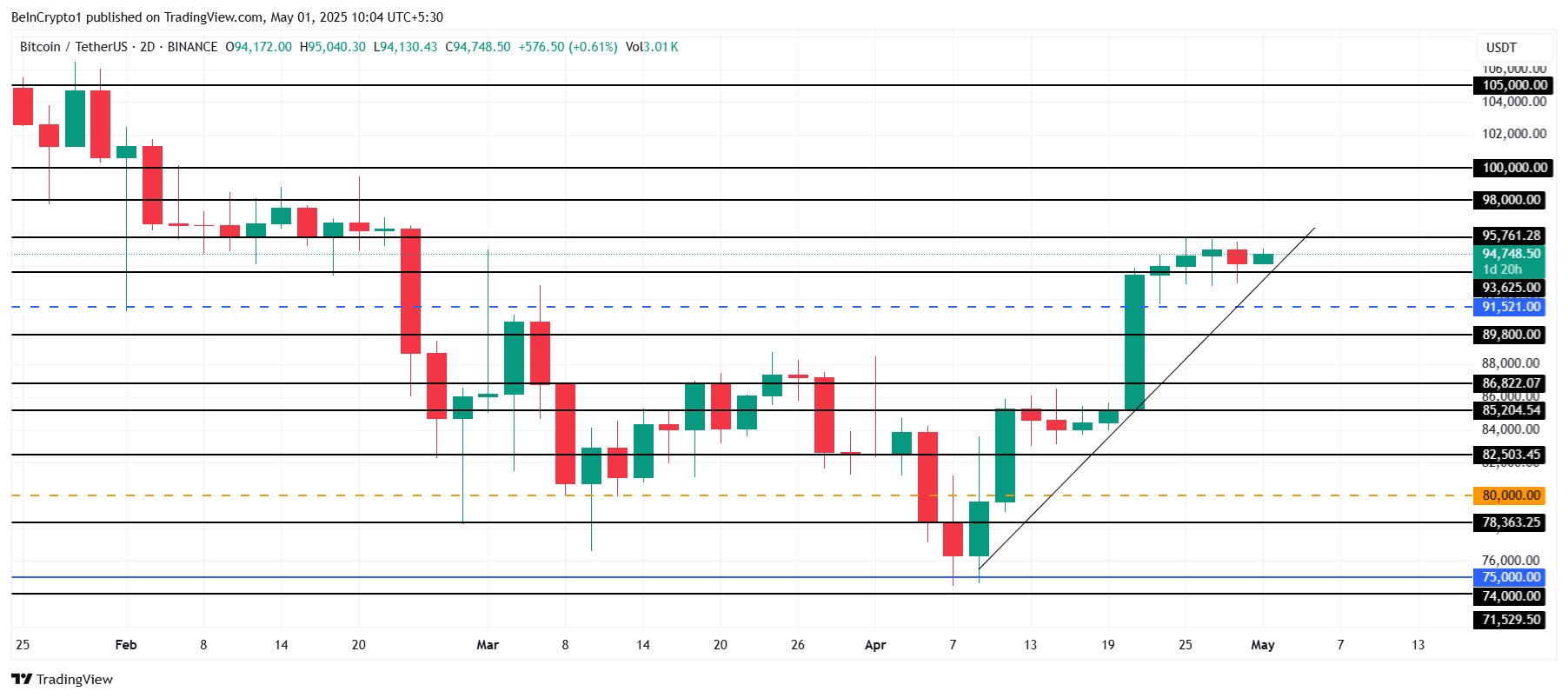

Bitcoin’s price has proven a short-term uptrend over the previous three weeks, at the moment buying and selling at $94,748. Though Bitcoin has been consolidating beneath the $95,761 degree for the previous week, it’s poised for a attainable surge. The optimistic momentum signifies that Bitcoin could break via the present resistance and proceed its upward trajectory.

If Bitcoin manages to safe $95,761 as help, it may start its climb towards $98,000. Breaking this resistance would open the trail for Bitcoin to focus on the following key degree of $100,000, which stays a significant psychological barrier for traders. With robust help ranges and optimistic market sentiment, Bitcoin may attain these milestones earlier than anticipated.

Nevertheless, if Bitcoin fails to breach $95,761 and falls via the help at $93,625, it may face a decline to $91,521. This drop would invalidate the short-term bullish outlook, signaling potential market weak point. A reversal at these ranges would require shut monitoring of market circumstances to find out the following potential value actions.

Disclaimer

Consistent with the Trust Project tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.