Bitcoin to $120K? Standard Chartered Predicts

Welcome to the US Morning Crypto Information Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso to see knowledgeable opinions on what the longer term holds for Bitcoin (BTC) amid renewed institutional curiosity. In the meantime, its market peer, gold, is now not the one go-to funding in instances of uncertainty.

Bitcoin to $120,000: Commonplace Chartered Predicts Subsequent BTC Rally

As indicated in a current US Crypto News publication, Bitcoin worth stays on target to the goal goal of the falling wedge sample.

After overcoming the resistance at $94,000, BTC is confronting quick resistance at $95,765. A decisive candlestick shut above this roadblock may clear the trail for additional upside, with Bitcoin worth probably finishing the forecasted 20% climb to $102,239.

This optimism comes as Bitcoin emerges as a possible beneficiary amid international commerce tensions. US tariffs are sparking capital flight and market volatility.

Towards this backdrop, analysts are already predicting a major revaluation of Bitcoin. They cite rising liquidity and international circumstances, parts that counsel a shift away from dollar-dependent property.

BeInCrypto contacted Commonplace Chartered for perception into the present Bitcoin market outlook. Curiously, the financial institution forecasted a breakout Bitcoin rally mirroring its post-US election surge, with a Q2 worth goal of $120,000 now in sight.

In response to Commonplace Chartered Head of Digital Asset Analysis Geoff Kendrick, Bitcoin’s worth is primed for a rally much like its dramatic rise following the US presidential election in November 2024.

The pioneer crypto hit a report excessive of $103,713 the next month.

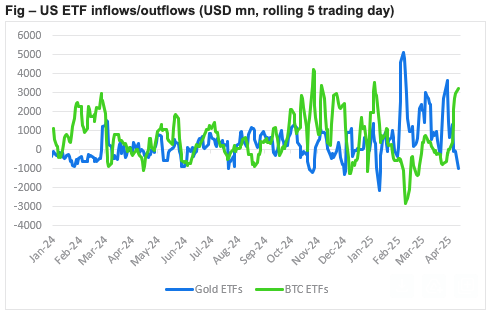

Kendrick pointed to accelerating US spot Bitcoin ETF (exchange-traded funds) inflows, significantly when contrasted with declining gold ETP (exchange-traded product) inflows.

“The final time the hole between Bitcoin and gold ETF flows was this broad was through the week of the US election,” Kendrick informed BeInCrypto.

In response to Kendrick, Bitcoin is catching as much as gold, with the king of crypto already serving as a greater hedge amid strategic asset reallocations away from the US.

This aligns with one other current US Crypto News publication that highlighted Bitcoin as a hedge towards traditional finance (TradFi) and US Treasury threat.

With this, the Commonplace Chartered govt maintains a bullish Q2 goal for the most important digital asset by market capitalization.

“I search for a contemporary all-time excessive of $120,000 in Q2, then on to my $200,000 end-year forecast,” Kendrick added.

Certainly, Commonplace Chartered just lately predicted that Bitcoin would hit a brand new all-time excessive, forecasting $200,000 by 2025 and $500,000 by 2028.

Chart of the Day

This chart compares funding flows into two monetary devices, Bitcoin ETFs and Gold ETPs. It reveals greater investor curiosity and volatility within the former in comparison with the latter.

Byte-Sized Alpha

- Over 85% of Bitcoin’s circulating supply is currently in profit, signaling sturdy investor confidence and bullish developments.

- Billionaire Ray Dalio warns the global monetary order is nearing collapse, pushed by tariffs and deglobalization developments.

- Tether’s Q1 2025 report reveals its tokenized gold product, XAUT, is backed by over 7.7 tons of physical gold. With rising international financial uncertainty, XAUT’s market cap surged to $853.7 million, making it the most important tokenized gold product.

- Bitcoin ETFs enjoyed seven consecutive days of positive inflows, with over $500 million in new capital added. Regardless of sturdy ETF demand, Bitcoin’s futures market reveals warning, with a rising choice for bearish choices.

- BNB Chain optimizes for speed, slicing block instances to 1.5 seconds for BSC and 0.5 seconds for OpBNB. In the meantime, Ethereum’s Fusaka faces a developer rift.

- Consultants warning that stablecoin transaction volumes may be inflated by bots, wash trades, and flash loans that distort precise utilization.

- Digital Protocol’s native token, VIRTUAL, has surged 161% in a week, reaching a two-month excessive as AI agent exercise rises.

Crypto Equities Pre-Market Overview

| Firm | On the Shut of April 28 | Pre-Market Overview |

| Technique (MSTR) | $369.25 | $370.47 (+0.33%) |

| Coinbase World (COIN) | $205.27 | $206.79 (+0.74%) |

| Galaxy Digital Holdings (GLXY.TO) | $21.21 | $21.81 (+2.81%) |

| MARA Holdings (MARA) | $14.01 | $14.04 (+0.21%) |

| Riot Platforms (RIOT) | $7.63 | $7.66 (+0.39%) |

| Core Scientific (CORZ) | $8.24 | $8.34 (+1.21%) |

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.

Source link