Bitcoin’s Supply in Profit Approaching Euphoria Zone

Bitcoin’s provide in revenue has continued to rise steadily regardless of latest setbacks and chronic market headwinds.

On-chain information exhibits that over 85% of BTC’s circulating provide is at present in revenue. It is a traditionally bullish sign however typically marks the start of euphoric phases in market cycles.

BTC Enters Bullish Territory, however Analysts Warn of Doable Pullback

BTC’s provide in revenue measures the share of coin holders who acquired their belongings at costs decrease than the present market worth. When this quantity rises, it signifies broad investor confidence and powerful capital inflows into the asset.

In a brand new report, pseudonymous CryptoQuant analyst Darkfost discovered that greater than 85% of BTC’s circulating provide is at present held in revenue. Though this pattern represents a bullish sign, it comes with a catch.

“Having a big portion of the availability in revenue just isn’t a nasty factor, fairly the alternative. After all, there are specific ranges which can be extra “snug” than others, however typically, a rise within the provide in revenue tends to gas bullish phases,” Darkfost wrote.

Based on the analyst’s word, the market is now getting into the euphoric zone, a section that emerges when the revenue provide approaches or exceeds 90%. These ranges, whereas bullish, have typically coincided with native market tops as merchants start to lock in earnings, triggering short- to medium-term corrections.

“Traditionally, when the availability in revenue surpassed the 90% threshold, it constantly triggered euphoric phases, and we at the moment are approaching that stage. Nonetheless, these euphoric phases will be short-lived and are sometimes followed by short- to medium-term corrections.”

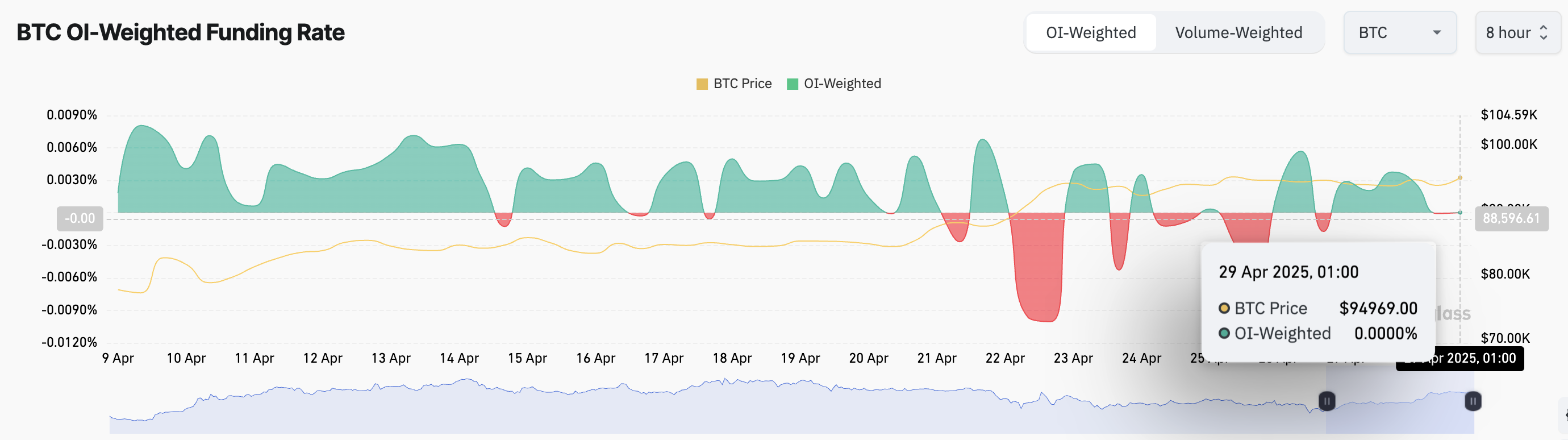

Funding Fee Indicators Market in Wait-and-See Mode

Curiously, BTC’s funding price stays comparatively balanced, indicating that the market is in a state of anticipation. At press time, the coin’s funding price is 0%.

The funding price is a periodic fee between merchants in perpetual futures markets, used to maintain contract costs aligned with the spot market. As with BTC, when an asset’s funding price is 0%, it signifies a impartial market sentiment, the place neither lengthy nor quick positions dominate.

This alerts that BTC buyers are ready for a catalyst to offer clearer route. This impartial market sentiment and rising profit provide set the stage for potential worth volatility within the close to time period.

Bitcoin Holds Agency Beneath Resistance

At press time, the king coin trades at $95,125, resting beneath a significant resistance stage of $95,971. Regardless of latest market volatility, BTC demand amongst spot market contributors stays vital, as mirrored by its Relative Power Index (RSI), which at present stands at 68.21.

The RSI indicator measures an asset’s overbought and oversold market circumstances. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a worth decline. Converesly, values underneath 30 point out that the asset is oversold and should witness a rebound.

BTC’s RSI studying signifies room for additional worth progress earlier than the coin turns into overbought. If demand strengthens, the coin could break above the $95,971 resistance and rally to $98,983.

Nonetheless, if bearish sentiment grows, BTC may resume its downtrend and fall to $91,851.

Disclaimer

Consistent with the Trust Project tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.