Bitcoin Jumps 5%, and Crypto Mining Stocks Soared Today

The worth of Bitcoin (CRYPTO: BTC) recovered on Tuesday as traders swung again to a risk-on commerce. Markets have feared rising commerce tensions between the U.S. and China, and that pushed shares decrease on Monday. Traders in search of a “protected” different have pushed gold and Bitcoin larger, with the largest cryptocurrency leaping 5.2% within the final 24 hours as of two:10 p.m. ET right this moment.

Crypto miners adopted the transfer with TeraWulf (NASDAQ: WULF) leaping as a lot as 20.9%, Riot Platforms (NASDAQ: RIOT) rising 14.3%, and MARA Holdings (NASDAQ: MARA) climbing 12.2%. The shares are at present up 17.6%, 12.1%, and 11.1% respectively.

The place to speculate $1,000 proper now? Our analyst crew simply revealed what they consider are the 10 finest shares to purchase proper now. Continue »

The unusual factor in regards to the strikes available in the market just lately is how irregular they’re. Normally, when shares drop, it is as a result of traders are fleeing to the security of Treasuries, however Treasuries have fallen as properly.

One potential place to retailer worth is in gold and Bitcoin, which is arguably the very best use case for the crypto right this moment. That is helped push it 8.3% larger since noon on Sunday.

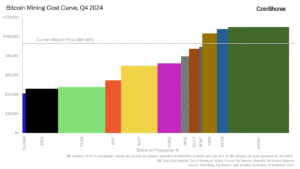

Corporations that mine Bitcoin have two methods to profit from the rising value of the cryptocurrency. First, their income and return on funding are within the type of the token. So, if the worth rises, their income goes up they usually change into extra worthwhile.

Most firms have additionally begun storing Bitcoin on their steadiness sheets. MARA Holdings stated it now holds over 46,000 bitcoins, and Riot now has 19,223. TeraWulf has much less held on the steadiness sheet and solely disclosed $274.5 million in money, equivalents, and Bitcoin on the finish of the fourth quarter of 2024.

The leveraged nature of Bitcoin miners will be good or dangerous for traders. If it rises, miners will generate an ideal return, but when it drops, it may result in vital losses.

Whereas markets are apprehensive about what occurs with the financial system and the place they’ve discovered security, the U.S. Securities and Alternate Fee has had a change of management with Paul Atkins being sworn in right this moment. Atkins is seen as being crypto-friendly, a distinction to Gary Gensler, who did not set clear guidelines and did not have many followers within the crypto trade.

However the brand new SEC chair could have extra of an affect exterior of Bitcoin, the place there’s extra utility and disruption. I do not suppose the crypto’s fortunes might be modified by the SEC. At finest, will probably be an alternative choice to gold, not a extra environment friendly type of cash.