Bitcoin Holders Set Stage for $100,000 as Exchange Inflows Drops

Main cryptocurrency Bitcoin (BTC) broke above the $95,000 psychological barrier on Thursday, pushed by renewed confidence amongst long-term holders.

With key on-chain metrics pointing to a slowdown in exchange-bound inflows, the coin might quickly reclaim the $100,000 worth mark.

BTC Poised for Additional Beneficial properties Amid Low Promote-Offs and Rising Demand

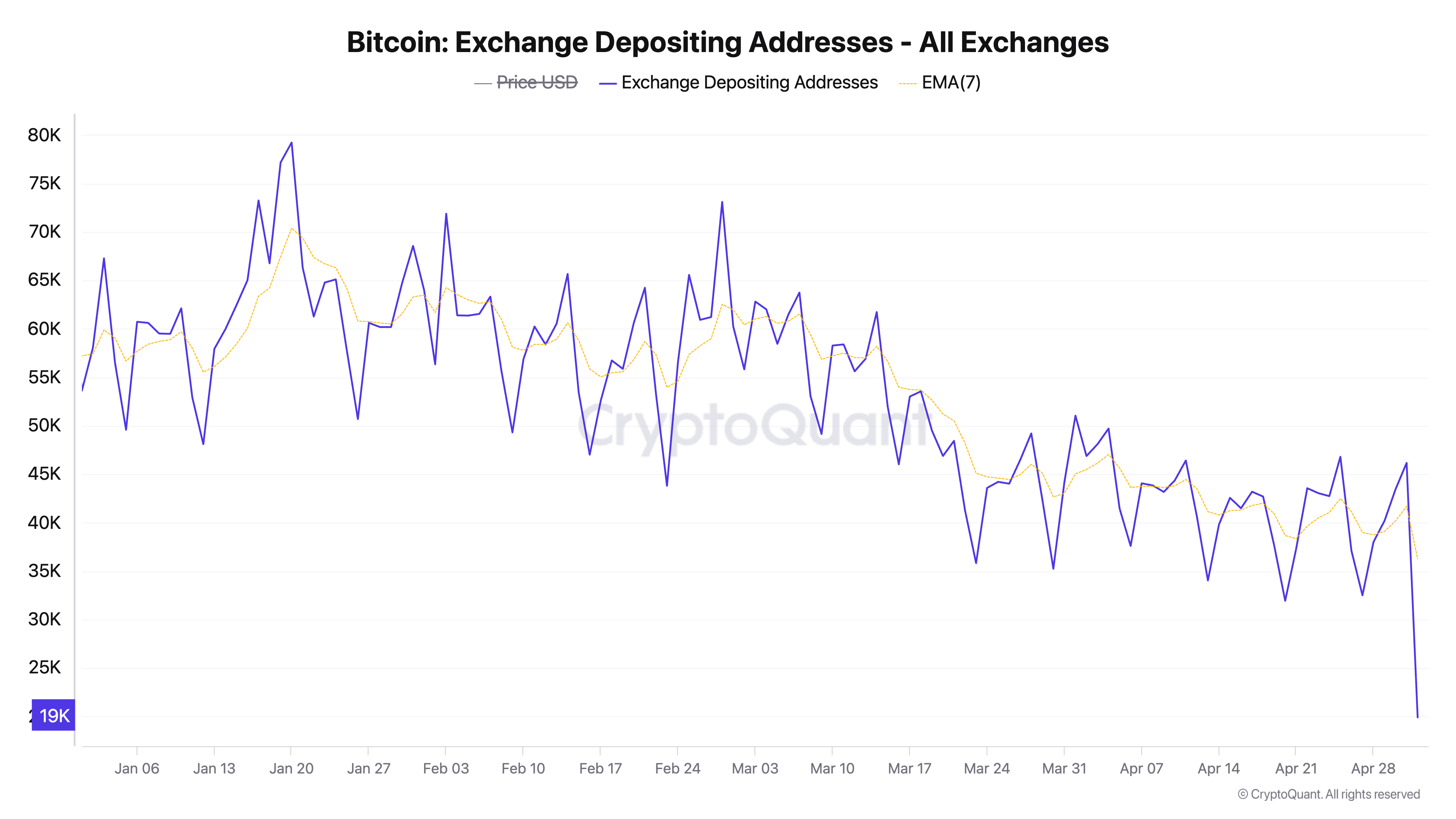

In response to on-chain knowledge from CryptoQuant, the variety of unique wallet addresses sending BTC to exchanges has dropped to its lowest stage since 2017. This presently sits at 19,282 addresses, falling by over 60% over the previous month.

This metric, generally interpreted as a measure of sell-side stress, means that fewer buyers need to offload their holdings, reinforcing the present bullish sentiment within the BTC market.

Traditionally, low change inflows like this have aligned with intervals of sturdy worth efficiency. Lowered promoting exercise tightens the coin’s provide on buying and selling platforms, driving up BTC’s worth.

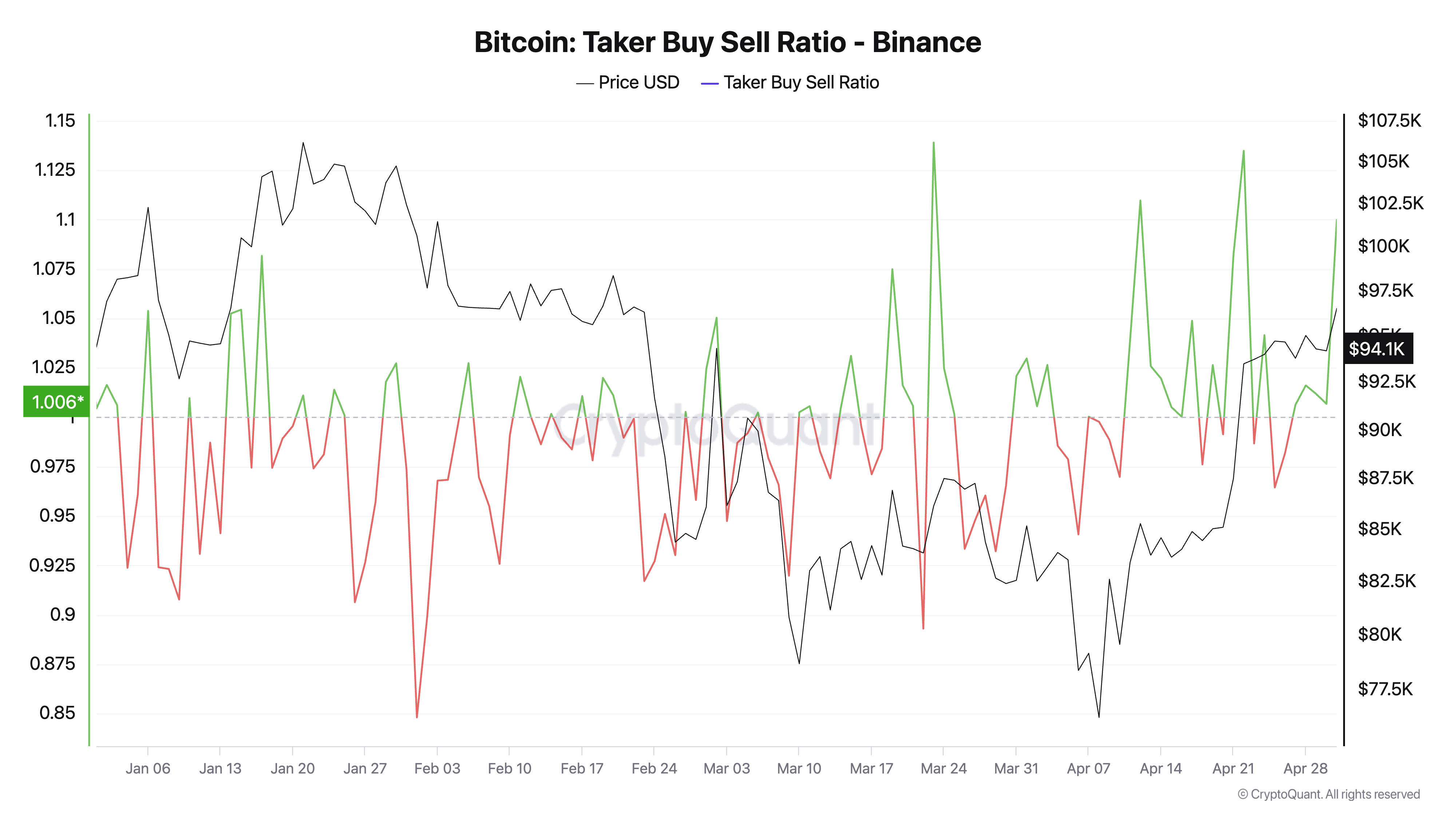

Furthermore, the spike in BTC’s Taker Purchase Promote Ratio on main cryptocurrency change Binance provides to this bullish narrative. In a brand new report, CryptoQuant analyst Amr Taha famous, “the newest knowledge level reveals a pointy improve to 1.142, the very best stage on this vary.”

This metric measures the ratio of buy orders executed towards promote orders within the futures market. A taker buy-sell ratio beneath one signifies that extra promote orders are being executed, suggesting a shift in market sentiment from bullish to bearish.

When this ratio is above one, there are extra purchase orders than promote orders. This means that extra market members are aggressively buying BTC fairly than promoting it, suggesting a demand-driven market.

The rising ratio on Binance is especially important, because it indicators rising demand for the coin on the most important cryptocurrency change by buying and selling quantity. If this pattern holds, BTC’s worth might proceed to climb.

Bitcoin Eyes $100,000 as Bull Energy Beneficial properties Momentum

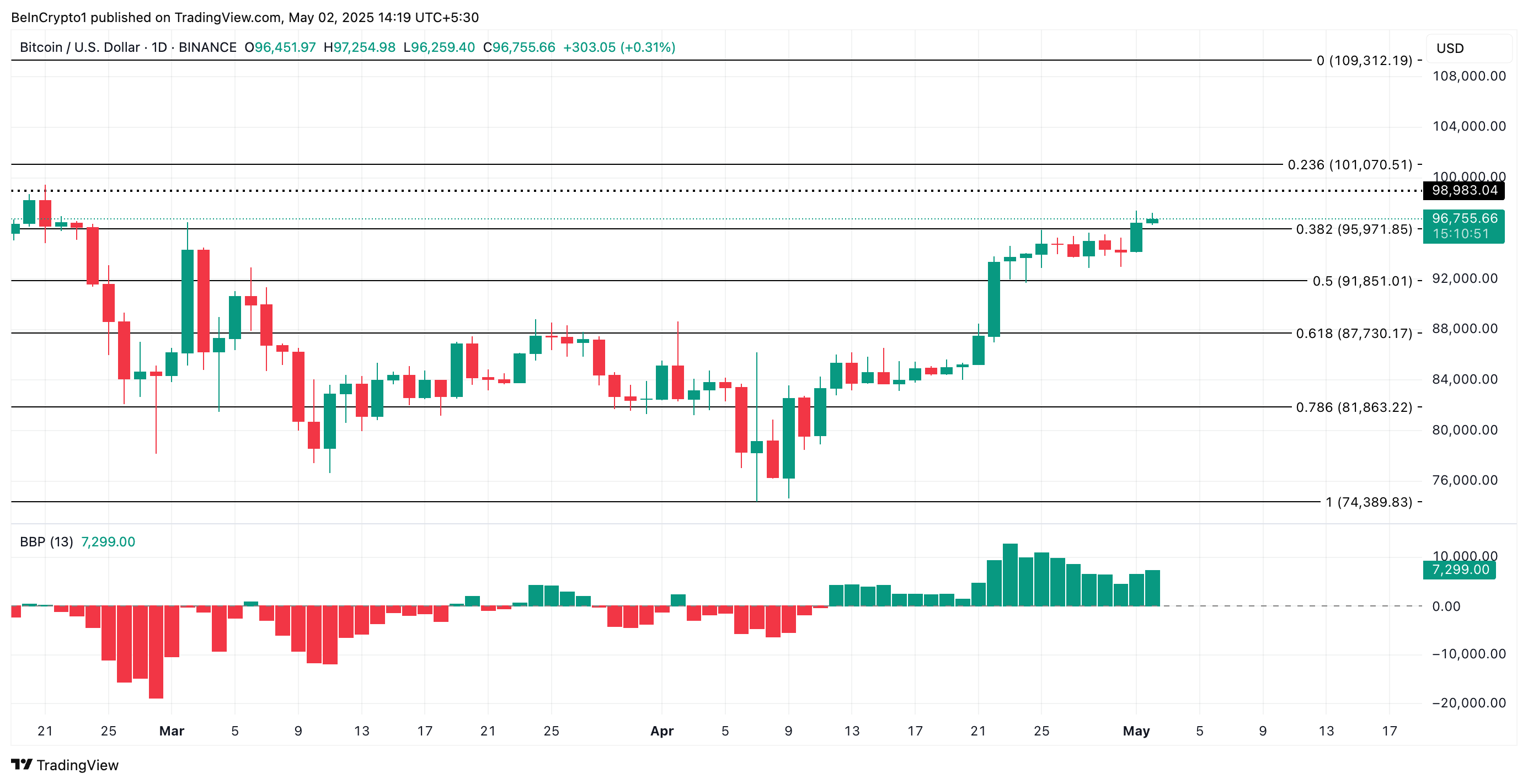

On the technical aspect, readings from BTC’s Elder-Ray Index affirm the strengthening demand for the coin. On the day by day chart, the histogram bars of this indicator have expanded in dimension over the previous few days, highlighting an increasing buildup of shopping for stress out there.

The Elder Ray Index measures the energy of shopping for and promoting stress out there, utilizing two key parts: Bull Energy and Bear Energy. When the scale of its bars will increase and its worth is constructive, it signifies rising shopping for stress. It suggests the market is in an uptrend with rising energy behind the bullish motion.

If this continues, BTC might smash by the resistance at $98,983, reclaim the $100,000 worth mark, and cost towards $101,070.

Nonetheless, if profit-taking exercise resumes, this bullish projection shall be invalidated. In that situation, BTC might resume its downward pattern, break below $95,971, and pattern to $91,851.

Disclaimer

According to the Trust Project tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.