Can altcoins extend gains alongside Bitcoin?

- As open curiosity and quantity surge, Bitcoin reveals immense potential to set off a transfer to $100,000.

- Virtuals Protocol’s value beneficial properties bullish momentum, tackling $1.50 resistance regardless of overbought circumstances.

- Floki goals to shift the narrative from bearish to strongly bullish, following a breakout from a triangle sample, focusing on $0.0001075.

- Hyperliquid value consolidates beneficial properties above the 100-day EMA, forward of a possible breakout past $20.00.

The cryptocurrency market sustains a market-wide bullish outlook on the time of writing on Tuesday, led by Bitcoin (BTC) and choose altcoins, together with Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE). International markets proceed to reply positively to the potential for commerce tensions de-escalation between the USA (US) and China.

Bitcoin value extends lead over altcoins

Curiosity in digital belongings surged considerably following statements from President Donald Trump’s administration that tariffs on Chinese language items could possibly be lowered. Bitcoin value held above $90,000 final week earlier than extending beneficial properties to $95,631, buoyed by document spot BTC ETF internet inflows of $3.06 billion within the week ending April 25.

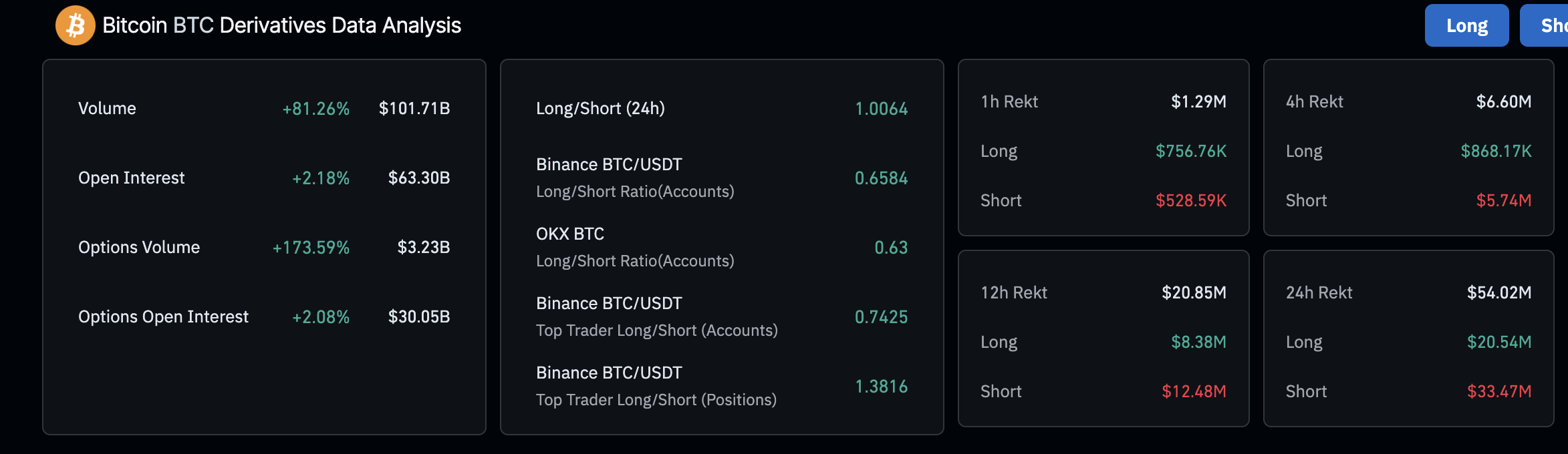

The rise within the Bitcoin price has led to many brief merchants being liquidated. Over the previous 24 hours, roughly $33 million briefly positions had been forcibly closed in comparison with about $20.5 million in lengthy positions. Furthermore, a 2.18% enhance within the derivatives’ Open Curiosity (OI) to $63.3 billion factors to rising dealer curiosity, doubtlessly amplifying the rally towards $100,000.

Bitcoin derivatives’ open curiosity | Supply: Coinglass

Virtuals Protocol tops trending cash as value soars

Virtuals Protocol’s value maintains the lead amongst altcoins, gaining over 38% within the final 24 hours, 157% within the final seven days, and 142% within the final month, buying and selling at $1.4228 on the time of writing.

The token holds above the 50, 100, and 200-day Exponential Transferring Averages (EMAs), signaling a stronger tailwind. Curiosity within the token stays regular regardless of overbought circumstances, with the Relative Energy Index (RSI) indicator’s place at 84.14.

Breaching the important thing resistance at $1.5000 is important to maintain the upward momentum towards $2.0000 (a help degree from January) and $2.5000 (a resistance/help zone final seen in December and January).

VIRTUAL/USDT each day chart

Floki poised for breakout above $0.0001

Floki’s value is presently within the inexperienced, and it’s aiming to construct on its 24-hour beneficial properties, which have surpassed 11.5%. The bullish momentum behind the meme coin will be attributed to the steadiness within the broader crypto market and a current technical breakout from a falling wedge sample.

The 100-day EMA at $0.000086 instantly helps the token, which is presently hovering at $0.000087. A each day shut above this degree might encourage merchants to hunt extra publicity whereas anticipating FLOKI to push above $0.0001 earlier than finishing the falling wedge sample’s 98% breakout, aiming for $0.0001075.

FLOKI/USDT each day chart

The 200-day EMA place at $0.0001110 might problem the bullish momentum. Furthermore, the RSI indicator is overbought at 73.82, hinting at a possible development reversal within the brief time period. In case of a pullback, the 50-day EMA at $0.000069 is predicted to supply help.

Hyperliquid value consolidates beneficial properties

Hyperliquid’s value is buying and selling at $18.57, down 0.54% on the day. The token has lately surpassed a descending trendline resistance since early 2025, indicating the potential for an enduring development reversal.

Following a rejection barely beneath $20.00, HYPE stays above the 100-day EMA at $18.35. Moreover, the token holds above a vital help zone (red-shaded space on the each day chart) and is backed by the 50-day EMA at $16.62.

HYPE/USDT each day chart

Based mostly on the RSI indicator’s impartial place at 60.25, Hyperliquid is but to be overbought, implying there’s nonetheless room for an additional leg up. Breaching the $20.00 resistance might affirm the bullish grip, prompting merchants to carry their positions for beneficial properties to $24.00, a degree final examined in February.