Dollar Strengthens Ahead of Employment Data

The USD/JPY and USD/CAD forex pairs are exhibiting an upward pattern, supported by the strengthening US greenback, which is backed by a lot of elements. At yesterday’s assembly, the Financial institution of Japan stored the important thing rate of interest unchanged, disappointing “yen bulls” who had hoped for indicators of a potential tightening of financial coverage. This choice by the Japanese regulator contributed to the weakening of the yen, inflicting the USD/JPY pair to replace native highs, approaching key resistance ranges.

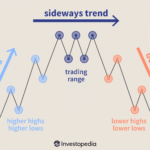

The USD/CAD pair continues to commerce close to native lows, holding above help round 1.3780, indicating stabilisation in demand for the greenback. A further issue is the weak efficiency of oil costs, which stay in a sideways vary, limiting the potential for strengthening the Canadian greenback.

In the present day, buyers’ consideration is concentrated on the publication of the Non-Farm Payrolls report — a key employment indicator within the US. The consensus forecast expects job progress in April to be between 135,000 and 145,000, which is considerably decrease than the March determine of 228,000. The unemployment price is predicted to stay at 4.2%, whereas the typical hourly earnings progress is forecast to be 0.3% month-on-month. Nevertheless, deviations from the forecast needs to be taken into consideration.

Stronger-than-expected knowledge might bolster the US greenback, as it might scale back the chance of an imminent price minimize by the Federal Reserve.

The rising uncertainty and speculative sentiment forward of the Non-Farm Payrolls launch are contributing to heightened dealer exercise and will result in false breakouts and combined value “spikes.”

USD/JPY

Technical evaluation of USD/JPY suggests potential progress of the pair in the direction of 146.80-146.30, throughout the framework of beforehand shaped reversal patterns such because the “piercing candle” and “bullish harami.” A rebound from these or present ranges might result in a decline in the direction of 145.00-144.00.

The next occasions might affect the pricing of USD/JPY:

- In the present day at 15:30 (GMT+3): US unemployment price;

- In the present day at 15:30 (GMT+3): US common hourly earnings;

- In the present day at 15:30 (GMT+3): Change in US non-farm payrolls.

USD/CAD

For the second consecutive week, patrons of the USD/CAD pair are stopping the worth from falling additional close to 1.3800-1.3770. In keeping with technical evaluation, the USD/CAD pair is in sideways motion throughout the vary of 1.3900–1.3870. If the worth consolidates above 1.3900, it could take a look at the 1.4000 degree. A transfer under 1.3780 might set off the resumption of a downward momentum in the direction of 1.3200-1.3100.

The next occasions might affect the course of USD/CAD:

- In the present day at 17:00 (GMT+3): US industrial orders;

- In the present day at 22:30 (GMT+3): CFTC web speculative positions on CAD.

Commerce over 50 foreign exchange markets 24 hours a day with FXOpen. Benefit from low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or study extra about buying and selling foreign exchange with FXOpen.

This text represents the opinion of the Firms working beneath the FXOpen model solely. It isn’t to be construed as a suggestion, solicitation, or advice with respect to services and products offered by the Firms working beneath the FXOpen model, neither is it to be thought of monetary recommendation.