Enterprise Blockchain Market Reflects Huge Growth at 287.8 Bn

Introduction

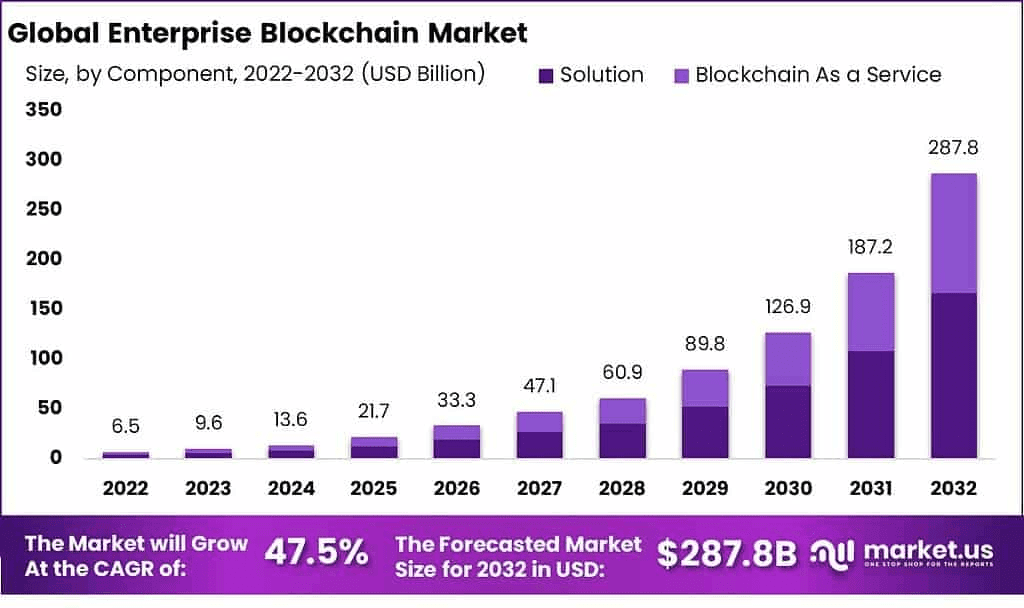

The International Enterprise Blockchain Market is on a robust progress trajectory, forecasted to develop at a compound annual progress charge (CAGR) of 47.5%, with a projected worth reaching USD 287.8 billion by 2032, up from USD 9.6 billion in 2023.

The market’s growth is pushed by an growing emphasis on information safety, accounting for 58% of the market share, and rising demand for blockchain options in sectors equivalent to monetary companies. Cloud companies have additional facilitated blockchain adoption as a result of scalability and safety. Regardless of regulatory uncertainties, scalability points, and a lack of information, the enterprise blockchain market is poised for important progress within the coming years.

US Tariff Impression on Market

US tariffs have a major impression on the Enterprise Blockchain Market, notably as a result of their results on the price of {hardware}, know-how adoption, and provide chain disruptions. With blockchain know-how typically requiring specialised {hardware} and software program, tariff will increase on imported items from key suppliers could result in value escalations for corporations within the blockchain area. Moreover, tariffs could disrupt world collaboration efforts, as worldwide gamers could be hesitant to enter or increase throughout the US market as a result of greater operational prices.

- Financial Impression: Tariffs might result in a rise in working bills for blockchain corporations, probably elevating the prices of {hardware} and software program integration.

- Geographical Impression: The US market could face slower adoption charges as companies try and mitigate greater prices via diminished funding.

- Enterprise Impression: Corporations could have to reevaluate pricing methods and discover different suppliers to soak up the tariff-related bills.

US Tariff Impression on Key Sectors

- {Hardware} (8-10%)

- Monetary Companies (5-7%)

- Know-how and Companies (3-5%)

Financial Impression

The imposition of US tariffs will increase prices for companies concerned in blockchain know-how, notably these reliant on imported {hardware}. This financial burden could deter new investments, decelerate adoption charges, and probably end in diminished profitability for corporations struggling to soak up greater operational prices.

Geographical Impression

US tariffs might disrupt blockchain adoption throughout North America, notably as corporations face rising prices for crucial {hardware} and know-how. This would possibly scale back the aggressive fringe of US corporations within the world blockchain market, resulting in slower adoption charges and limiting the sector’s progress in key geographic areas.

Enterprise Impression

The enterprise panorama for enterprise blockchain might expertise elevated operational prices and decreased revenue margins as a result of greater tariffs. Corporations could also be pressured to cross these prices onto prospects, decelerate mission implementation, or alter their methods to take care of market competitiveness in mild of disrupted provide chains.

Key Takeaways

- Enterprise Blockchain Market is rising at a strong 47.5% CAGR.

- The market is predicted to achieve USD 287.8 billion by 2032.

- Growing demand for information safety is a serious driver, holding a 58% market share.

- US tariffs could hinder progress by elevating operational prices.

- Cloud companies adoption is crucial to blockchain scalability.

Analyst Viewpoint

The current outlook for the enterprise blockchain market is extremely constructive, pushed by demand for safe information sharing and fraud prevention. Regardless of challenges, equivalent to regulatory uncertainty and tariff impacts, the growing adoption of blockchain-as-a-service (BaaS) platforms is positioning the marketplace for future progress.

In the long run, technological developments in blockchain and better regulatory readability will possible foster a extra supportive surroundings for innovation, resulting in widespread adoption throughout industries. The US market will stay a key participant, although its progress could possibly be tempered by exterior financial pressures like tariffs and world competitors.

Regional Evaluation

North America is predicted to take care of its dominant place within the enterprise blockchain market, accounting for 40% of the worldwide income share in the course of the forecast interval. That is primarily pushed by robust regulatory frameworks, digital transformation initiatives, and elevated industry-specific adoption.

The Asia-Pacific area, nevertheless, is poised for important progress, bolstered by financial improvement, authorities help for blockchain initiatives, and a quickly increasing demand for safe and clear options. As regional markets evolve, North America will proceed to steer whereas Asia-Pacific will possible see speedy growth as a result of its favorable enterprise surroundings.

Enterprise Alternatives

Because the enterprise blockchain market grows, quite a few enterprise alternatives will emerge, particularly in sectors like monetary companies, provide chain administration, and healthcare. Corporations can leverage blockchain know-how to boost safety, enhance transaction transparency, and streamline enterprise operations.

The rise of Blockchain-as-a-Service (BaaS) platforms gives a pretty entry level for companies searching for scalable, cost-effective options. Moreover, regulatory developments and growing adoption throughout industries will create new income streams for tech corporations, notably in blockchain consulting, implementation, and innovation. The rising curiosity in information privateness and digital transformation will provide additional progress avenues for blockchain-driven companies.

➤ Tariff impression overview by market?

Key Segmentation

The enterprise blockchain market is segmented primarily based on know-how, utility, and {industry}. The important thing applied sciences embrace options and blockchain-as-a-service (BaaS), with the previous dominating the market as a result of its transaction traceability, fraud prevention, and accountability. Utility-wise, the fee phase leads with its robust give attention to enhancing transaction safety and effectivity.

Geographically, North America leads the market, whereas Asia-Pacific is anticipated to develop quickly. Business-wise, the monetary companies sector holds the most important income share as a result of blockchain’s position in reworking operations. The healthcare and provide chain sectors are additionally anticipated to witness important blockchain adoption.

Key Participant Evaluation

Key gamers within the enterprise blockchain market are centered on creating modern blockchain options and platforms to cater to numerous {industry} wants. These gamers are leveraging developments in cloud companies and blockchain-as-a-service (BaaS) to supply scalable and safe options.

They’re additionally forming strategic partnerships to boost product choices and drive adoption in industries like finance, provide chain, and healthcare. Whereas some are centered on enterprise-specific blockchain functions, others are increasing their attain via collaborations with governmental and regulatory our bodies to make sure compliance and facilitate industry-wide blockchain adoption.

High Key Gamers

- Microsoft Company

- IBM Corporation

- Digital Asset Holdings, LLC

- BTL Group Ltd.

- The Linux Basis

- Deloitte Touche Tohmatsu Ltd.

- International Area Holding, Inc.

- Oracle Company

- Ripple

- Circle Web Monetary Restricted

- Different Key Gamers

Latest Developments

Latest developments within the enterprise blockchain market embrace a surge in blockchain-as-a-service (BaaS) adoption, enabling corporations to deploy blockchain know-how shortly and cost-effectively. Moreover, regulatory our bodies in key areas have began releasing clearer frameworks, that are fostering extra funding and innovation in blockchain options throughout varied industries.

Conclusion

The enterprise blockchain market is positioned for important progress, with North America sustaining its management. Whereas US tariffs could pose challenges, rising alternatives within the Asia-Pacific area and a rising demand for blockchain options in sectors like finance and healthcare will gas future progress and technological developments.