Bitcoin nears $95,000 levels on April 29 — is a crypto market bull run likely soon? Here’s what experts say

Bitcoin worth as we speak, April 29: The world’s largest cryptocurrency, Bitcoin, at 9 am was buying and selling at $94,662.19, up 1.16 per cent over the previous 24 hours, based on information on CoinMarketCap.

Additional, the market cap of Bitcoin additionally rose, up 1.06 per cent to $1.87 trillion, with buying and selling quantity for the 24 hours recorded at $32.12 billion, information confirmed.

The worth rise has seemingly been pushed by Bitcoin exchange-traded funds (ETFs), institutional demand, and hints of beneficial crypto-related insurance policies by the US authorities below Donald Trump. Additional, the US state of Arizona is contemplating investments in a Bitcoin treasury, which might probably affect different states in the direction of together with digital belongings of their monetary methods.

In accordance with Alankar Saxena, Co-founder and CTO of Mudrex, Bitcoin is testing the $95,000 zone as optimistic institutional developments proceed to spice up sentiment — i.e. Technique including $1.4 billion worth BTC to its holdings and Commonplace Chartered projecting a rally in the direction of $120,000 within the close to time period.

Crypto Information: Costs of Ether, Solana, extra

The worldwide cryptocurrency market capitalisation stood at $2.97 trillion on Tuesday, up 1.59 per cent over the day gone by. The full market commerce quantity over the interval can be up by 47.79 per cent to $89.69 billion, CoinMarketCap information confirmed.

Alex Kuptsikevich, chief market analyst at FxPro, famous that the crypto market capitalisation has been hovering round $2.97 trillion because the finish of final week. “The market has recovered to its 200-day transferring common, however is hesitant to beat it, as we see within the case of Bitcoin. The sentiment within the markets is impartial. It appears that evidently gamers desire to maneuver upwards with comparatively lengthy stops,” he stated.

Additional, Decentralised Finance includes $6.31 billion or 7.03 per cent of the whole crypto market, whereas the quantity of all stablecoins is $83.77 billion or 93.40 per cent. Total, Bitcoin holds 63.37 per cent dominance amongst tokens, a minor 0.03 per cent drop over the previous 24 hours.

- World’s second largest crypto by circulation, Ethereum is at $1,795.46, up 1.29 per cent over the day gone by, with a market cap of $216.76 billion and commerce quantity of $15.84 billion.

- On Ethereum, Kuptsikevich stated the token “is scuffling with resistance within the type of the 50-day transferring common close to $1800 for the sixth day. Over the previous couple of years”, including that it’s “accelerating features when breaking above it and dealing with vital strain when falling beneath it”.

- On Ethereum, Saxena felt it’s “exhibiting sturdy indicators of a breakout, with whale inflows surging by 2,682 per cent, signalling a possible transfer in the direction of the $2,000 degree”.

- Stablecoin Tether is at $1, with a market cap of $148 billion and commerce quantity of $68.91 billion over the previous 24 hours. It’s the most traded crypto on the earth.

- Additional, Donald Trump’s favoured Solana token is at $147.52, with a market cap of $76.36 billion and commerce quantity of $3.67 billion over the previous 24 hours.

- As per CoinDesk Analysis information, altcoins throughout the high 10 have seen some energy as Ethereum sustains above $1800, whereas XRP rises above $2.28. However Solana, BinanceCoin, Dogecoin, and Cardano stay caught beneath their respective resistances at $150, $610, $0.18, and $0.72. The buying and selling quantity has elevated together with Bitcoin dominance, and the ETFs made seven consecutive inflows, suggesting an enormous breakout is underway.

Bull Market Run on Horizon for Crypto, Bitcoin?

In accordance with Kuptsikevich, Bitcoin is stabilising close to $94,500, “having totally recovered to the consolidation ranges seen in February earlier than its sharp decline. The technical outlook stays bullish, with BTCUSD buying and selling above each its 50- and 200-day transferring averages. Each indicators are trending upward, and final week’s consolidation above these ranges marked a robust transfer, reinforcing the bullish momentum”.

In accordance with Saxena, traders are actually in search of a catalyst to gasoline a decisive transfer towards the $100,000 mark. “Upcoming macroeconomic information, together with PCE, ISM, and jobs reviews, might present the wanted momentum in the event that they meet market expectations,” he stated.

QCP Capital famous that the bitcoin choices market is at the moment dominated by name choices with $95,000 strike costs for the tip of April and Might, suggesting that danger urge for food stays sturdy.

Cathie Wood’s Ark Make investments predicts a “bullish state of affairs” the place Bitcoin might rise to $2.4 million by the tip of 2030 amid the rising adoption of the asset by establishments and sovereign wealth funds. “BTC will attain $1.2 million within the baseline state of affairs and $500,000 within the bearish state of affairs,” Ark stated in its evaluation, based mostly on calculations of the whole goal market (TAM), penetration fee and issuance of the primary cryptocurrency.

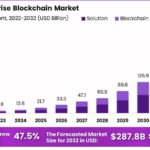

Additional, Citigroup forecasts that 2025 “may very well be a breakthrough 12 months in institutional adoption of blockchain know-how, with stablecoins being one of many drivers”. It feels that stablecoin capitalisation by 2030 might develop to $1.6 trillion in a base case state of affairs and $3.7 trillion in a bullish state of affairs.

It’s not the lone lender with an optimistic view, Commonplace Chartered Financial institution predicts Bitcoin to achieve a brand new ATH at round $120,000 in Q2, 2025, and $200,000 by the tip of the 12 months.

Disclaimer: The views and proposals made above are these of particular person analysts or broking corporations, and never of Mint. We advise traders to test with licensed consultants earlier than making any funding selections.