Grinex exchange suspected rebrand of sanctioned Garantex crypto firm

A brand new cryptocurrency trade named Grinex is believed to be a rebrand of Garantex, a Russian cryptocurrency trade whose domains had been seized by the U.S. authorities and an admin arrested.

In accordance with a brand new report by blockchain intelligence agency TRM Labs, Grinex reveals robust ties to Garantex’s earlier operations however has not decided if it is at the moment getting used for illicit transactions.

Garantex was a Russian cryptocurrency trade, formally registered in Estonia, that was sanctioned by the U.S. (OFAC) in April 2022, adopted by comparable actions by the UK and the EU.

U.S. authorities seized Garantex’s domains in early March 2025 for a number of violations, together with the processing of $100 billion price of illicit transactions and facilitating cash laundering for ransomware gangs and darknet markets.

TRM Labs confirmed transactions with the Conti ransomware group and the darkish internet markets Hydra, Mega, Kraken, OMG!OMG! And Solaris.

Two directors of Garantex, Aleksej Besciokov and Aleksandr Mira Serda, had been subsequently charged, with Besciokov arrested a number of days later whereas vacationing in India.

Grinex’s sudden rise

Quickly after the seizure, Grinex was promoted on Telegram channels linked to the Garantex-adjacent Satoshkin group, stating it was a “a brand new platform with acquainted performance.”

The consumer interface similarities between the 2 platforms had been in depth, however extra notably, Grinex was ready to make preparations to seize Garantex’s employees and consumer base from its very launch.

“Grinex introduced it had entered into an settlement with Garantex to onboard its shoppers and was contemplating hiring former Garantex workers,” explains TRM Labs.

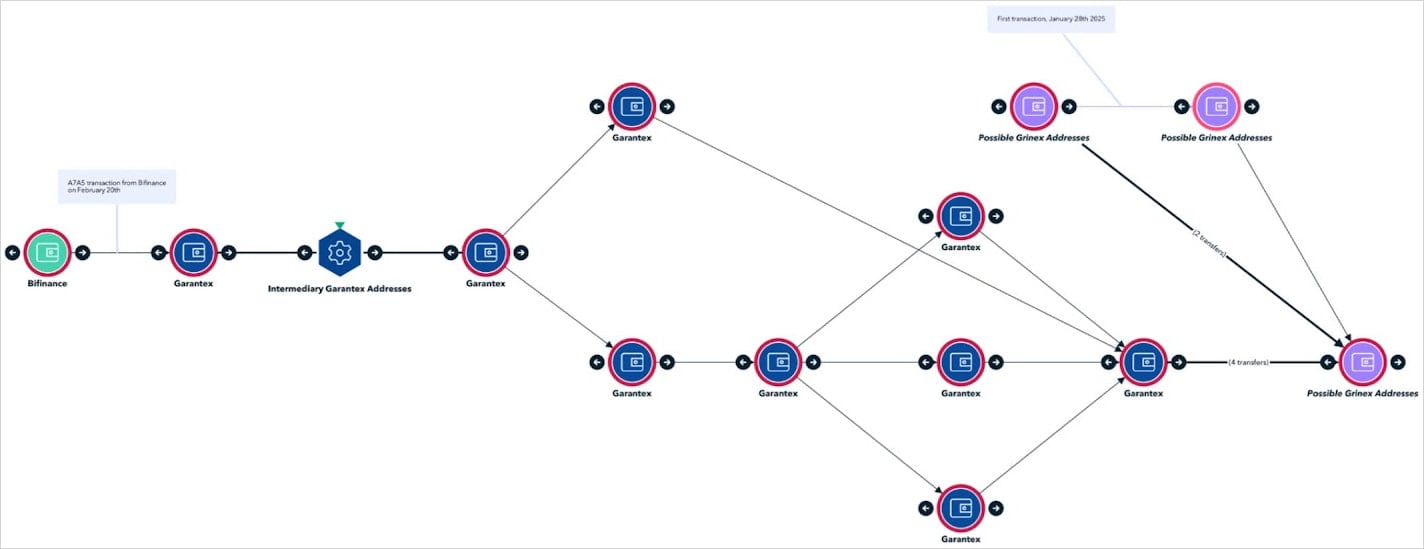

“Much more revealing, Grinex started distributing former Garantex consumer property by a brand new token, A7A5.”

Two weeks previous to Garantex’s takedown, a brand new stablecoin referred to as A7A5, pegged 1:1 to the Russian ruble, was introduced on the platform, possible as a measure of the anticipated upcoming authorized motion.

TRM Labs discovered two Kyrgyzstan-based companies to be behind massive transactions involving the A7A5 token, however the connections are obscure.

What is obvious is that after the Garantex takedown, Grinex began distributing former Garantex consumer property by the A7A5 token, with Telegram channels beforehand linked to Garantex selling Grinex as a means for customers to get well their frozen funds.

Supply: TRM Labs

In the end, the rise of Grinex reveals that blocking cybercrime and sanctions evasion mechanisms is an advanced course of, as illicit networks can rapidly adapt by rebranding, creating new stablecoins, and exploiting decentralized platforms to proceed their operations unabated.

TRM Labs mentions two different platforms that emerged as a Garantex substitute, particularly ABCEX, which is straight associated to Garantex founder Sergey Mendeleev, and Rapira, which has welcomed a number of former Garantex customers already.

Source link