Is Bitcoin Bad for the Environment? Crypto & ESG Investing

Can crypto be environmentally accountable?

It’s true that Bitcoin will get a nasty rap for utilizing a stunning quantity of power—on par with many nations. However the fact about cryptocurrency power utilization is extra nuanced than you would possibly assume. And consider it or not, you may put money into crypto responsibly with out creating a huge carbon footprint. In different phrases, crypto could be a part of an ESG-friendly portfolio.

Let’s check out the intersection of digital property and environmental, social, and governance investing.

What’s ESG investing, and the way can crypto slot in?

ESG investing refers back to the follow of investing in corporations or property which have a optimistic affect on the setting, society, or governance. Crypto traders can think about blockchain projects that search to reduce their carbon footprint, have optimistic social affect, or follow particularly good governance.

- Investing in crypto for environmental affect means selecting energy-efficient cryptocurrencies, understanding how a lot power is utilized by a cryptocurrency’s mining practices, and supporting eco-friendly blockchain tasks.

- Crypto investing for social affect means supporting blockchain tasks which can be absolutely decentralized, foster monetary inclusion, or assist moral working situations.

- Cryptocurrency investing for governance aligns with rules of decentralization and autonomy. Crypto holders can use governance tokens to actively take part in decision-making regarding a blockchain undertaking—just like shareholders voting their proxy cards.

What makes cryptocurrency an power hog?

Each blockchain or cryptocurrency community requires power, though how the power is used (and the way a lot is used) can differ considerably throughout blockchains.

Consensus mechanism. The consensus mechanism utilized by a blockchain, both proof-of-stake or proof-of-work, is crucial consider figuring out its power consumption. A blockchain community’s consensus mechanism merely dictates how the community operates. It may allow competitors amongst community contributors based mostly on computing energy or token holdings.

A cryptocurrency that makes use of the proof-of-work protocol requires miners to compete for crypto rewards by amassing computing sources. A blockchain that makes use of proof-of-stake obligates validators to stake—that’s, agree to not commerce or promote—their cryptocurrency.

Crypto mining is very power intensive, whereas staking usually isn’t. The selection of consensus mechanism is the most important driver of a blockchain’s power use.

Transaction quantity. The busiest blockchains usually use probably the most power. Consider street visitors. The extra automobiles on a freeway, the extra power is getting used. Proof-of-work blockchains particularly use extra power because the transaction quantity rises, as a result of extra transactions increase the required computing energy.

Hash fee. The hash fee—a technical time period that denotes the velocity at which computations are carried out—impacts the power consumption of a blockchain. Miners that obtain excessive hash charges are conducting many calculations per second, and consuming extra power accordingly.

Mining issue. Proof-of-work blockchains with excessive mining issue—people who require important computing energy to efficiently mine a block of transactions—use probably the most power. Blockchains with many competing miners within the community have the best mining issue.

Cooling necessities. Proof-of-work mining methods can generate important warmth, requiring superior cooling options. These cooling methods are important to stop {hardware} from overheating and keep optimum mining efficiency, however require further power to function.

Bitcoin, a proof-of-work blockchain, makes use of probably the most power of any cryptocurrency community. Ethereum is a significant cryptocurrency community that not too long ago lower its power use by an estimated 99.9% by switching its consensus protocol from proof-of-work to proof-of-stake.

What different elements decide a blockchain’s big-picture affect on the setting?

Power use often is the greatest issue contributing to cryptocurrencies’ environmental affect, however it’s not the one one.

- Power sources. A blockchain that will get most of its power from renewable or alternative sources has much less environmental affect than a blockchain that runs on fossil-based fuels.

- Power costs. Low cost power can have an hostile affect, as miners could discover it economically viable to eat cheap electrical energy with little or no regard for conservation or effectivity.

- {Hardware} effectivity. Proof-of-work miners utilizing energy-efficient {hardware} can cut back the carbon emissions of a blockchain community with out sacrificing computing energy.

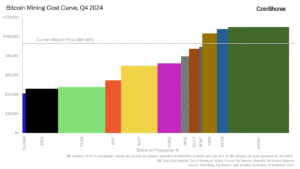

- Cryptocurrency costs. A gorgeous cryptocurrency worth can increase the variety of energetic miners. Extra miners on a proof-of-work blockchain usually ends in extra carbon emissions.

- Block rewards. Similar to excessive token costs, engaging block rewards can enhance the environmental affect of a cryptocurrency community, as extra miners compete to earn them.

The underside line

The large takeaway right here is you could be a accountable investor and personal cryptocurrency. Simply do your analysis and select the digital property which can be greatest aligned along with your ESG values. The kinds of digital property in your portfolio, and what you do with them, are key elements.