Trump Tariffs Could Trigger Bitcoin Revaluation

Trump’s commerce agenda continues to shock international monetary markets, prompting a revaluation of Bitcoin (BTC) and equities.

Bitcoin and the crypto market witnessed notable volatility during the last a number of weeks. This got here as merchants and buyers reeled from the impacts of tariffs beneath US President Donald Trump.

Bitcoin and Equities Could Be On The Cusp Of A Main Revaluation

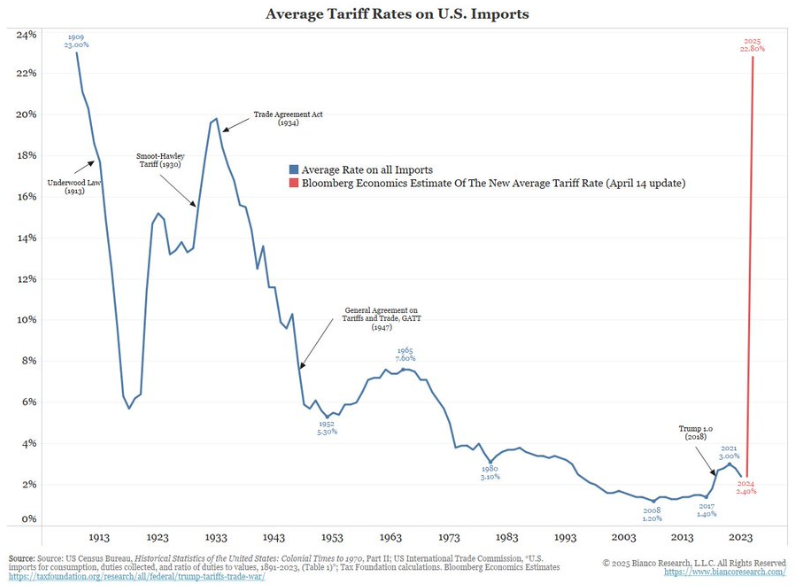

The latest surge in Trump tariffs has inadvertently positioned Bitcoin as a possible beneficiary. Enterprise capital agency MV World highlights the spike in US tariffs in 2025, citing ranges final seen within the Nineteen Thirties. This has triggered greater than $10 trillion in fairness losses worldwide.

“The ensuing capital flight is reshaping funding flows throughout asset courses,” MV World noted.

With liquidity quietly rebuilding, analysts anticipate a significant market revaluation, with Bitcoin on the coronary heart of it.

This forecast comes after MV World’s World Financial system Index lately turned upward. This typically precedes broader asset reflation. Notably, the metric tracks each cross-border capital flows and financial situations.

“Liquidity is quietly rebuilding throughout main economies. Because the World Financial system Index turns upward, historic patterns counsel Bitcoin and equities could also be on the cusp of a significant revaluation,” the agency noted.

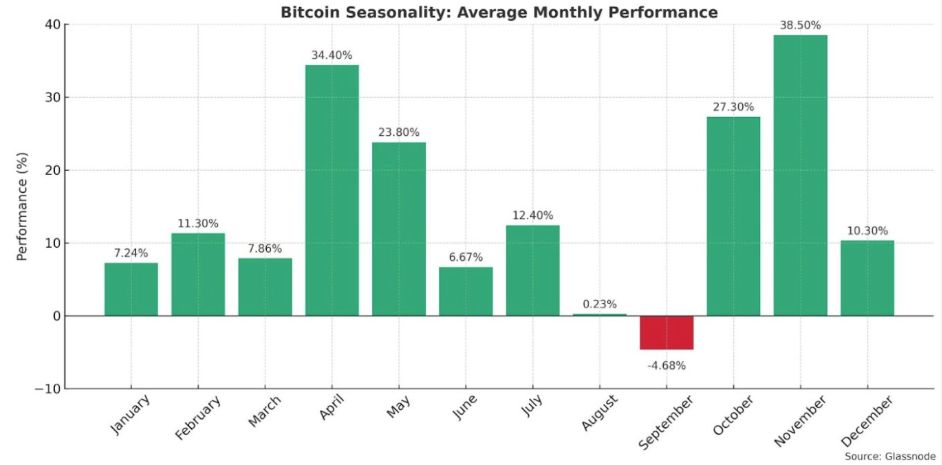

Certainly, Bitcoin’s efficiency is already outpacing traditional markets, which provides credence to its common April return of greater than 34.4%. Macroeconomic instability and capital flight are the forces behind this seasonal sample.

Primarily based on this, analysts argue that the present market outlook mirrors historic durations when buyers moved away from dollar-centric techniques in quest of decentralized options.

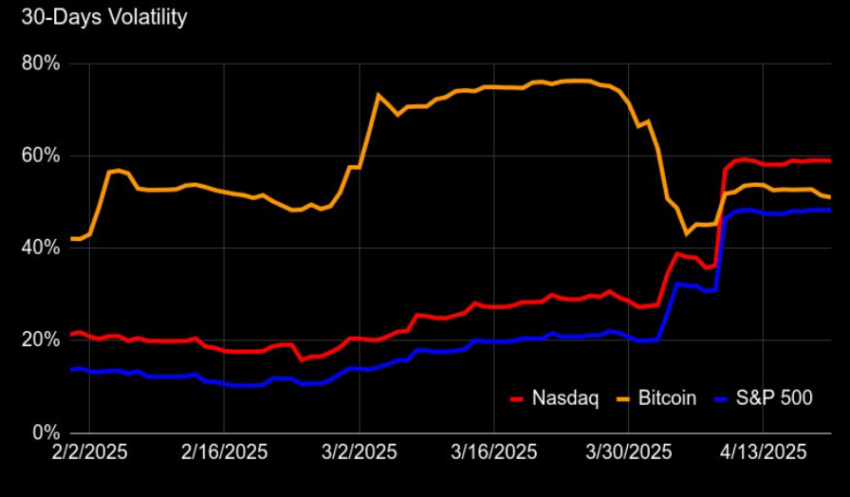

Tomas Greif, chief of product technique at Braiins Mining Ecosystem, agrees. He notes that Bitcoin’s volatility aligns extra intently with main fairness indexes.

“In the event you beforehand thought Bitcoin was too unstable, chances are you’ll need to re-evaluate your passive funding methods for retirement,” Greif remarked.

In response to Mathew Sigel, head of digital property analysis at VanEck, this rising macro backdrop might speed up Bitcoin’s transition from a speculative asset to a useful financial hedge.

“Bitcoin is evolving from a speculative asset right into a useful financial instrument—significantly in economies seeking to bypass the greenback and scale back publicity to US-led monetary techniques,” Sigel wrote.

Sigel’s level displays a broader development: Bitcoin is more and more considered as a strategic asset as geopolitical and commerce tensions mount. This aligns with a latest US Crypto Information publication, which indicated how Bitcoin is progressively presenting itself as a hedge against traditional finance (TradFi) and US treasury risks.

Bitcoin’s potential to achieve traction in its place reserve or settlement asset may develop. This optimism comes as extra economies distance themselves from conventional US financial affect. BeInCrypto reported that Russia is contemplating Ruble-pegged stablecoin to problem US Greenback dominance.

As fairness markets reel and liquidity rotates, Bitcoin’s resilience may redefine how buyers hedge in opposition to geopolitical uncertainty.