Bitcoin Surges Above $91K As Corporate Holders, Crypto Miners, And Exchanges All See Strategy Shares Rise

Key Takeaways:

- Technique shares surged greater than 9% following Bitcoin’s rise past $91,000.

- Crypto mining shares logged double-digit beneficial properties on renewed investor enthusiasm.

- Market members are nonetheless break up on whether or not the BTC rally will maintain above $93,000.

Bitcoin’s Rally Sparks Surge in Crypto-Linked Shares

Bitcoin climbed again above $91,000 on April 22, hitting its highest degree since early March and prompting a broad rally in crypto-related equities. The milestone despatched shares of Technique (MSTR) up over 9%, sustaining a four-day surge during which the inventory reached a two-month excessive of $348.08.

The surge follows an announcement from Technique concerning a brand new Bitcoin buy: 6,556 BTC for round $566 million. With this transfer, the agency’s complete holdings climbed to 538,200 BTC, additional solidifying its lead because the largest company holder of the digital asset.

Regardless of macroeconomic uncertainty, market confidence in Technique’s Bitcoin-focused method has remained sturdy. The corporate’s share worth is up greater than 15% this 12 months and greater than doubled prior to now 12 months — at the same time as traders react to President Donald Trump’s current tariff bulletins, which have impacted main indices.

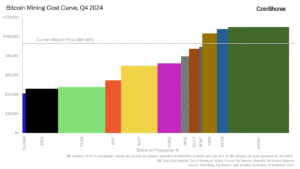

Double-Digit Features Led By Miners

Bitcoin’s 4.76% achieve on the day boosted not solely Technique’s shares but in addition sparked a rally amongst cryptocurrency mining corporations. Cipher Mining (CIFR) jumped greater than 15%, whereas Terawulf (WULF) and Cleanspark (CLSK) rose 16.2% and 13.9%, respectively.

Riot Platforms (RIOT), the No. 3 public firm Bitcoin holder, additionally spiked greater than 10% at the moment. Bitfarms (BITF), alternatively, climbed almost 14%.

Nonetheless, the sector-wide optimism didn’t translate properly for Marathon Digital (MARA), which solely posted an 8.5% achieve towards the double-digit jumps seen with different friends. Analysts cited the relative lag on current delays in Marathon’s mining enlargement efforts.

Exchanges Rebound on Continued Bullish Sentiment

Crypto exchanges additionally reaped rewards from the Bitcoin rebound. Coinbase International (COIN) shares climbed almost 9%, whereas Robinhood (HOOD) shares jumped 7.3%. Elevated consumer exercise and transaction volumes have traditionally been related to main spikes in crypto costs. In consequence, these platforms profit from the upward momentum.

Investor sentiment was additionally lifted by a broader rebound in U.S. shares, which rebounded from losses on Monday that adopted President Trump’s scolding of Federal Reserve Chair Jerome Powell. His feedback have led to contemporary fears about central financial institution independence and rate of interest coverage, prompting some traders to show to various belongings akin to Bitcoin and gold.

$93K Robust Resistance Stage is Main Hurdle for Bitcoin

Merchants marked the $93,000 degree — Bitcoin’s yearly open — as an vital resistance level, with Bitcoin lately surpassing $91,000.

Bitcoin was approaching a horizontal vary low that had as soon as acted as help.

Bitcoin’s Attractiveness in Broader Market Context

The current rally coincides with escalating commerce tensions, because the U.S. imposes new tariffs on international locations like China and Japan. Issues over how worldwide markets will reply have led traders to show to extra time-tested safe-haven belongings—gold hit its historic excessive, whereas Bitcoin continues to be thought of a hedge towards the instability of fiat currencies.

Whereas sentiment has clearly improved, many merchants stay cautious and wait for higher affirmation indicators earlier than piling in with long-term bullish bets.

Extra Information: Metaplanet’s $28M Bitcoin Buy Signals Rising Institutional Confidence in Crypto