HBAR Token Struggles, Risks Hitting $0.12 Low

Regardless of the broader market uptick this week, Hedera’s native token HBAR has bucked the development, registering a 5% decline over the previous seven days.

With bearish momentum constructing, the HBAR token now dangers a return to its year-to-date low.

HBAR Slides Under Key Indicators

HBAR’s decline comes as many high cryptocurrencies post modest good points this week, reflecting its divergence from common market sentiment.

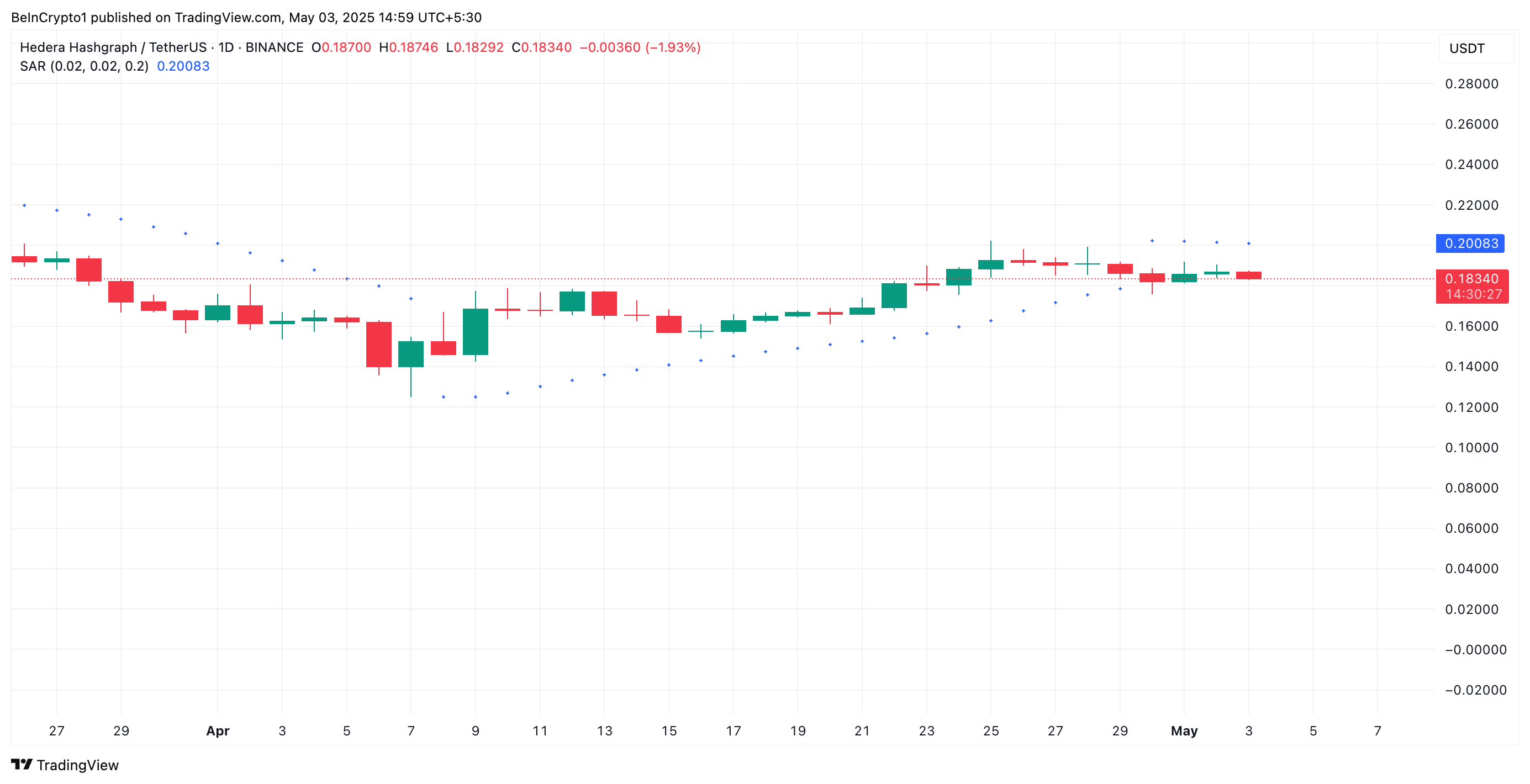

Readings from the HBAR/USD one-day chart recommend that this bearish development may persist within the brief time period. For instance, as of this writing, HBAR trades beneath the dots that make up its Parabolic SAR (Cease and Reverse) indicator.

This indicator measures an asset’s worth developments and identifies potential entry and exit factors. When an asset’s worth trades below the SAR, it signifies a downtrend. It suggests the market is in a bearish section, with the potential for additional worth dips.

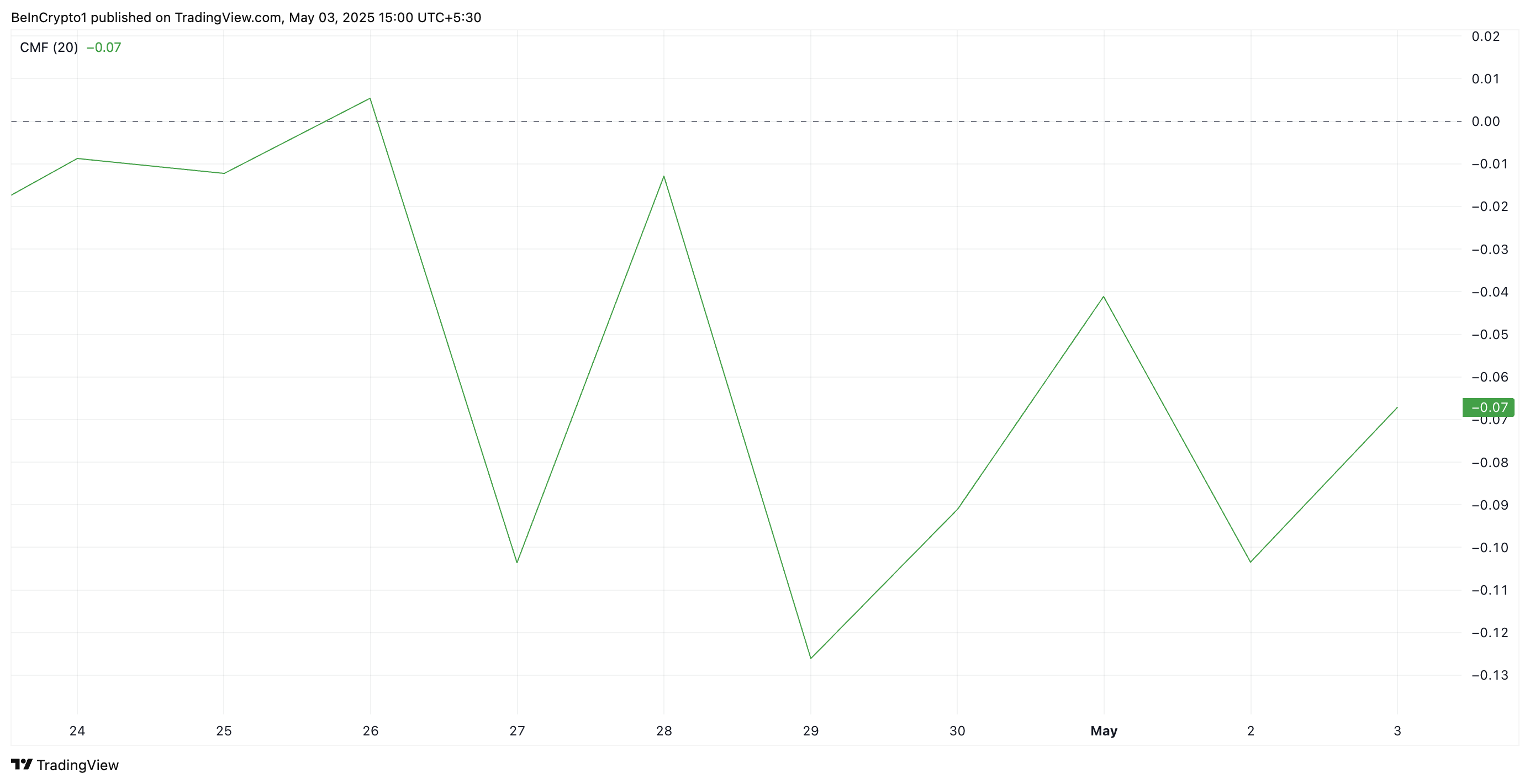

Supporting this bearish outlook, HBAR’s Chaikin Money Flow (CMF) stays within the adverse territory, signaling a decline in shopping for quantity and a rising presence of sellers available in the market. It at present stands at -0.07.

This key momentum indicator measures cash flows into and out of an asset. A adverse CMF studying, like HBAR’s, indicators that promoting stress dominates the market. Which means extra traders are offloading the token than accumulating it, a sample related to a weakening worth development.

HBAR Exams 20-Day EMA: Will It Maintain or Break Towards $0.12?

The day by day chart reveals HBAR’s decline has pushed it close to the 20-day exponential shifting common (EMA). This key shifting average measures an asset’s common worth over the previous 20 buying and selling days, giving weight to current modifications.

When the value falls close to the 20-day EMA, it indicators a possible assist stage being examined. Nonetheless, if the value breaks decisively beneath the EMA, it might verify sustained bearish momentum and additional draw back threat.

Due to this fact, HBAR’s break beneath the 20-day EMA may decrease its worth to its year-to-date low of $0.12.

Nonetheless, if demand rockets and HBAR bounces off its 20-day EMA, its worth may rally above $0.19.

Disclaimer

Consistent with the Trust Project tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.