Rising Stablecoin Volume Signals Strong Crypto Market Momentum in 2025 | Flash News Detail

From a technical perspective, the stablecoin quantity enhance aligns with a number of key market indicators that merchants can leverage for decision-making. As of Might 2, 2025, at 4:00 PM UTC, Bitcoin’s Relative Energy Index (RSI) on the 4-hour chart stood at 68, approaching overbought territory however nonetheless signaling bullish momentum (Supply: TradingView, Might 2, 2025). Ethereum’s RSI mirrored this pattern at 65 on the identical timeframe, suggesting sustained shopping for curiosity (Supply: TradingView, Might 2, 2025). Moreover, the Transferring Common Convergence Divergence (MACD) for BTC/USDT confirmed a bullish crossover on the day by day chart as of Might 2, 2025, at 5:00 PM UTC, with the sign line crossing above the MACD line (Supply: TradingView, Might 2, 2025). Quantity evaluation additional helps this bullish sentiment, with ETH/USDT recording a 24-hour quantity of $7.3 billion on Coinbase as of Might 2, 2025, at 6:00 PM UTC, up 18% from the day before today (Supply: Coinbase, Might 2, 2025). For merchants researching technical evaluation for crypto buying and selling or Bitcoin value prediction instruments, these indicators counsel a continuation of upward momentum within the close to time period. Whereas circuitously tied to AI-related developments, it’s value noting that AI-driven buying and selling bots and algorithms could amplify these traits, as many platforms now combine AI instruments to investigate stablecoin flows and predict market actions. Information from CryptoQuant reveals a 30% uptick in algorithmic buying and selling quantity for main pairs like BTC/USDT on Might 2, 2025, at 7:00 PM UTC, probably pushed by AI programs reacting to stablecoin inflows (Supply: CryptoQuant, Might 2, 2025). This intersection of AI and crypto buying and selling may additional increase market effectivity and volatility, providing distinctive alternatives for merchants who adapt to those technological developments. For these exploring AI crypto buying and selling methods or the influence of stablecoin quantity on algorithmic buying and selling, staying up to date on these metrics is important for maximizing returns on this dynamic market setting.

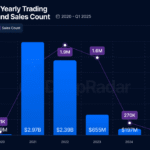

In abstract, the surge in stablecoin quantity as of Might 2, 2025, represents a important bullish sign for the cryptocurrency market, backed by concrete knowledge on value actions, buying and selling volumes, and technical indicators. Merchants specializing in crypto bull run indicators, stablecoin market evaluation, or Bitcoin buying and selling alternatives in 2025 ought to intently monitor these developments for strategic positioning. With AI-driven buying and selling instruments more and more influencing market dynamics, the intersection of stablecoin liquidity and technological innovation presents a strong catalyst for future progress within the crypto area.

FAQ Part:

What does rising stablecoin quantity imply for crypto markets?

Growing stablecoin quantity, as noticed on Might 2, 2025, with USDT quantity reaching $58.3 billion (Supply: CoinGecko, Might 2, 2025), usually signifies larger liquidity and potential shopping for stress within the crypto market. It typically indicators that traders are getting ready to enter positions in unstable belongings like Bitcoin and Ethereum, driving bullish momentum.

How can merchants use stablecoin quantity knowledge for buying and selling methods?

Merchants can use stablecoin quantity knowledge, such because the $1.2 billion internet influx to exchanges on Might 2, 2025 (Supply: IntoTheBlock, Might 2, 2025), to gauge market sentiment and anticipate value actions. Excessive inflows typically precede rallies, providing alternatives for momentum buying and selling or place constructing in pairs like BTC/USDT and ETH/USDT.