Weekly Forex Forecast – April 27th

I wrote on 20th April that the most effective trades for the week could be:

- Lengthy of the EUR/USD currency pair. Sadly, it fell by 0.24% over the week.

- Wanting the USD/JPY currency pair. Sadly, it rose by 1.00% over the week.

- Lengthy of Gold following a every day (New York) shut above $3,343.10. This arrange on Monday however sadly the value then fell by 3.06% over the remainder of the week.

The general consequence was a lack of 4.30%, which was 1.43% per asset.

Final week noticed a a lot calmer market as we appear to have moved past any new tariff bombshells. Negotiations will probably be ongoing till the 90-day interval ends in early July.

The key occasion of final week, which had a really mild information agenda, was President Trump’s try at a delicate stroll again of his feedback blasting Jerome Powell of the Federal Reserve for not chopping charges extra aggressively, which had led to a pointy fall in inventory markets the earlier week. Trump’s feedback could have aided the restoration we noticed in inventory markets and in different dangerous property final week.

Final week’s different main knowledge factors had been:

- Flash Companies & Manufacturing PMI UA, Germany, UK, France – principally worse than anticipated, prompt slowing economies.

- Chair of Swiss Nationwide Financial institution Speech

- Canada Retail Gross sales – as anticipated.

- US Unemployment Claims – as anticipated.

- UK Retail Gross sales – this was significantly better than anticipated, displaying a 0.4% month-on-month enhance, when a decline of 0.3% was anticipated.

The approaching week has a busy schedule of essential releases, together with key US financial knowledge and a coverage assembly on the Financial institution of Japan.

This week’s essential knowledge factors, so as of seemingly significance, are:

- US Core PCE Value Index

- US Common Hourly Earnings

- US Non-Farm Employment Change

- German Preliminary CPI

- Australian CPI (inflation)

- US Advance GDP

- Financial institution of Japan Coverage Fee, Financial Coverage Assertion, and Outlook Report

- Canadian GDP

- Canadian Federal Election

- Australian Parliamentary Election

- US JOLTS Job Openings

- US ISM Manufacturing PMI

- US Employment Price Index

- US Unemployment Claims

- US Unemployment Fee

- Chinese language Manufacturing PMI

For the month of April 2025, I made no month-to-month forecast, as at first of that month, Forex was boring and there have been solely blended long-term traits.

As there have been no unusually giant worth actions in Foreign exchange forex crosses over the previous week, I make no weekly forecast.

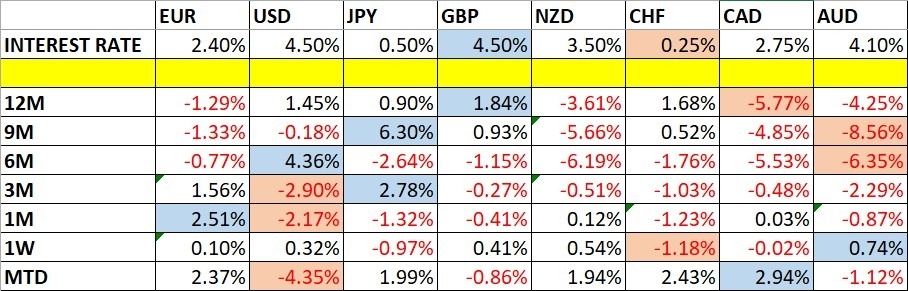

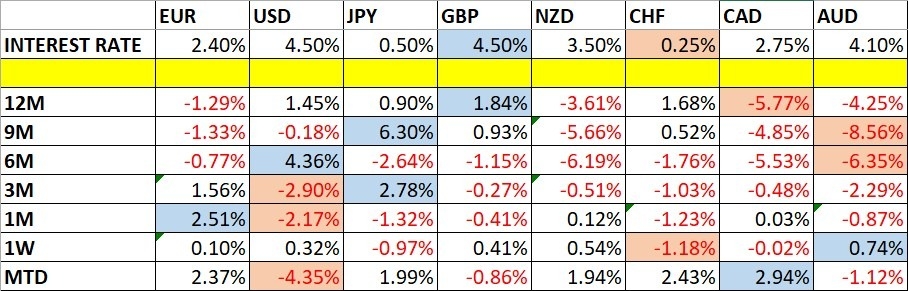

The Australian Greenback was the strongest main currencies final week, whereas the Swiss Franc was the weakest. Volatility decreased barely final week, with greater than 33% of crucial Foreign exchange forex pairs and crosses altering in worth by greater than 1%. Subsequent week will seemingly see extra volatility as there will probably be a really full knowledge schedule.

You may commerce these forecasts in an actual or demo Forex brokerage account.

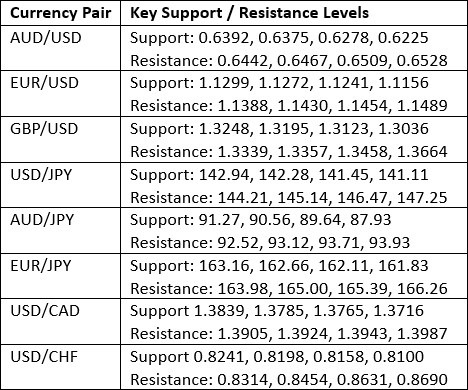

Final week, the US Greenback Index printed a bullish pin bar which closed not removed from the excessive of its vary. The value reached a brand new 4-year low earlier than bouncing strongly off the assist stage proven within the worth chart beneath, at 97.67. These are bullish indicators, however the robust long-term bearish pattern is a bearish signal, as is the truth that the value ended the week beneath the seemingly resistance stage at 99.28.

It’s exhausting to say what is going to occur to the US Greenback subsequent week after this bullish bounce, however buying and selling consistent with the long-term pattern will definitely look to be going in need of the buck. A lot could rely on common hourly earnings and PCE Value Index knowledge that will probably be launched on Friday, and presumably additionally GDP knowledge earlier within the week.

The EUR/USD forex pair rose final week to achieve a brand new multi-year excessive close to $1,1500, earlier than reversing strongly to print a bearish pin bar, closing decrease close to the underside of its weekly vary. This can be a bearish signal and suggests we could have seen a significant bearish reversal. Nevertheless, the long-term pattern remains to be bullish, the value has simply been buying and selling in blue sky, and this forex pair tends to pattern slowly however reliably.

So, it could nonetheless be value being concerned on the lengthy facet right here, however I’d need to see a brand new important bullish breakout first.

If the value can get established above $1.1517 that can most likely be a very good lengthy commerce entry sign, as there aren’t any key resistance ranges above that space for just a few hundred pips.

The USD/JPY forex pair fell early within the week to make one other new multi-month low just under the massive spherical quantity at ¥140 earlier than making a powerful bullish bounce and shutting the week notably larger. The long-term pattern is definitely bearish, however we could properly have seen a big bullish reversal right here, with the pair advancing in tandem with inventory markets, which principally noticed recoveries over the previous week because the US tariffs problem appears to have been largely defused by now, no less than till the July deadline begins to get very shut.

This main forex pair tends to pattern with some reliability, so I wish to be quick right here, however solely after we see a powerful bearish reversal resulting in a brand new multi-month every day (New York) low shut beneath ¥140.75.

Gold rose firmly final week to achieve yet one more new file excessive only a fraction beneath the spherical quantity at $3,500 earlier than falling strongly sufficient to shake out most pattern followers from their lengthy positions by the tip of the week. The weekly shut ended up forming a candlestick which was roughly a bearish pin bar, though not a really well-formed one.

Gold can advance during times of disaster just like the one we’re in now and that is what appears to have occurred, and this can be why we’re seeing fairly a powerful bearish reversal as danger urge for food improves because the US tariffs problem appears to have been kicked away into contact till the summer season arrives.

It’s value contemplating Gold as having standalone advantage, as a have a look at the weekly worth chart beneath exhibits a really robust long-term bullish pattern having been underway for nearly 1.5 years. Because the begin of 2024, the value of Gold in opposition to the USD has elevated by greater than 55%, which is a powerful quantity for any asset, and particularly so for a treasured metallic.

I feel it’s wisest to be out of Gold proper now until we see a brand new excessive every day (New York) closing worth above $3,425.

The S&P 500 Index superior final week on improved danger sentiment. The bullish technical improvement is the weekly shut above the pivotal level and spherical quantity at 5500.

Regardless of that bullish signal, it’s value noting that the value would possibly nonetheless simply be sitting beneath the tip of the pivotal zone – yet another larger shut would most likely be a extra decisive bullish break.

On the bearish facet, the value stays properly beneath the 200-day transferring common which is proven inside the worth chart beneath. The value is traded properly inside correction territory, having beforehand fallen into bear market territory.

Shorting US fairness indices may be very dangerous and doubtless not advisable to anybody besides a really skilled dealer. That is very true as we are actually seeing some indicators of resilience which could see a unbroken restoration till US tariffs come again into focus in June just a few weeks from now.

I consider there may be going to be extra turbulence within the inventory market over the approaching months as we method the 90-day tariff deadline in early July, so I’m glad to be out of shares for now.

The USD/MXN currency pair has been falling for a number of days, even because the USD began to get well very firmly over the previous week. The value ended the week at a 6-month low closing worth – each this and the latest worth motion are bearish. There’s a strongly bearish pattern right here over each the lengthy and quick time period, which can entice merchants on the quick facet.

One other bearish technical improvement is the best way the value has develop into properly and comfortably established beneath the massive spherical quantity at 20.00.

The basic driver behind the robust Mexican Peso is the best way the commerce conflict between the USA and Mexico has been defused, no less than for the subsequent few weeks. Absent any signal of worse US intentions, the value is prone to proceed trending decrease over the approaching week.

I see the most effective trades this week as:

- Lengthy of the EUR/USD forex pair following a every day (New York) shut above $1.1517.

- Wanting the USD/JPY forex pair (New York) shut beneath ¥140.75.

- Lengthy of Gold following a every day (New York) shut above $3,425.

- Wanting the USD/MXN forex pair.