Can Ethereum Price Cross $2,000 in May 2025?

After a comparatively flat April marked by decreased community demand and sideways worth motion, the second-largest cryptocurrency, Ethereum (ETH), could also be positioned for a shift.

ETH holders are optimistic about Could. This optimism is fueled by strengthening fundamentals, the anticipated Pectra improve, and renewed curiosity from institutional traders by way of spot ETH exchange-traded funds (ETFs).

ETH Struggled in April, however Could Brings a Glimmer of Hope

In April, on-chain knowledge confirmed a dip in person exercise throughout the Ethereum community, whereas broader market stagnation stored ETH buying and selling beneath key resistance ranges.

In accordance with Artemis, throughout the 30-day interval, person demand for Ethereum plummeted, resulting in a decline within the variety of active addresses, each day transaction depend, and consequently, its community charges and income.

This and the broader market downturn impacted ETH’s efficiency, inflicting the main altcoin’s worth to stay beneath the $2,000 mark all through April.

Nevertheless, in an interview with BeInCrypto, Gabriel Halm, a analysis analyst at IntoTheBlock, mentioned that ETH’s worth may break above the $2,000 worth mark in Could and stabilize above it.

For Halm, the improved capital inflows into ETH spot ETFs, Ethereum’s dominance within the coin’s decentralized finance (DeFi) vertical, and its upcoming Pectra improve may assist deliver this to fruition.

ETF Inflows, DeFi Dominance, and Pectra: Triple Enhance for Ethereum in Could

In accordance with SosoValue, month-to-month web inflows into ETH ETFs totaled $66.25 million in April, signaling a shift in market sentiment in comparison with the $403.37 million in web outflows recorded in March.

This reversal from heavy outflows to modest inflows means that investor confidence within the altcoin is step by step returning. It signifies that institutional gamers could also be positioning for a longer-term rebound, particularly as Ethereum’s community fundamentals start to enhance, certainly one of which is its climbing dominance within the DeFi sector.

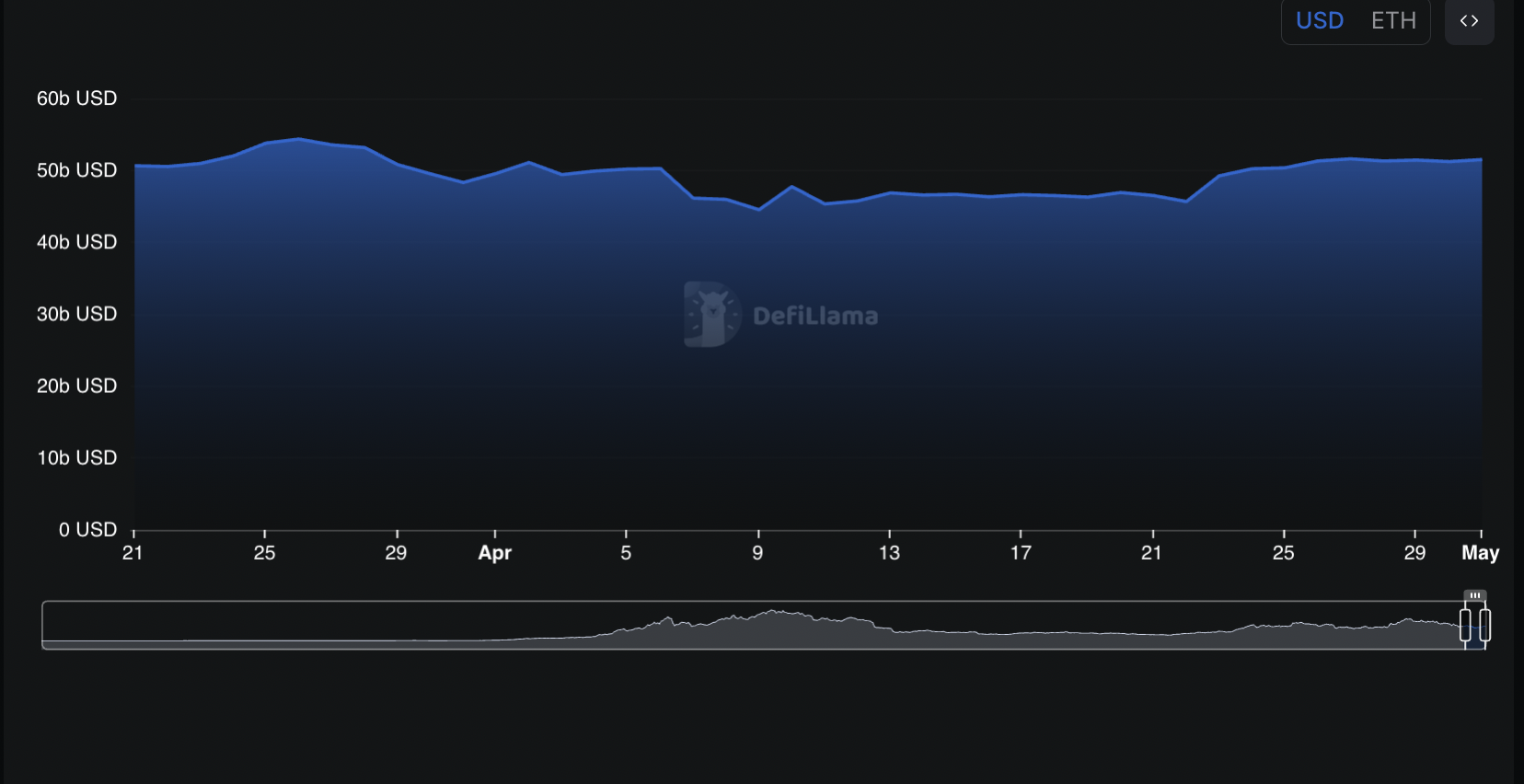

Over 50% of the whole worth locked (TVL) in DeFi protocols nonetheless resides on the Ethereum blockchain. Which means the Layer-1 (L1) stays the popular settlement layer for varied monetary functions, together with lending, staking, yield farming, and decentralized exchanges.

Subsequently, in Could, if broader market circumstances start to enhance, renewed capital inflows into Ethereum’s DeFi sector may, in flip, drive up demand for ETH and help its worth rally.

Furthermore, in keeping with Halm, Ethereum’s upcoming Pectra upgrade, set to launch on Could 7, 2025, may additional assist ETH’s worth efficiency this month. The improve guarantees to reinforce the community’s scalability, scale back transaction charges, enhance security, and introduce sensible account performance.

These enhancements might gasoline a surge in person demand all through Could, doubtlessly lifting ETH’s worth, supplied macroeconomic circumstances stay favorable.

ETH’s Development Hinges on Broader Market Stability

Regardless of this, the broader financial pressures pose a major danger to ETH in Could. Halm famous that “the upcoming CPI report on Could thirteenth will probably be notably vital, doubtlessly influencing market sentiment and contributing to this volatility.”

It’s because inflation or hawkish indicators from the Federal Reserve may worsen the risk-off sentiment within the crypto market, placing strain on ETH’s worth.

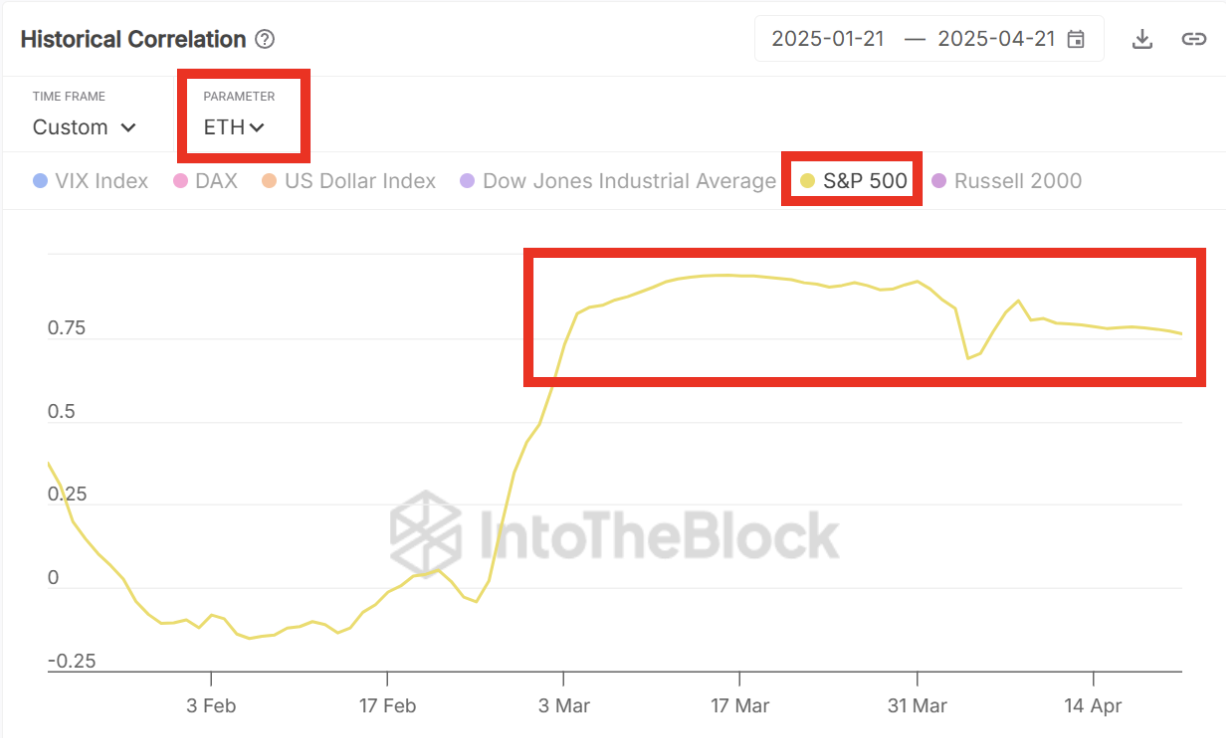

Halm additionally identified that ETH’s worth stays tightly correlated with US equities. Subsequently, if fairness markets face renewed stress this month as a result of inflation fears or fee hike expectations, the altcoin might come under comparable strain.

“Waiting for Could, if this excessive correlation persists, it implies that Ethereum’s vulnerability to market downturns and inflation-related pressures would probably be much like that of conventional danger belongings like these within the S&P 500. A downturn within the common market or elevated considerations about inflation impacting equities may subsequently negatively have an effect on ETH’s worth,” mentioned Gabriel Halm, analysis analyst at IntoTheBlock,

Whereas a sustained push above $2,000 stays potential, any rally will probably rely on inflation traits, danger sentiment in conventional markets, and the way tightly ETH stays tied to equities.

Disclaimer

According to the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.